| By Order of the Board of Directors |

|

| ANNE ROTONDO |

| Secretary |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Copytele, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

COPYTELE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 31, 2006

TO THE STOCKHOLDERS OF COPYTELE, INC.

You are cordially invited to attend the Annual Meeting of Stockholders of CopyTele, Inc., a Delaware corporation, to be held at the Fox Hollow, Woodbury, New York, on Monday, October 31, 2006, at 10:30 a.m., local time, for the following purposes:

| 1. | To elect four directors to serve until the next Annual Meeting of Stockholders; |

| 2. | To ratify the appointment of Grant Thornton LLP, an independent registered public accounting firm, as CopyTele’s independent auditors for fiscal year 2006; and |

| 3. | To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

The Board of Directors of CopyTele has fixed the close of business on October 2, 2006, as the record date for the Annual Meeting. This means that only holders of record of Common Stock at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting or at any adjournment or postponement of the Annual Meeting.

Whether or not you expect to attend the Annual Meeting, please read the accompanying proxy statement and promptly complete, date, sign and mail the enclosed proxy so that your shares may be represented at the Annual Meeting. If you attend the Annual Meeting, you may vote in person even if you have previously returned your proxy.

| By Order of the Board of Directors |

|

| ANNE ROTONDO |

| Secretary |

Melville, New York

October 3, 2006

COPYTELE, INC.

900 Walt Whitman Road

Melville, NY 11747

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 31, 2006

The Board of Directors of CopyTele, Inc. (“CopyTele”, “we” or “us”) is furnishing you this Proxy Statement to solicit proxies on its behalf to be voted at our Annual Meeting of Stockholders to be held on Tuesday, October 31, 2006, at 10:30 a.m., local time, and at any adjournments or postponements thereof. We are first sending this Proxy Statement and the accompanying form of proxy to stockholders on or about October 5, 2006.

VOTING

General

The Board of Directors has fixed the close of business on October 2, 2006 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. Each stockholder will be entitled to one vote for each share of Common Stock held on all matters to come before the Annual Meeting and may vote in person or by proxy authorized in writing. As of October 2, 2006, there were 97,313,345 shares of Common Stock issued and outstanding.

At the Annual Meeting, stockholders will be asked to consider and vote upon:

| • | the election of four directors; and |

| • | the ratification of the appointment of Grant Thornton LLP, an independent registered public accounting firm, as our independent auditors for fiscal year 2006. |

Stockholders may also consider and act upon such other matters as may properly come before the Annual Meeting or any adjournment or adjournments thereof.

Quorum and Required Votes

To carry on the business of the Annual Meeting, we must have a quorum. This means that at least a majority of the outstanding shares eligible to vote must be present at the Annual Meeting, either by proxy or in person. Shares of Common Stock represented by a properly signed and returned proxy are considered present at the Annual Meeting for purposes of determining a quorum. Abstentions and broker non-votes are counted as present at the Annual Meeting for determining whether we have a quorum. A broker non-vote occurs when a broker returns a proxy but does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner.

1

Election of directors will be determined by a plurality vote of the combined voting power of all shares of Common Stock present in person or by proxy and voting at the Annual Meeting. Accordingly, votes “withheld” from director-nominee(s), abstentions and broker non-votes will not count against the election of such nominee(s).

Approval of the proposal to ratify the appointment of Grant Thornton LLP as our independent auditors for fiscal year 2006, or any other matter that may come before the Annual Meeting, will be determined by the vote of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting and voting on such matters. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting and they will have the same effect as votes against the matter. With respect to broker non-votes, the shares will not be considered entitled to vote at the Annual Meeting for such matter and the broker non-votes will have the practical effect of reducing the number of affirmative votes required to achieve a majority vote for such matter by reducing the total number of shares from which the majority is calculated.

Voting and Revocation of Proxies

Your vote is important. We encourage you to promptly complete, date, sign and return the accompanying form of proxy in the enclosed envelope. The way you vote now does not limit your right to change your vote at the Annual Meeting if you attend in person.

