|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

|

|

FORM

10-K

|

|

|

|

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934 For the fiscal year ended October 31, 2009

|

| |

|

or

|

| |

|

o TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934 For

the transition period from ___________ to ___________

|

| |

|

Commission

file number: 0-11254

|

|

COPYTELE,

INC.

|

|

(Exact

Name of Registrant as Specified in its Charter)

|

| |

|

Delaware

|

|

11-2622630

|

|

(State

or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S.

Employer Identification No.)

|

| |

|

900

Walt Whitman Road

Melville,

NY 11747

(631)

549-5900

|

|

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of

Registrant’s Principal Executive Offices)

|

|

Securities

registered pursuant to Section 12(b) of the Act:

None

|

|

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, $.01 par value

|

|

|

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. Yes

[_] No [x]

|

| |

|

Indicate

by check mark if the registrant is not required to file reports pursuant

to Section 13 or Section 15(d) of the Act. Yes [_] No

[x]

|

| |

|

Indicate

by check mark whether the registrant: (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90

days. Yes [x] No [_]

|

| |

|

Indicate

by check mark whether the registrant has submitted electronically and

posted on its corporate Website, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files). Yes [_] No [_]

|

| |

|

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and

will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form

10-K. [ ]

|

| |

|

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

|

| Large accelerated

filer [__] |

Accelerated

filer [__] |

| |

|

| Non-accelerated

filer [x] (Do not check if a smaller reporting

company) |

Smaller reporting

company [__] |

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes [_] No

[x]

|

| |

|

Aggregate

market value of the voting stock (which consists solely of shares of

Common Stock) held by non-affiliates of the registrant as of April 30,

2009 (the last business day of the registrant’s most recently completed

second fiscal quarter), computed by reference to the closing sale price of

the registrant’s Common Stock on the Over-the-Counter Bulletin Board on

such date ($0.29 ): $33,998,452

|

| |

|

On

January 25, 2010, the registrant had outstanding 146,040,511 shares of

Common Stock, par value $.01 per share, which is the registrant’s only

class of common stock.

|

|

DOCUMENTS

INCORPORATED BY REFERENCE:

NONE

|

PART

I

Item

1. Business.

Forward-Looking

Statements

Information

included in this Annual Report on Form 10-K may contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are not statements of historical

facts, but rather reflect our current expectations concerning future events and

results. We generally use the words “believes,” “expects,” “intends,”

“plans,” “anticipates,” “likely,” “will” and similar expressions to identify

forward-looking statements. Such forward-looking statements,

including those concerning our expectations, involve risks, uncertainties and

other factors, some of which are beyond our control, which may cause our actual

results, performance or achievements, or industry results, to be materially

different from any future results, performance or achievements expressed or

implied by such forward-looking statements. These risks,

uncertainties and factors include, but are not limited to, those factors set

forth in this Annual Report on Form 10-K under “Item 1A. – Risk Factors”

below. Except as required by applicable law, including the securities

laws of the United States, we undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new information,

future events or otherwise. You are cautioned not to unduly rely on

such forward-looking statements when evaluating the information presented in

this Annual Report on Form 10-K.

Overview

As used

herein, “we,” “us,” “our,” the “Company” or “CopyTele” means CopyTele, Inc.

unless otherwise indicated. Our principal operations include the

development, production and marketing of thin, flat, low-voltage phosphor

display technology, the development of thin, flat, low-power passive display

technology and the development, production and marketing of multi-functional

encryption products that provide information security for domestic and

international users over virtually every communications media.

We have

pioneered the basic development of an innovative new type of flat panel display

technology, which is brighter, has higher contrast and consumes less power than

our prior display technology. This new proprietary display is a color

phosphor based display having a unique lower voltage electron emission system to

excite the color phosphors. As with our prior display technology, the

new technology emits light to display color images, such as movies from DVD

players. In addition, we are also developing another version of our

new type low voltage and low power display having a different matrix

configuration and phosphor excitation system. These new type of

displays are expected to be lower in cost than our prior displays.

In

November 2007, we entered into a Technology License Agreement (as amended, the

“License Agreement”) with Videocon Industries Limited, an Indian company

(“Videocon”). Under the License Agreement, we provide Videocon with a

non-transferable, worldwide license of our technology for thin, flat, low

voltage phosphor displays (the “Licensed Technology”), for Videocon (or a

Videocon Group company) to produce and market products, including TVs,

incorporating displays utilizing the Licensed Technology. Under the

License Agreement, we expect to receive a license fee of $11 million from

Videocon, payable in installments over a 27 month period, which commenced in May

2008, and an agreed upon royalty from Videocon based on display sales by

Videocon. In April 2008, the government of India approved the License

Agreement. As of October 31, 2009, we have received aggregate license

fee payments of $2,600,000.

Videocon

is the flagship company of the Videocon Group, one of India’s leading business

houses. Videocon Group is a fully integrated consumer electronics and

home appliances enterprise with backward integration in plasma panel, CRT glass,

color picture tubes and other key components for the consumer electronics, home

appliances and components industries. Videocon Group also operates in

the oil & gas sector. The Videocon Group has sales and service networks

throughout India and operates facilities in Europe and elsewhere in the

world.

We are

working with Videocon to implement our technology into production display

modules. The display modules consist of our low voltage phosphor

displays, the attached associated driver circuits, and controller

circuits. Under the License Agreement, Videocon, with our assistance,

is to provide the design and process engineering required to produce such

display modules and also provide all tooling and fixtures required for the

production process. Videocon has a group of qualified and experienced

personnel assigned to this program. As part of our assistance to

Videocon to produce such display modules, we are providing technical support to

Videocon’s technical team. We are also cooperating with Videocon to

jointly implement our technology prior to production to produce prototypes of

such modules. Videocon is utilizing its display processing technology

and facilities to continue to produce various configurations of our display

matrix to optimize its performance. The matrix is the main component

of our display, since it contains the structure to accommodate our electron

emission technology and the color phosphors that are used to illuminate our

display. Improvements to the technology are to be jointly owned by

CopyTele and Videocon.

Under the

License Agreement we continue to have the right to produce and market products

utilizing the Licensed Technology. We also continue to have the right

to utilize Volga Svet Ltd., a Russian corporation (“Volga”), with whom we have

been working with for more than twelve years, and an Asian company, with whom we

have been working with for more than six years, to produce and market, products

utilizing the Licensed Technology. Additional licenses of the

Licensed Technology to third parties require the joint agreement of CopyTele and

Videocon.

In

connection with the License Agreement, Videocon and CopyTele have each appointed

one senior advisor to the other’s board of directors to advise with respect to

strategic planning and technology in the display field.