Common Stock represented by properly executed proxies received by us and not revoked will be voted at the Annual Meeting in accordance with the instructions contained therein. If instructions are not given, proxies will be voted FOR the election of each nominee for election as a director named herein and FOR the ratification of the appointment of Grant Thornton LLP as CopyTele’s independent auditors for fiscal year 2006. The Board of Directors has not received timely notice (and does not know) of any matters that are to be brought before the Annual Meeting other than as set forth in the Notice of Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named in the enclosed form of proxy or their substitutes will vote in accordance with their best judgment on such matters.

Any proxy signed and returned by a stockholder may be revoked at any time before it is voted by filing with the Secretary of CopyTele written notice of such revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy.

Proxy Solicitation

We will bear the costs of solicitations of proxies for the Annual Meeting. In addition to solicitation by mail, our directors, officers and regular employees may solicit proxies from stockholders by telephone, telegram, personal interview or otherwise. Such directors, officers and employees will not receive additional compensation, but may be reimbursed for out-of-pocket expenses in connection with such solicitation. We have requested brokers, nominees, fiduciaries and other custodians to forward soliciting material to the beneficial owners of Common Stock held of record by them, and such custodians will be reimbursed for their reasonable expenses.

PRINCIPAL HOLDERS OF COMMON STOCK

The following table sets forth certain information with respect to Common Stock beneficially owned as of September 27, 2006 by: (a) each person who is known by our management to be the beneficial

2

owner of more than 5% of our outstanding Common Stock; (b) each director, director nominee and executive officer of CopyTele; and (c) all directors, director nominees and executive officers as a group:

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership(1)(2) |

Percent of Class(3) |

|||

| Denis A. Krusos 900 Walt Whitman Road Melville, NY 11747 |

10,546,130 | 9.9 | % | ||

| Frank J. DiSanto(4) 900 Walt Whitman Road Melville, NY 11747 |

4,358,905 | 4.3 | % | ||

| Henry P. Herms 900 Walt Whitman Road Melville, NY 11747 |

831,575 | * | |||

| George P. Larounis 900 Walt Whitman Road Melville, NY 11747 |

560,000 | * | |||

| All Directors, Director Nominees and Executive Officers as a Group (4 persons) |

16,296,610 | 14.7 | % | ||

| * | Less than 1%. |

| (1) | A beneficial owner of a security includes any person who directly or indirectly has or shares voting power and/or investment power with respect to such security or has the right to obtain such voting power and/or investment power within sixty (60) days. Except as otherwise noted, each designated beneficial owner in this Proxy Statement has sole voting power and investment power with respect to the shares of Common Stock beneficially owned by such person. |

| (2) | Includes 8,725,000 shares, 3,723,000 shares, 820,000 shares, 560,000 shares and 13,828,000 shares as to which Denis A. Krusos, Frank J. DiSanto, Henry P. Herms, George P. Larounis, and all directors, director nominees and executive officers as a group, respectively, have the right to acquire within 60 days upon exercise of options granted pursuant to the CopyTele, Inc. 1993 Stock Option Plan (the “1993 Plan”), the CopyTele, Inc. 2000 Share Incentive Plan (the “2000 Plan”) and the CopyTele, Inc. 2003 Share Incentive Plan (the “2003 Plan”). |

| (3) | Based on 97,313,345 shares of common stock outstanding as of September 27, 2006. |

| (4) | Edward A. Ambrosino, Esq., a receiver for certain of Mr. DiSanto’s assets, may share beneficial ownership of the shares beneficially owned by Mr. DiSanto as a result of a court order signed by a judge on September 14, 2006, authorizing Mr. Ambrosino to cause the sale of such shares. CopyTele is not aware whether such order has been entered. |

ELECTION OF DIRECTORS

(Item 1)

Four directors are to be elected at the Annual Meeting by the holders of Common Stock, each to serve until the next Annual Meeting of Stockholders and until his successor shall be elected and shall

3

qualify. All of the nominees at present are available for election as members of the Board of Directors. If for any reason a nominee becomes unavailable for election, the proxies solicited by the Board of Directors will be voted for a substitute nominee selected by the Board of Directors. Information regarding the nominees is as follows:

| Name |

Age | Position with the Company | ||

| Denis A. Krusos |

78 | Director, Chairman of the Board and Chief Executive Officer | ||

| Frank J. DiSanto |

82 | Director and President | ||

| Henry P. Herms |

61 | Director, Chief Financial Officer and Vice President – Finance | ||

| George P. Larounis |

78 | Director | ||

Mr. Krusos has served as one of our Directors and as our Chairman of the Board and Chief Executive Officer since November 1982. He holds an M.S.E.E. degree from Newark College of Engineering, a B.E.E. degree from City College of New York and a J.D. degree from St. John’s University.

Mr. DiSanto has served as one of our Directors and as our President since November 1982. He holds a B.E.E. degree from Polytechnic Institute of Brooklyn and an M.E.E. degree from New York University.

Mr. Herms has served as our Chief Financial Officer and Vice President - Finance since November 2000 and as one of our Directors since August 2001. Mr. Herms was also our Chief Financial Officer from 1982 to 1987. He is also a former audit manager with the firm of Arthur Andersen LLP and a CPA. He holds a B.B.A. degree from Adelphi University.

Mr. Larounis has served as one of our Directors since September 1997, prior to which he served as a consultant to us. Mr. Larounis is currently retired. From 1960 to 1993, he held numerous positions as a senior international executive of The Bendix Corporation and AlliedSignal Inc., which is now known as Honeywell International, Inc. He has also served on the Boards of Directors of numerous affiliates of AlliedSignal in Europe, Asia and Australia. He holds a B.E.E. degree from the University of Michigan and a J.D. degree from New York University.

The Board of Directors recommends a vote FOR each nominee as a Director to hold office until the next Annual Meeting. Proxies received by the Board of Directors will be so voted unless stockholders specify in their proxy a contrary choice.

Board of Directors and Corporate Governance

General

Our Board of Directors oversees the activities of our management in the handling of the business and affairs of our company. As part of the Board’s oversight responsibility, it monitors developments in the area of corporate governance, including new SEC requirements, and periodically reviews and amends, as appropriate, our governance policies and procedures.

None of our directors are “independent” under the rules applicable to the Nasdaq Stock Market.

We do not have a standing audit, nominating or compensation committee. Our full Board of Directors has assumed the functions of our former Audit Committee and Stock Option Committee. The functions of the Audit Committee assumed by the Board of Directors include fulfilling its responsibility to oversee management’s conduct of our financial reporting process, including the selection of our

4

independent auditors and the review of the financial reports and other financial information provided by us to any governmental or regulatory body, the public or other users thereof, our systems of internal accounting and financial controls, and the annual independent audit of our financial statements.

The functions of the Stock Option Committee assumed by the full Board of Directors include administration the 1993 Plan, the 2000 Plan, and the 2003 Plan. We have discontinued granting options under the 1993 Plan.

Attendance

Four meetings, exclusive of action by unanimous written consent, of the Board of Directors were held during fiscal year 2005. During such year, each director attended at least 75% of the aggregate number of meetings of the Board of Directors and committees on which he served while a member thereof. All members of our Board of Directors, except George Larounis, attended our 2005 annual meeting of stockholders. We encourage our directors to attend the annual meeting of stockholders.