At the

same time as we entered into the License Agreement, we entered into a share

subscription agreement with Mars Overseas (“Mars Overseas”), an affiliate of

Videocon, to purchase 20,000,000 unregistered shares of our common stock (the

“Share Subscription Agreement”), and CopyTele International Ltd. (“CopyTele

International”), our subsidiary, entered into a GDR Purchase Agreement to

purchase 1,495,845 global depository receipts (“GDRs”) of

Videocon. Both transactions were completed in our first fiscal

quarter of fiscal year 2008. See Note 1 to the Consolidated Financial

Statements.

Our

display technology includes a proprietary mixture of specially coated carbon

nanotubes and nano materials in combination with our proprietary low voltage

color phosphors. The specially coated carbon nanotubes, which are

supplied to us by a U.S. company, and nano materials, require a low voltage for

electron emission and are extremely small – approximately 10,000 times thinner

than the width of a human hair. The 5.5 inch (diagonal) display we

developed has 960 x 234 pixels and utilizes a new memory-based active matrix

thin film technology with each pixel phosphor activated by electrons emitted by

a proprietary carbon nanotube network located extremely close from the

pixels. The matrix also has a high pixel field factor to obtain high

contrast and low power consumption. As a result, each pixel phosphor brightness

is controlled using less than 40 volts. The carbon nanotubes and

proprietary color phosphors are precisely placed and separated utilizing our

proprietary nanotube and phosphor deposition technology. We have

developed a process of maintaining uniform carbon nanotube deposition

independent of phosphor deposition. We have also developed a method

of enhancing nanotube electron emission to increase the brightness of this type

of display.

We

believe our displays could potentially have a cost similar to a CRT and thus

cost less than current LCD or PDP displays partly because our display does not

contain a backlight, or color filter or polarizer, which represents a

substantial portion of the cost of an LCD.

In August

2009, we entered into a development agreement with a U.S. company to provide

engineering and implementation support for the development of our patented

extremely low power passive monochrome or color display for use in portable

devices. This company has experience in the field involving portions

of our display technology. Our proprietary extremely low power

display that we are developing, in conjunction with this U.S. company,

incorporates a new micro-matrix substrate. The display is designed to

have bi-stability capability, and uses low power when an image is being

created. Once an image is created, power consumption is

negligible. The display is expected to have both monochrome and or

color capability, and operate over wide temperature and environmental

conditions. The display utilizes a single substrate so that it can be

extremely thin, rugged and low weight. This display can be made in

any size, is expected to be low cost, and is especially suitable for portable

devices, such as, cell phones, I-phones, e-books, and other potential portable

devices. We have jointly formulated display designs and have

completed simulation analyses to optimize the display

configuration.

With the

arrival of the rapidly expanding digital book and news media applications, in

August 2009, we entered into an Engagement Agreement with ZQX Advisors, LLC

(“ZQX”) to assist us in seeking business opportunities and licenses for our

electrophoretic display technology (E-Paper®). ZQX

has an experienced business and legal team to assist us in this

area. Concurrently with entering into the Engagement

Agreement, we acquired a 19.5% ownership interest in ZQX in exchange for 800,000

unregistered shares of our common stock and warrants to purchase an additional

500,000 unregistered shares of our common stock, of which warrants to purchase

250,000 shares are exercisable at $0.37 per share and warrants to purchase

250,000 shares are exercisable at $0.555 per share. The warrants

expire in August 2019.

In

September 2009, we entered into a Technology License Agreement with Volga to

produce and market our thin, flat, low voltage phosphor displays in

Russia. We have been working with Volga for the past 12 years to

assist us with our low voltage phosphor displays. As part of our Technology

License Agreement with Volga, we expect to receive revenues from Volga, as it is

required to purchase the matrix substrate, carbon nanotubes, and associated

display electronics from us.

In

addition, in September 2009, we entered into a separate agreement with Volga

whereby we have obtained a 19.9% ownership interest in Volga in exchange for

150,000 unregistered shares of our common stock.

We

continue to pursue opportunities to market our voice, fax and data encryption

solutions in commercial and government markets. Our full array of hardware and

software products provide security over landline and wireless telephone systems

and networks.

Our

government and international markets are being supported by The Boeing Company

(“Boeing”) as well as their large distributors of Thuraya satellite telephones

and communication services. The Thuraya satellite network provides

blanket coverage to more than 110 countries in Europe, North, Central Africa and

large parts of Southern Africa, the Middle East, Central and South Asia and has

grown as a communications provider due to its geographic coverage, quality of

service and cost effective usage.

We have

developed a full lineup of specialized products for the Thuraya satellite

network that we are continuing to promote. Boeing distributes 13 of

our products, including our DCS-1400D (docker voice encryption device), USS-900T

(satellite fax encryption device), USS-900TL (landline to satellite fax

encryption device), USS-900WF (satellite and cellular fax encryption device),

USS-900WFL (landline to satellite and cellular fax encryption device) and

USS-900TC (satellite fax encryption to computer) products, which were

specifically designed for the Thuraya satellite network.

Our

products are being used by government agencies, military, as well as domestic

and international non-governmental organizations in the Middle East, Europe, Far

East and Africa. Our products are now being evaluated for use by Middle Eastern

and Far Eastern governments.

Asia

Pacific Satellite Industries (“APSI”) has manufactured new Thuraya handsets and

docking units that allow satellite communications both outdoors and

indoors. We have created devices allowing customers to easily set up

and engage in secure communications over the Thuraya satellite network

compatible with landline telephone systems. APSI’s FDU-3500 docking

unit for its SO-2510 phone allows for outdoor and indoor operation of the

satellite phone on the Thuraya satellite network. Our PA-3500 and

PA-3500T products allow compatibility between our DCS-1200, DCS-1400 and

USS-900T encryption devices and the APSI FDU-3500 docking unit and SO-2510

phone.

Our

products provide secure communications with many different satellite phones,

including the Thuraya 7100/7101/SO-2510 handheld terminal (“HHT”), Globalstar

GSP-1600 HHT, Telit SAT-550/600 HHT, Globalstar GSP-2800/2900 fixed phone,

Iridium 9500/9505/9505A HHT, Inmarsat M4 and Mini “M” HHT units from Thrane

& Thrane and Nera. Through the use of our products, encrypted

satellite communications are available for many Thuraya docking units, including

Teknobil’s Next Thuraya Docker, Thuraya’s Fixed Docking Adapter, APSI’s FDU-2500

and FDU-3500 Fixed Docking Units, and Sattrans’s SAT-OFFICE Fixed Docking Unit

and SAT-VDA Hands-Free Car Kit.

We have

designed and developed a breathe of products that provide flexible security

performance, whether using any of the many satellite phones or docking units on

the market while having the ability of using the same device or compatible

device on cellular or landline phones. We are continuing our

consultations with specialists of the Inmarsat BGAN system and the new Iridium

USB satellite phone developing compliant encryption solutions that offer new

opportunity and an increased customer base. We continue to seek

opportunities to market our products for securing landline and wireless voice

and fax communications. Our specific Thuraya products are being

evaluated for use by a Middle Eastern government. Also, a Far Eastern

government is in the process of determining the system requirements necessary to

encrypt voice communications utilizing our USS-900, DCS-1200 and DCS-1400

products.