Nominations of Directors

We have not designated a nominating committee or other committee performing a similar function, due to the size of our company and Board. Such matters are discussed by our Board of Directors as a whole. In selecting directors, the Board will consider candidates that possess qualifications and expertise that will enhance the composition of the Board, including the considerations set forth below. The considerations set forth below are not meant as minimum qualifications, but rather as guidelines in weighing all of a candidate’s qualifications and expertise.

| • | Candidates should be individuals of personal integrity and ethical character. |

| • | Candidates should have background, achievements, and experience that will enhance our Board. This may come from experience in areas important to our business, substantial accomplishments or prior or current associations with institutions noted for their excellence. Candidates should have demonstrated leadership ability, the intelligence and ability to make independent analytical inquiries and the ability to exercise sound business judgment. |

| • | Candidates should be free from conflicts that would impair their ability to discharge the fiduciary duties owed as a director to CopyTele and its stockholders, and we will consider directors’ independence from our management and stockholders. |

| • | Candidates should have, and be prepared to devote, adequate time and energy to the Board and its committees to ensure the diligent performance of their duties, including by attending meetings of the Board and its committees. |

| • | Due consideration will be given to the Board’s overall balance of diversity of perspectives, backgrounds and experiences, as well as age, gender and ethnicity. |

| • | Consideration will also be given to relevant legal and regulatory requirements. |

We are of the view that the continuing service of qualified incumbents promotes stability and continuity in the board room, contributing to the Board’s ability to work as a collective body, while giving us the benefit of the familiarity and insight into our affairs that our directors accumulate during their tenure. Accordingly, the process of the Board for identifying nominees for directors will reflect our practice of generally re-nominating incumbent directors who continue to satisfy the Board’s criteria for membership on the Board, whom the Board believes continue to make important contributions and who consent to continue their service on the Board. If the Board determines that an incumbent director consenting to

5

re- nomination continues to be qualified and has satisfactorily performed his or her duties as director during the preceding term, and that there exist no reasons, including considerations relating to the composition and functional needs of the Board as a whole, why in the Board’s view the incumbent should not be re-nominated, the Board will, absent special circumstances, generally propose the incumbent director for re-election.

If the incumbent directors are not nominated for re-election or if there is otherwise a vacancy on the Board, the Board may solicit recommendations for nominees from persons that the Board believes are likely to be familiar with qualified candidates, including from members of the Board and management. The Board may also determine to engage a professional search firm to assist in identifying qualified candidates. We do not have a policy with regard to the consideration of director candidates recommended by stockholders. Due to the size of our company and Board, the Board does not believe that such a policy is necessary.

Depending on its level of familiarity with the candidates, the Board may choose to interview certain candidates that it believes may possess qualifications and expertise required for membership on the Board. It may also gather such other information it deems appropriate to develop a well-rounded view of the candidate. Based on reports from those interviews or from Board members with personal knowledge and experience with a candidate, and on all other available information and relevant considerations, the Board will select and nominate candidates who, in its view, are most suited for membership on the Board.

Communications with Directors

Stockholders may send written communications to the Board by mailing those communications to CopyTele, Inc., 900 Walt Whitman Road, Melville, NY 11747, Attn.: Secretary, who will forward such communications to the relevant addressee. We will generally not forward to the directors shareholder communications that merely request general information about us.

Code of Ethics

We have adopted a formal code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. We will provide a copy of our code of ethics to any person without charge, upon request. For a copy of our code of ethics write to Secretary, CopyTele, Inc., 900 Walt Whitman Road, Melville, NY 11747.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and ten percent stockholders to file initial reports of ownership and reports of changes in ownership of Common Stock with the Securities and Exchange Commission. Directors, executive officers and ten percent stockholders are required to furnish us with copies of all Section 16(a) forms that they file. Based upon a review of these filings, we believe that all required Section 16(a) fillings were made on a timely basis during fiscal year 2005.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Denis A. Krusos, Chairman of the Board, Chief Executive Officer and Director, Frank J. DiSanto, President and Director and Henry P. Herms, Chief Financial Officer, Vice President - Finance and Director, are our executive officers. While there are no formal agreements, Denis A. Krusos and Frank J. DiSanto waived any and all rights to receive salary and related pension benefits commencing November 1, 1985 through October 31, 2003. As a result, Messrs. Krusos and DiSanto received no salary or bonus during fiscal 2003. Effective for fiscal 2004, Mr. Krusos and Mr. DiSanto began to receive salary. The salary received by Mr. Krusos in fiscal 2005 and 2004 included approximately $97,000 and $135,000, respectively, which was paid in the form of common stock. Except for Mr. Krusos, no other executive

6

officer received an annual salary and bonus in excess of $100,000 during the fiscal year ended October 31, 2005. The following is compensation information regarding Mr. Krusos for the fiscal years ended October 31, 2005, 2004 and 2003:

SUMMARY COMPENSATION TABLE

| Name and Principal Position |

Fiscal Year Ended |

Annual Salary |

Long-Term Securities Underlying | ||||

| Denis A. Krusos, |

10/31/05 | $ | 147,200 | 2,500,000 | |||

| Chairman of the Board, |

10/31/04 | $ | 135,075 | 1,750,000 | |||

| Chief Executive Officer and Director |

10/31/03 | — | 1,500,000 | ||||

The following is information regarding stock options granted to Mr. Krusos pursuant to the 2003 Plan during the fiscal year ended October 31, 2005:

OPTION GRANTS IN LAST FISCAL YEAR

| Individual Grants |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||||||||||||

| Number of Securities Underlying Options Granted (#) |

Percent of Total Options Granted to Employees in Fiscal Year |

Exercise Price ($/Share) |

Expiration Date | |||||||||||||||

| Name |

5% ($) | 10% ($) | ||||||||||||||||

| Denis A. Krusos |

1,500,000 1,000,000 |

(1) (1) |

19.00 12.67 |

% % |

$ $ |

0.65 0.52 |

(2) (2) |

2/17/15 10/30/15 |

$ $ |

613,172 327,025 |

$ $ |

1,553,900 828,746 | ||||||

| (1) | Options granted pursuant to the 2003 Plan, which are exercisable in whole or in part on the date of grant. The options are not issued in tandem with stock appreciation or similar rights and are not transferable other than by will or the laws of descent and distribution. The options terminate upon termination of employment, except that in the case of death, disability or termination for reasons other than cause, options may be exercised for certain periods of time thereafter as set forth in the 2003 Plan. |

| (2) | The exercise price of these options was equal to the fair market value (closing price) of the underlying common stock on the date of grant. These options are nonqualified options. |

The following is information regarding stock option exercises during fiscal 2005 by Mr. Krusos and the values of his options as of October 31, 2005:

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FY-END OPTION/VALUES

| Name |

Shares Acquired on Exercise (#) |

Value Realized ($) |

Number of Securities Underlying Unexercised Options at Fiscal Year End (#) |

Value of Unexercised In-the- Money Options at Fiscal Year End ($)(1) | |||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

| Denis A. Krusos |

— | — | 8,278,290 | — | $ | 480,000 | — | ||||||

| (1) | Such value was determined by multiplying the net difference between the last sales price of the stock on October 31, 2005 and the exercise price for the options by the number of unexercised in-the-money options held. |

7

There is no present arrangement for cash compensation of directors for services in that capacity. Under the 2003 Share Incentive Plan, each non-employee director is entitled to receive nonqualified stock options to purchase 60,000 shares of common stock each year that such director is elected to the Board of Directors. Accordingly, Mr. Larounis was granted nonqualified stock options to purchase 60,000 shares of common stock for services as a director. In addition, Mr. Larounis was granted nonqualified stock options to purchase 100,000 shares of common stock for services as a consultant.

REPORT OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION

In view of the fact that CopyTele’s executive officers, with the exception of Henry P. Herms, had waived all salary and related pension benefits prior to fiscal year 2004, the Board of Directors did not adopt any policy with respect to the payment of cash compensation to the executive officers of CopyTele for such period. During fiscal 2004 and 2005, Denis A. Krusos received compensation in the form of common stock and cash and Frank J. DiSanto received cash compensation. In addition, Mr. Herms continued to receive a salary in fiscal 2005. The compensation paid to Messrs. Krusos, DiSanto and Herms was not paid under an overall compensation policy and was not specifically related to corporate performance. The compensation paid to Mr. Krusos was determined by CopyTele’s Board of Directors, and compensation paid to Messrs. DiSanto and Herms was determined by CopyTele’s Chief Executive Officer. The Board of Directors may consider developing an overall compensation policy for its executive officers, including the Chief Executive Officer.