We were

incorporated on November 5, 1982 under the laws of the State of

Delaware. Our principal executive offices are located at 900 Walt

Whitman Road, Melville, New York 11747, our telephone number is 631-549-5900,

and our Internet website address is www.copytele.com. We make

available free of charge on or through our Internet website our annual report on

Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy

statements on Schedule 14A, and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as

soon as reasonably practicable after we electronically file such materials with,

or furnish them to, the Securities and Exchange Commission (the

“SEC”).

New Technologies Under

Development

Display

Technology

We are

continuing to pursue our efforts to develop new technologies for our color

nanotube and E-Paper®

displays. We are continuing to develop another version of our new

type low voltage and low power nanotube display having a different matrix

configuration and phosphor excitation system. This new type of

display is covered under the license provided to Videocon and is expected to be

lower in cost to produce than our prior displays.

Encryption

Technology

We are

continually engaged in the development of additional capabilities for our

current product lines as well as the development of new products to meet current

and anticipated customer applications. We are further developing encryption

products and pursuing commercial security opportunities created by the Health

Insurance Portability and Accountability Act (“HIPAA”), the Sarbanes-Oxley Act,

the Gramm-Leach-Bliley Act and other corporate governance

requirements.

Other

products under development include the following:

|

·

|

A

voice encryption device for integration into the APSI SO-2510 handset that

takes advantage of the Thuraya voice network. This application

simplifies the customer’s security configuration while reducing the

utilization costs.

|

|

·

|

Advancing

our compatibility with Universal Serial Bus (USB) connected cellular and

satellite phones with our DCS-1400 device. The additional

services will expand our wireless compatibility domestically and

abroad.

|

|

·

|

A

software based voice encryption solution that is capable of running on new

“smart phone” cellular/Voice Over Internet Protocol (VoIP)

devices.

|

Production

Flat Panel Video Display

Products

Under our

License Agreement with Videocon, Videocon (or a Videocon Group company) is to

produce products incorporating displays utilizing our technology. We

are working with Videocon to implement our display technology for Videocon to

produce the displays. We are also producing color displays, with the

assistance of Volga and the Asian company, which incorporate the new type of

matrix and phosphor excitation system described above.

Encryption

Products

Our

hardware encryption products consist of a printed circuit board populated with

electronic components and connectors enclosed in a plastic case. We

design all the hardware, software, packaging and operating manuals for our

products. The four main electronic components – the Citadel™ CCX

encryption chip or hardware key generator chip; a digital signal processor; a

vocoder; and modems – are contained on a printed circuit board. We

are currently using several U.S.-based electronics-production contractors to

procure the printed circuit boards and mount the associated electronics

components on the circuit board. We currently use approximately a

dozen primary component and printed circuit-board suppliers and one production

assembly contractor. Given normal lead times, we anticipate having a

readily available supply of all electronic components that we require for

assembling our encryption products.

Our

production contractors produce and visually inspect the completed circuit

boards. We perform final assembly, including installation of the

software, by enclosing the completed printed circuit boards into the product and

performing functionality testing of all units at our premises at Melville, New

York prior to shipment to our customers. We test our finished

products using internally developed product assurance testing

procedures. We currently produce our line of products in quantities

to meet marketing requirements.

Marketing and

Sales

Flat Panel Video Display

Products

Under our

License Agreement with Videocon, Videocon (or a Videocon Group company) is to

market the products it produces that incorporate displays utilizing our

technology. We are cooperating with Videocon to implement our display

technology for Videocon to produce such products, including TV’s.

Encryption

Products

During

the past year we have continued to direct our marketing efforts to participate

in the security opportunities created by the U.S. Department of Homeland

Security, the Defense Department, and the enactment of laws such as HIPAA, the

Sarbanes-Oxley Act, and Gramm-Leach-Bliley Act, which mandate that government

and private sector firms provide higher levels of information privacy and

security. We are working on applications involving our encryption

technology that offer simple, straight-forward compliance measures for these

laws.

Our

distributors market our line of encryption products to domestic and

international commercial and government customers. These products

include voice, fax and data devices on a non-exclusive basis. We are

also supported by international Thuraya service providers to distribute our

encryption equipment abroad. The launch of the third Thuraya

Geo-mobile satellite in January 2008 allowed Thuraya to embark on major

expansion plans to provide their mobile satellite services in the Asia-Pacific

region, potentially opening new markets for CopyTele security solutions that are

designed for the Thuraya network.

In

addition, we presently use a network of distributors in the security field and

original equipment manufacturers which market our encryption products on a

non-exclusive basis. These distributors, along with our internal

marketing group, have sold and marketed our encryption products to multinational

corporations, U.S. and foreign governments and local and federal law enforcement

agencies.

We

continue to provide training and technical support to our customers and to our

distributors and dealers.

Customers

During

fiscal year 2009, we recognized approximately $913,000 in net revenue from

Videocon, representing approximately 95% of net revenue in our Display

Technology Segment and approximately 87% of our total net

revenue. During fiscal year 2008, we recognized approximately

$1,687,000 in net revenue in our Display Technology Segment from Videocon

(constituting all of the revenue in such segment), representing approximately

82% of our total net revenue. During fiscal year 2007, we recognized

$240,000 in net revenue from Digital Info Security Co. Inc. (“DISC”),

representing approximately 49% of our total net revenue, and approximately

$143,000 in net revenue from Delta Bridge, Inc., representing approximately

29% of total net revenue. All net revenue during fiscal year 2007 was

in our Encryption Products and Services Segment.

Competition

The

market for encryption products and flat panel displays worldwide is highly

competitive and subject to technological changes. Although successful

product and systems development is not necessarily dependent on substantial

financial resources, most of our competitors are larger than us and possess

financial, research, service support, marketing, manufacturing and other

resources significantly greater than ours.

There are

several other companies that sell hardware and/or software encryption products

and there are many large companies that sell flat panel displays. We

believe, however, that the technology contained in our encryption products and

our flat panel displays have features that distinguish them from the products

being sold by our competitors. The encryption security and flat panel

display markets are likely to be characterized by rapid advances in technology

and the continuing introduction of new products that could render our products

obsolete or non-competitive. We can give no assurances that we will

be able to compete successfully in the market for our encryption products and

our flat panel displays.

Patents

We have

received patents from the United States and certain foreign patent offices,

expiring at various dates between 2010 and 2027. We have also filed

or are planning to file patent applications for our video and E-Paper® displays,

and encryption technologies.

We can

give no assurances that patents will be issued for any of our pending

applications. In addition, we can give no assurances that any patents

held or obtained will sufficiently protect us against our

competitors. We are not aware that any of our encryption products are

infringing upon the patents of others. We cannot provide any

assurances, however, that other products developed by us, if any, will not

infringe upon the patents of others, or that we will not have to obtain licenses

under the patents of others, although we are not aware of any such infringement

at this time.

We

believe that the foregoing patents are significant to our future

operations.

Research and

Development

Research

and development expenses were approximately $4,116,000, $4,127,000, and

$3,404,000 for the fiscal years ended October 31, 2009, 2008 and 2007,

respectively. See “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” below and our Consolidated Financial

Statements.

Employees and

Consultants

We had 20

employees and 14 consultants as of October 31, 2009. Eighteen of

these individuals, including our Chairman of the Board and Chief Executive

Officer, are engaged in research and development. Their backgrounds

include expertise in physics, chemistry, optics and electronics. Six

individuals are engaged in marketing and the remaining individuals are engaged

in administrative and financial functions for us. None of our

employees is represented by a labor organization or union.

Financial Information About

Segments and Geographical Areas

See our

Consolidated Financial Statements.

Item

1A. Risk

Factors.

Our

business involves a high degree of risk and uncertainty, including the following

risks and uncertainties:

|

·

|

We

have experienced significant net losses and negative cash flows from

operations and they may continue.

|

We have

had net losses and negative cash flows from operations in each year since our

inception, and we may continue to incur substantial losses and experience

substantial negative cash flows from operations. We have incurred

substantial costs and expenses in developing our encryption and flat panel

display technologies and in our efforts to produce commercially marketable

products incorporating our technology. We have had limited sales of

products to support our operations from inception through October 31,

2009. We have set forth below our net losses, research and

development expenses and net cash used in operations for the three fiscal years

ended October 31, 2009, 2008 and 2007:

|

|

|

Fiscal Years Ended October

31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

|

Net

loss

|

|

$ |

16,489,015 |

|

|

$ |

5,821,604 |

|

|

$ |

5,458,218 |

|

|

Research

and development expenses

|

|

|

4,116,200 |

|

|

|

4,127,393 |

|

|

|

3,403,943 |

|

|

Net

cash used in operations

|

|

|

2,501,566 |

|

|

|

901,868 |

|

|

|

2,396,859 |

|

|

·

|

We

may need additional funding in the future which may not be available on

acceptable terms and, if available, may result in dilution to our

stockholders.

|

We

anticipate that, if cash generated from operations is insufficient to satisfy

our requirements, we will require additional funding to continue our research

and development activities and market our products. We believe that

our existing cash, cash equivalents, investments in U.S. government securities

and accounts receivable, together with cash flows from expected sales of our

encryption products and revenue relating to our thin, flat, low-voltage phosphor

display technology, including license fees and royalties from Videocon, and

other potential sources of cash flows, will be sufficient to enable us to

continue our marketing, production, and research and development

activities. However, our projections of future cash needs and cash

flows may differ from actual results. If current cash and cash that

may be generated from operations are insufficient to satisfy our liquidity

requirements, we may seek to sell debt or equity securities or to obtain a line

of credit. The sale of additional equity securities or convertible

debt could result in dilution to our stockholders. It is also

management’s intention to continue to compensate employees by issuing stock or

stock options. We currently have no arrangements with respect to

additional financing. We can give no assurances that we will generate

sufficient revenues in the future (through sales, license fees and royalties, or

otherwise) to satisfy our liquidity requirements or sustain future operations,

that our production capabilities will be adequate, that other products will not

be produced by other companies that will render our products obsolete, or that

other sources of funding would be available, if needed, on favorable terms or at

all. If we cannot obtain such funding if needed, we would need to

curtail or cease some or all of our operations.

|

·

|

We

may not generate sufficient revenue to support our operations in the

future or to generate profits.

|

Our

principal operations include the development, production and marketing of thin,

flat, low-voltage phosphor display technology, the development of thin, flat,

low-power passive display technology and the development, production and

marketing of multi-functional encryption products that provide information

security for domestic and international users over virtually every

communications media. In May 2008, we began receiving license fees

related to our display technology from Videocon pursuant to the License

Agreement. The License Agreement provides for payment of additional

license fees over the next fiscal year as well as the payment of certain

royalties based on sales of products containing our display

technology. However, we can give no assurances that thereafter we

will receive any license or similar fees relating to our display technology or

that we will receive any royalty payments from Videocon. In addition,

our arrangements with Videocon involve counterparty risk. Our

encryption products are only in their initial stages of commercial

production. Our investments in research and development are

considerable. Our ability to generate sufficient revenues to support

our operations in the future or to generate profits will depend upon numerous

factors, many of which are beyond our control, including, but not limited

to:

|

·

|

Our

and Videocon’s ability to implement our technology for Videocon to produce

and market products containing our

displays.

|

|

·

|

The

capability of Volga, with whom we have been working for twelve years, to

produce color and monochrome displays and supply them to

us.

|

|

·

|

Our

ability to successfully market our line of encryption

products.

|

|

·

|

Our

production capabilities and those of our suppliers as required for the

production of our encryption

products.

|

|

·

|

Long-term

performance of our products.

|

|

·

|

The

capability of our dealers and distributors to adequately service our

encryption products.

|

|

·

|

Our

ability to maintain an acceptable pricing level to end-users for both our

encryption and display products.

|

|

·

|

The

ability of suppliers to meet our and Videocon’s requirements and

schedule.

|

|

·

|

Our

ability to successfully develop other new products under development,

including our thin, flat, low-power passive display

technology.

|

|

·

|

Rapidly

changing consumer preferences.

|

|

·

|

The

possible development of competitive products that could render our

products obsolete or unmarketable.

|

|

·

|

Our

future negotiations with Volga with respect to payments and other

arrangements with Volga.

|

|

·

|

Our

ability to successfully implement and commercialize our E-Paper®

display technology.

|

Because

our revenue is subject to fluctuation, we may be unable to reduce operating

expenses quickly enough to offset any unexpected revenue

shortfall. If we have a shortfall in revenue in relation to expenses,

our operating results would suffer. Our operating results for any

particular fiscal year may not be indicative of future operating

results. You should not rely on year-to-year comparisons of results

of operations as an indication of our future performance.

|

·

|

Our

arrangements with Videocon involve market

risks.

|

At the

same time as we entered into the License Agreement, we entered into the Share

Subscription Agreement with Mars Overseas, to purchase 20,000,000 unregistered

shares of our common stock (the “CopyTele Shares”), and a subsidiary of ours,

CopyTele International, entered into a GDR Purchase Agreement to purchase

1,495,845 GDRs of Videocon (the “Videocon GDRs”). The Videocon GDRs

are listed on the Luxembourg Stock Exchange. The value of the

Videocon GDRs owned by us depends upon, among other things, the value of

Videocon’s securities in its home market of India, as well as exchange rates

between the U.S. dollar and Indian rupee (the currency in which Videocon’s

securities are traded in its home market). The value of the Videocon GDRs

declined substantially in fiscal year 2008 and while it has partially recovered

in fiscal year 2009, we recorded an other than temporary

impairment. We can give no assurances that the value of the Videocon

GDRs will not decline in the future and future write downs may

occur.