Generally, options previously granted under the 1993 Plan and 2000 Plan, and options currently granted under the 2003 Plan, are granted as an inducement in respect of future performance. During fiscal year 2005, options were granted to Messrs. Krusos, DiSanto and Herms for 2,500,000, 500,000 and 200,000 shares of common stock, respectively, under the 2003 Plan. Such grants were approved by the Board of Directors, which has assumed the functions of our former Stock Option Committee. All three plans also provide for the granting of stock appreciation rights, although no stock appreciation rights have been granted under any of the plans. Additionally, the 2000 Plan and 2003 Plan provide for the granting of other benefits, including stock awards, performance awards and stock units. Other than stock awards granted to Mr. Krusos and Mr. Herms, no such benefits had been granted to CopyTele’s executive officers under those plans in fiscal 2005. The Board of Directors believes that the 1993 Plan, the 2000 Plan and the 2003 Plan have been effective in attracting and retaining executives and employees.

With certain exceptions, Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986, as amended, denies a deduction to CopyTele for compensation paid to certain executive officers in excess of $1 million per executive per taxable year (including any deduction with respect to the exercise of a nonqualified option or right or the disqualifying disposition of stock purchased pursuant to an incentive option). CopyTele believes that options previously granted under the 1993 Plan and options and rights granted under the 2000 Plan and the 2003 Plan by a qualifying committee of the Board of Directors, should qualify for the performance-based compensation exception to Section 162(m). However, since the resignation of Mr. Bowers from our Board of Directors, we no longer have such a qualifying committee.

This Report has been prepared by the Board of Directors.

| Denis A. Krusos Frank J. DiSanto |

Henry P. Herms George P. Larounis |

8

AUDIT COMMITTEE REPORT

Because we no longer have a standing Audit Committee, the following is the report of our entire Board of Directors, including our independent director, Mr. Larounis, with respect to our audited financial statements for fiscal year 2005.

Review with Management. Mr. Larounis reviewed and discussed our audited financial statements with management.

Review and Discussions with Independent Auditors. The Board of Directors discussed with Grant Thornton LLP, our independent auditors for the fiscal year ended October 31, 2005, the matters required to be discussed by Statement on Auditing Standards (“SAS”) 61 (Communications with Audit Committees) and SAS 90 (Audit Committee Communications) regarding the auditor’s judgments about the quality of our accounting principles as applied in its financial reporting.

The Board of Directors also received written disclosures and the letter from Grant Thornton LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with Grant Thornton LLP their independence.

Conclusion. Based on the review and discussions referred to above, the Board of Directors determined to include our audited financial statements in our Annual Report on Form 10-K for fiscal year 2005, for filing with the Securities and Exchange Commission.

| Denis A. Krusos Frank J. DiSanto |

Henry P. Herms George P. Larounis |

The information contained in the foregoing reports shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate them by reference in such filing.

9

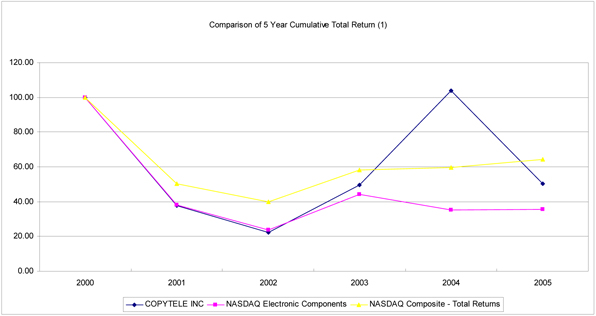

STOCKHOLDER RETURN PERFORMANCE GRAPH

Set forth below is a graph showing the five-year cumulative total return for: (i) our Common Stock; (ii) The Nasdaq Stock Market U.S. Index, a broad market index covering shares of common stock of domestic companies that are listed on Nasdaq; and (iii) The Nasdaq Electronic Components Stock Index, a group of companies that are engaged in the manufacture of electronic components and related accessories with a Standard Industrial Classification Code of 367 and listed on NASDAQ.