In

addition, for the purpose of effecting a lock up of the Videocon GDRs and

CopyTele Shares (collectively, the “Securities”) for a period of seven years,

and therefore restricting both parties from selling or transferring the

Securities during such period, CopyTele International and Mars Overseas entered

into two Loan and Pledge Agreements. The Videocon GDRs are to be held

as security for a loan in principal the amount of $5,000,000 from Mars Overseas

to CopyTele International, and the CopyTele Shares are similarly held as

security for a loan in the principal amount of $5,000,000 from CopyTele

International to Mars Overseas. The loans are for a term of

seven years and do not bear interest. The loan agreements also

provide for customary events of default which may result in forfeiture of the

Securities by the defaulting party. We can give no assurances that

the respective parties receiving such loans will not default on such

loans.

|

·

|

Our

arrangements with Volga involve liquidity and market

risks.

|

At the

same time as we entered into the Technology License Agreement with Volga, we

acquired a 19.9% ownership interest in Volga in exchange for 150,000

unregistered shares of our common stock. The Volga shares are not

publicly traded and there is no assurance that we will be able to sell the

shares at an acceptable price, if at all.

|

·

|

We

are dependent upon a few key employees and the loss of their services

could adversely affect us.

|

Our

future success is dependent on our ability to hire, retain and motivate highly

qualified personnel. In particular, our success depends on the

continued efforts of our Chief Executive Officer, Denis A. Krusos, who is

engaged in the management and operations of our business, including all aspects

of the development, production and marketing of our encryption products and flat

panel display technology. In addition, Mr. Krusos, as well as our

other skilled management and technical personnel, are important to our future

business and financial arrangements. We do not have an employment

agreement with, nor do we maintain “key person” life insurance on, Mr.

Krusos. The loss of the services of any such persons could have a

material adverse effect on our business and operating results.

|

·

|

The

very competitive markets for our encryption products and flat panel

display technology could have a harmful effect on our business and

operating results.

|

The

markets for our encryption products and flat panel display technology worldwide

are highly competitive and subject to rapid technological

changes. Most of our competitors are larger than us and possess

financial, research, service support, marketing, manufacturing and other

resources significantly greater than ours. Competitive pressures may

have a harmful effect on our business and operating results.

|

·

|

Our

common stock is subject to the SEC’s penny stock rules which may make our

shares more difficult to sell.

|

Our

common stock fits the definition of a penny stock and therefore is subject to

the rules adopted by the SEC regulating broker-dealer practices in connection

with transactions in penny stocks. These SEC rules may have the

effect of reducing trading activity in our common stock making it more difficult

for investors to sell their shares. The SEC rules require a broker or

dealer proposing to effect a transaction in a penny stock to deliver the

customer a risk disclosure document that provides certain information prescribed

by the SEC, including, but not limited to, the nature and level of risks in the

penny stock market. The broker or dealer must also disclose the

aggregate amount of any compensation received or receivable by him in connection

with such transaction prior to consummating the transaction. In

addition, the SEC rules also require a broker or dealer to make a special

written determination that the penny stock is a suitable investment for the

purchaser and receive the purchaser’s written agreement to the transaction

before completion of the transaction. The existence of these SEC

rules may result in a lower trading volume of our common stock and lower trading

prices.

|

·

|

We

have not paid, nor do we anticipate paying, any cash dividends in the

future.

|

We have

never paid cash dividends and do not anticipate paying any cash dividends in the

foreseeable future. Payment of dividends on our common stock is

within the discretion of our Board of Directors and will depend upon our future

earnings, capital requirements, financial condition and other relevant

factors. We have no plan to declare any cash dividends in the

foreseeable future. It is anticipated that earnings, if any, which

may be generated from future operations will be used to finance our continued

operations.

Item

1B. Unresolved Staff

Comments.

None.

Item

2. Properties.

We lease

approximately 12,000 square feet of office and laboratory research facilities at

900 Walt Whitman Road, Melville, New York (our principal offices) from an

unrelated party pursuant to a lease that expires November 30,

2011. It is our intent to renew this lease upon

expiration. Our base rent is approximately $288,000 per annum with a

3% annual increase and an escalation clause for increases in certain operating

costs. See Note 8 to our Consolidated Financial

Statements.

We

believe that the facilities described above are adequate for our current

requirements.

Item

3. Legal

Proceedings.

We are

not a party to any material pending legal proceedings. We are party

to claims, and complaints that arise in the ordinary course of business.

We believe that any liability that may ultimately result from the resolution of

these matters will not, individually or in the aggregate, have a material

adverse effect on our financial position or results of operations.

Item

4. Submission of Matters to a

Vote of Security Holders.

At our

Annual Meeting of Stockholders, held on October 29, 2009, three directors were

elected and the selection of KPMG LLP, independent registered public

accountants, as our independent auditors for fiscal year ending October 31, 2009

was ratified. The following is a tabulation of the voting with

respect to the foregoing matters:

(a) Election

of Directors:

|

Nominee

|

For

|

Withheld

|

|

|

|

|

|

Denis

A. Krusos

|

122,204,111

|

3,414,021

|

|

Henry

P. Herms

|

112,988,877

|

3,629,255

|

|

George

P. Larounis

|

123,874,325

|

1,743,007

|

(b) Ratification

of selection of KPMG LLP as independent auditors for fiscal year ending October

31, 2009:

|

For

|

Against

|

Abstain

|

|

|

|

|

|

125,321,316

|

237,658

|

59,160

|

|

Item

5.

|

Market for the

Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity

Securities.

|

Market

Information

Our

common stock trades on the Over-the-Counter Bulletin Board (the “OTCBB”) under

the symbol “COPY”. The high and low sales prices as reported by the

OTCBB for each quarterly fiscal period during our fiscal years ended October 31,

2009 and 2008 have been as follows:

|

Fiscal

Period

|

High

|

Low

|

|

1st

quarter 2009

2nd

quarter 2009

3rd

quarter 2009

4th

quarter 2009

|

$0.50

0.38

0.42

1.10

|

$0.25

0.19

0.28

0.34

|

|

1st

quarter 2008

2nd

quarter 2008

3rd

quarter 2008

4th

quarter 2008

|

$1.94

1.39

1.15

0.98

|

$0.80

0.69

0.65

0.34

|

Holders

As of

January 25, 2010, the approximate number of record holders of our common stock

was 1,241 and the closing price of our common stock was $0.48 per

share.

Securities Authorized for

Issuance Under Equity Compensation Plans

See “Item

12. Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.”

Dividend

Policy

No cash

dividends have been paid on our common stock since our inception. We

have no present intention to pay any cash dividends in the foreseeable

future.

Recent Sales of Unregistered

Securities

As more

fully set forth in “Item 1. Business” above, on August 20, 2009, we issued to

ZQX 800,000 unregistered shares of our common stock together with warrants to

purchase an additional 500,000 unregistered shares of our common stock in

exchange for a 19.5% ownership interest in ZQX. Warrants to purchase

250,000 shares are exercisable at $0.37 per share and warrants to purchase the

remaining 250,000 shares are exercisable at $0.555 per share. The warrants are

exercisable at any time after August 19, 2010 and expire in August

2019.

As more

fully set forth in “Item 1. Business” above, on September 9, 2009, we issued to

Volga 150,000 unregistered shares of our common stock in exchange for a 19.9%

ownership interest in Volga.

The

securities issuances referred to above (i) were not subject to any underwriting

discounts or commissions, (ii) were issued only to “accredited investors” as

such term is defined in Rule 501 of Regulation D and (iii) were exempt from

registration pursuant to Section 3(b) and 4(2) of the Securities Act of 1933, as

amended.

Stockholder Return

Performance Graph

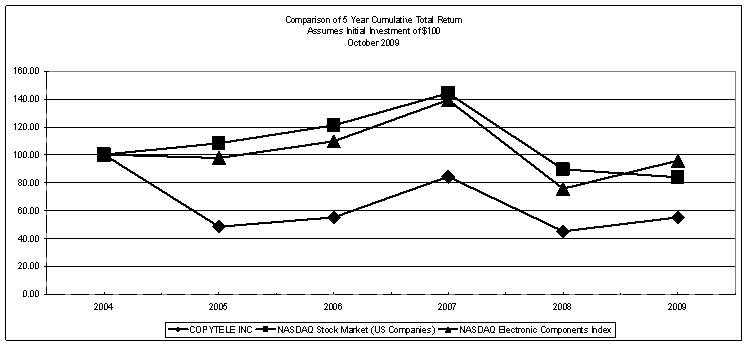

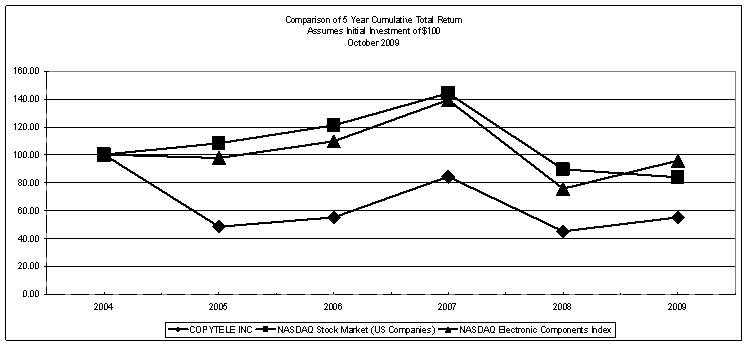

Set forth

below is a graph showing the five-year cumulative total return for: (i) our

Common Stock; (ii) The Nasdaq Stock Market U.S. Index, a broad market index

covering shares of common stock of domestic companies that are listed on Nasdaq;

and (iii) The Nasdaq Electronic Components Stock Index, a group of

companies that are engaged in the manufacture of electronic components and

related accessories with a Standard Industrial Classification Code of 367 and

listed on NASDAQ.

|

|

|

|

Fiscal

Year Ended October 31

|

|

|

|

|

|

2004

|

|

|

2005

|

|

|

2006

|

|

|

2007

|

|

|

2008

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COPYTELE

INC

|

Cum

$

|

|

|

100.00 |

|

|

|

48.60 |

|

|

|

55.14 |

|

|

|

84.11 |

|

|

|

44.85 |

|

|

|

55.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NASDAQ

Stock Market (US Companies)

|

Cum

$

|

|

|

100.00 |

|

|

|

108.28 |

|

|

|

121.32 |

|

|

|

144.29 |

|

|

|

89.37 |

|

|

|

83.71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NASDAQ

Electronic Components Index

|

Cum

$

|

|

|

100.00 |

|

|

|

97.80 |

|

|

|

109.52 |

|

|

|

139.21 |

|

|

|

75.89 |

|

|

|

95.78 |

|

The

comparison of total return on investment for each fiscal year ended October 31

assumes that $100 was invested on November 1, 2004 in each of CopyTele, The

Nasdaq Electronic Components Index and The Nasdaq Stock Market U.S. Index with

investment weighted on the basis of market capitalization and all dividends

reinvested.

Issuer Purchases of Equity

Securities

None.

Item

6. Selected Financial

Data.

The

following selected financial data has been derived from our audited Consolidated

Financial Statements and should be read in conjunction with those statements,

and the notes related thereto, which are included in this Annual Report on Form

10-K.

|

|

|

As

of and for the fiscal years ended October 31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2007

|

|

|

2006

|

|

|

2005

|

|

|

Net

Revenue

|

|

$ |

1,055,797 |

|

|

$ |

2,063,123 |

|

|

$ |

486,852 |

|

|

$ |

508,651 |

|

|

$ |

439,785 |

|

|

Cost

of encryption products sold

|

|

|

27,861 |

|

|

|

95,594 |

|

|

|

73,953 |

|

|

|

104,672 |

|

|

|

112,321 |

|

|

Provision

for excess inventory

|

|

|

19,627 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

586,662 |

|

|

Cost

of encryption services

|

|

|

- |

|

|

|

- |

|

|

|

86,407 |

|

|

|

51,774 |

|

|

|

20,645 |

|

|

Cost

of display engineering services

|

|

|

18,200 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Research

and Development Expenses

|

|

|

4,116,200 |

|

|

|

4,127,393 |

|

|

|

3,403,943 |

|

|

|

4,614,300 |

|

|

|

2,266,911 |

|

|

Selling,

General and Administrative Expenses

|

|

|

4,194,227 |

|

|

|

3,829,654 |

|

|

|

2,414,916 |

|

|

|

3,365,521 |

|

|

|

1,919,010 |

|

|

Impairment

in value of available for sale securities

|

|

|

9,218,972 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Dividend

Income

|

|

|

29,468 |

|

|

|

130,886 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Interest

Income

|

|

|

20,807 |

|

|

|

37,028 |

|

|

|

34,149 |

|

|

|

26,715 |

|

|

|

14,507 |

|

|

Net

Loss

|

|

|

(16,489,015 |

) |

|

|

(5,821,604 |

) |

|

|

(5,458,218 |

) |

|

|

(7,600,901 |

) |

|

|

(4,451,257 |

) |

|

Net

Loss Per Share of Common Stock – Basic and

Diluted

|

|

$ |

(.12 |

) |

|

$ |

(.05 |

) |

|

$ |

(.05 |

) |

|

$ |

(.08 |

) |

|

$ |

(.05 |

) |

|

Total

Assets

|

|

|

9,848,446 |

|

|

|

7,497,869 |

|

|

|

1,870,159 |

|

|

|

1,863,629 |

|

|

|

1,466,253 |

|

|

Long

Term Obligations

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Shareholders’

Equity

|

|

|

4,452,272 |

|

|

|

1,730,277 |

|

|

|

1,191,350 |

|

|

|

1,281,841 |

|

|

|

1,118,023 |

|

|

Cash

Dividends Per Share of Common Stock

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results

of Operations.

|

Forward-Looking

Statements

Information

included in this Annual Report on Form 10-K may contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are not statements of historical

facts, but rather reflect our current expectations concerning future events and

results. We generally use the words “believes,” “expects,” “intends,”

“plans,” “anticipates,” “likely,” “will” and similar expressions to identify

forward-looking statements. Such forward-looking statements,

including those concerning our expectations, involve risks, uncertainties and

other factors, some of which are beyond our control, which may cause our actual

results, performance or achievements, or industry results, to be materially

different from any future results, performance or achievements expressed or

implied by such forward-looking statements. These risks,

uncertainties and factors include, but are not limited to, those factors set

forth in this Annual Report on Form 10-K under “Item 1A. – Risk Factors”

above. Except as required by applicable law, including the securities

laws of the United States, we undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new information,

future events or otherwise. You are cautioned not to unduly rely on

such forward-looking statements when evaluating the information presented in

this Annual Report on Form 10-K.

General

Our

principal operations include the development, production and marketing of thin,

flat, low-voltage phosphor display technology, the development of thin, flat,

low-power passive display technology and the development, production and

marketing of multi-functional encryption products that provide information

security for domestic and international users over virtually every

communications media.

We have

developed an innovative new type of flat panel display technology, which is

brighter, has higher contrast and consumes less power than our prior display

technology. This new proprietary display is a color phosphor based

display having a unique lower voltage electron emission system to excite the

color phosphors. As with our prior display technology, the new

technology emits light to display color images, such as movies from DVD

players. In addition, we are also developing another version of our

new type low voltage and low power display having a different matrix

configuration and phosphor excitation system. These new type of

displays are expected to be lower in cost than our prior displays.

In November 2007, we entered into a Technology License

Agreement (as amended, the “License Agreement”) with Videocon Industries

Limited, an Indian company (“Videocon”). Under the License Agreement,

we provide Videocon with a non-transferable, worldwide license of our technology

for thin, flat, low voltage phosphor displays (the “Licensed Technology”), for

Videocon (or a Videocon Group company) to produce and market products, including

TVs, incorporating displays utilizing the Licensed Technology. Under

the License Agreement, we expect to receive a license fee of $11 million from

Videocon, payable in installments over a 27 month period, which commenced in May

2008, and an agreed upon royalty from Videocon based on display sales by

Videocon. In April 2008, the government of India approved the

License Agreement.

Videocon

is the flagship company of the Videocon Group, one of India’s leading business

houses. Videocon Group is a fully integrated consumer electronics and

home appliances enterprise with backward integration in plasma panel, CRT glass,

color picture tubes and other key components for the consumer electronics, home

appliances and components industries. Videocon Group also operates in

the oil & gas sector. The Videocon Group has sales and service networks

throughout India and operates facilities in Europe and elsewhere in the

world.

We are

working with Videocon to implement our technology into production display

modules. The display modules consist of our low-voltage phosphor

displays, the attached associated driver circuits, and controller

circuits. Under the License Agreement, Videocon, with our assistance,

is to provide the design and process engineering required to produce such

display modules and also provide all tooling and fixtures required for the

production process. Videocon has a group of qualified and experienced

personnel assigned to this program. As part of our assistance to

Videocon to produce such display modules, we are providing technical support to

Videocon’s technical team. We are also cooperating with Videocon to

jointly implement our technology prior to production to produce prototypes of

such modules. Videocon is utilizing its display processing technology

and facilities to continue to produce various configurations of our display

matrix to optimize its performance. The matrix is the main component

of our display, since it contains the structure to accommodate our electron

emission technology and the color phosphors that are used to illuminate our

display. Improvements to the technology are to be jointly owned by

CopyTele and Videocon.

Under the

License Agreement we continue to have the right to produce and market products

utilizing the Licensed Technology. We also continue to have the right

to utilize Volga Svet Ltd., a Russian corporation (“Volga”), with whom we have

been working with for more than twelve years, and an Asian company, with whom we

have been working with for more than six years, to produce and market, products

utilizing the Licensed Technology. Additional licenses of the

Licensed Technology to third parties require the joint agreement of CopyTele and

Videocon.

In

connection with the License Agreement, Videocon and CopyTele have each appointed

one senior advisor to the other’s board of directors to advise with respect to

strategic planning and technology in the display field.

At the

same time as we entered into the License Agreement, we entered into a share

subscription agreement with Mars Overseas (“Mars Overseas”), an affiliate of

Videocon, to purchase 20,000,000 unregistered shares of our common stock (the

“Share Subscription Agreement”), and CopyTele International Ltd. (“CopyTele

International”), our subsidiary, entered into a GDR Purchase Agreement to

purchase 1,495,845 global depository receipts (“GDRs”) of

Videocon. Both transactions were completed in our first fiscal

quarter of fiscal year 2008. See Note 1 to the Consolidated Financial

Statements.

Our

display technology includes a proprietary mixture of specially coated carbon

nanotubes and nano materials in combination with our proprietary low voltage

color phosphors. The specially coated carbon nanotubes, which are

supplied to us by a U.S. company, and nano materials, require a low voltage for

electron emission and are extremely small – approximately 10,000 times thinner

than the width of a human hair. The 5.5 inch (diagonal) display we

developed has 960 x 234 pixels and utilizes a new memory-based active matrix

thin film technology with each pixel phosphor activated by electrons emitted by

a proprietary carbon nanotube network located extremely close from the

pixels. The matrix also has a high pixel field factor to obtain high

contrast and low power consumption. As a result, each pixel phosphor brightness

is controlled using less than 40 volts. The carbon nanotubes and

proprietary color phosphors are precisely placed and separated utilizing our

proprietary nanotube and phosphor deposition technology. We have

developed a process of maintaining uniform carbon nanotube deposition

independent of phosphor deposition. We have also developed a method

of enhancing nanotube electron emission to increase the brightness of this type

of display.

We

believe our displays could potentially have a cost similar to a CRT and thus

cost less than current LCD or PDP displays partly because our display does not

contain a backlight, or color filter or polarizer, which represents a

substantial portion of the cost of an LCD.

In August

2009, we entered into a development agreement with a U.S. company to provide

engineering and implementation support for the development of our patented

extremely low power passive monochrome or color display for use in portable

devices. This company has experience in the field involving portions

of our display technology. Our proprietary extremely low power

display that we are developing, in conjunction with the U.S. company,

incorporates a new micro-matrix substrate. The display is designed to

have bi-stability capability, and uses low power when an image is being

created. Once an image is created, power consumption is

negligible. The display is expected to have both monochrome and or

color capability, and operate over wide temperature and environmental

conditions. The display utilizes a single substrate so that it can be

extremely thin, rugged and low weight. This display can be made any

size, is expected to be low cost, and is especially suitable for portable

devices, such as, cell phones, I-phones, and e-books, and other potential

portable devices. We have jointly formulated display designs and have

completed simulation analyses to optimize the display

configuration.

With the

arrival of the rapidly expanding digital book and news media applications, in

August 2009, we entered into an Engagement Agreement with ZQX Advisors, LLC

(“ZQX”) to assist us in seeking business opportunities and licenses for our

electrophoretic display technology (E-Paper®). ZQX

has an experienced business and legal team to assist us in this

area. Concurrently with entering into the Engagement

Agreement, we acquired a 19.5% ownership interest in ZQX in exchange for 800,000

unregistered shares of our common stock and warrants to purchase an additional

500,000 unregistered shares of our common stock, of which warrants to purchase

250,000 shares are exercisable at $0.37 per share and warrants to purchase

250,000 shares are exercisable at $0.555 per share. The warrants

expire in August 2019.

In

September 2009, we entered into a Technology License Agreement with Volga to

produce and market our thin, flat, low voltage phosphor displays in

Russia. We have been working with Volga for the past 12 years to

assist us with our low voltage phosphor displays. As part of our Technology

License Agreement with Volga, we anticipate receiving revenues from Volga, as it

is required to purchase the matrix substrate, carbon nanotubes, and associated

display electronics from us.

In

addition, in September 2009, we entered into a separate agreement with Volga

whereby we have obtained a 19.9% ownership interest in Volga in exchange for

150,000 unregistered shares of our common stock.

We

continue to pursue opportunities to market our voice, fax and data encryption

solutions in commercial and government markets. Our full array of

hardware and software products provide security over landline and wireless

telephone systems and networks.

Our

operations and the achievement of our objectives in marketing, production, and

research and development are dependent upon an adequate cash

flow. Accordingly, in monitoring our financial position and results

of operations, particular attention is given to cash and accounts receivable

balances and cash flows from operations. Since our initial public

offering, our cash flows have been primarily generated through the sales of

common stock in private placements and upon exercise of stock

options. Since 1999 we have also generated cash flows from sales of

our encryption products and services. We are continuing to direct our

encryption marketing efforts to opportunities in both the commercial and

government security markets and have recently uncovered new opportunities to

market products to Middle Eastern and Far Eastern governments to secure voice

and fax communications. In addition, in fiscal year 2008, we entered

into the License Agreement with Videocon and in May 2008, we began

receiving from Videocon license fees related to our display

technology.

In

reviewing Management’s Discussion and Analysis of Financial Condition and

Results of Operations, you should refer to our Consolidated Financial Statements

and the notes related thereto.

Critical Accounting

Policies

Our

consolidated financial statements are prepared in conformity with accounting

principles generally accepted in the United States of America. As

such, we are required to make certain estimates, judgments and assumptions that

management believes are reasonable based upon the information

available. These estimates and assumptions affect the reported

amounts of assets and liabilities and the disclosure of contingent assets and

liabilities at the dates of the consolidated financial statements and the

reported amounts of revenue and expenses during the reporting

periods.

We

believe the following critical accounting polices affect the more significant

judgments and estimates used in the preparation of our consolidated financial

statements.

Revenue

Recognition

Revenues

from sales are recorded when all four of the following criteria are met: (i)

persuasive evidence of an arrangement exists; (ii) delivery has occurred and

title has transferred or services have been rendered; (iii) our price to the

buyer is fixed or determinable; and (iv) collectibility is reasonably

assured.

We have

assessed the revenue guidance of Accounting Standards Codification (“ACS”)

605-25 “Multiple-Element Arrangements” (“ASC 605-25”) to determine whether

multiple deliverables in our arrangement with Videocon represent

separate units of accounting. Under the License Agreement, CopyTele

is required to: (a) disclose to Videocon the Licensed Technology and

provide reasonable training by Videocon personnel; (b) jointly cooperate with

Videocon to produce prototypes prior to production; and (c) assist Videocon in

preparing for production. CopyTele has determined that these

performance obligations do not have value to Videocon on a standalone

basis, as defined in ASC 605-25, and accordingly they do not represent separate

units of accounting.

We have

established objective and reasonable evidence of fair value for the royalty to

be earned during the production period based on analysis of the pricing for

similar agreements. Accordingly, we have determined that the license

fee of $11 million to be paid during the pre-production period and royalties on

product sales reflects the established fair value for these

deliverables. We expect to recognize the $11 million license fee over

the estimated period that we expect to provide cooperation and assistance during

the pre-production period, limiting the revenue recognized on a cumulative basis

to the aggregate license fee payments received from Videocon. We will

assess at each reporting period the progress and assistance provided and will

continue to evaluate the period during which this fee will be

recognized. On this basis, we have recognized license fee revenue

during the fiscal years ended October 31, 2009 and 2008

of approximately $913,000 and $1,687,000,

respectively. License fee payments received from Videocon which are

in excess of the amounts recognized as revenue ($-0- as of October 31, 2009, and

approximately $313,000 as of October 31, 2008) are recorded as deferred revenue

on the accompanying consolidated balance sheet.

Investment

Securities

We

classify our investment securities in one of two categories: available-for-sale

or held-to-maturity. Available-for-sale securities are recorded at

fair value. Unrealized gains and losses, net of the related tax

effect, on available-for-sale securities are excluded from earnings and are

reported as a component of accumulated other comprehensive income (loss) until

realized. Realized gains and losses from the sale of

available-for-sale securities are determined on a specific identification

basis. Held-to-maturity securities, which are investment securities

that we have the intent and ability to hold to maturity, are carried at

amortized cost. The amortization of premiums and accretion of

discounts are recorded on the level yield (interest) method, over the period

from the date of purchase to maturity. When sales do occur, gains and

losses are recognized at the time of sale and the determination of cost of

securities sold is based upon the specific identification

method. Dividend and interest income are recognized when

earned.

We

monitor the value of our investments for indicators of impairment, including

changes in market conditions and the operating results of the underlying

investment that may result in the inability to recover the carrying value of the

investment. During the fourth quarter of fiscal year 2009, we

determined that there was an other than temporary impairment in both our

Videocon and DISC investments. See Note 4 to the Consolidated

Financial Statements for further discussion. We will record an

additional impairment charge if and when we believe any such investment has

experienced an additional decline that is other than temporary.

Accounts

Receivable

Accounts