| Fiscal Year Ended October 31 | |||||||||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | ||||||||

| CopyTele, Inc. |

$ | 100 | 38 | 22 | 49 | 104 | 50 | ||||||

| Nasdaq Electronic Components |

$ | 100 | 38 | 24 | 44 | 35 | 35 | ||||||

| Nasdaq Stock Market U.S. |

$ | 100 | 50 | 40 | 58 | 60 | 64 | ||||||

| (1) | The comparison of total return on investment for each fiscal year ended October 31 assumes that $100 was invested on November 1, 2000 in each of CopyTele, The Nasdaq Electronic Components Index and The Nasdaq Stock Market U.S. Index with investment weighted on the basis of market capitalization and all dividends reinvested. |

The information contained in the foregoing graph shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate it by reference in such filing.

10

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(Item 2)

The Board of Directors has appointed the firm of Grant Thornton LLP, an independent registered public accounting firm, to serve as our independent auditors for fiscal year 2006, subject to ratification of this appointment by our stockholders. We have been advised by that firm that neither it nor any member thereof have any direct or material indirect financial interest in CopyTele.

The following table describes fees for professional audit services rendered by Grant Thornton LLP, our present independent registered public accounting firm and principal accountant, for the audit of our annual financial statements and for other services for the years ended October 31, 2005, and 2004.

| Type of Fee |

2005 | 2004 | ||||

| Audit Fees(1) |

$ | 219,854 | $ | 127,460 | ||

| Audit Related Fees(2) |

7,800 | — | ||||

| Tax Fees – tax return review |

— | — | ||||

| All Other Fees |

— | — | ||||

| Total |

$ | 227,654 | $ | 127,480 | ||

| (1) | Audit fees consist of fees for the audit of our annual financial statements, review of our quarterly financial statements, and audit of our internal control over financial reporting. |

| (2) | Audit related fees consist of fees related to our 2003 Plan. |

Procedures for Board of Directors Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors. Our Board of Directors is responsible for reviewing and approving, in advance, any audit and any permissible non-audit engagement or relationship between us and our independent registered public accounting firm. Grant Thornton LLP’s engagement to conduct our audit was approved by the Board of Directors on September 30, 2005. We did not enter into any non-audit engagement or relationship with Grant Thornton LLP during fiscal 2005.

One or more representatives of Grant Thornton LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Ratification of the appointment of the independent auditors requires the affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and entitled to vote on such matter at the Annual Meeting.

The Board of Directors recommends a vote FOR this proposal. Proxies received by the Board of Directors will be so voted unless stockholders specify in their proxy a contrary choice.

STOCKHOLDER PROPOSALS

All proposals from stockholders to be included in the proxy materials to be distributed by us in connection with the next annual meeting must be received by the Secretary of CopyTele, 900 Walt Whitman Road, Melville, New York 11747, not later than the close of business on June 7, 2007.

In addition, in accordance with Article I, Section 10 of our Amended and Restated By-laws, in order to be properly brought before the next annual meeting, a matter must have been: (i) specified in a

11

written notice of such meeting (or any supplement thereto) given to the stockholders by or at the direction of the Board of Directors (which would be accomplished if a stockholder proposal were received by the Secretary of the CopyTele as set forth in the preceding paragraph); (ii) brought before such meeting at the direction of the Board of Directors or the Chairman of the meeting; or (iii) specified in a written notice given by or on behalf of a stockholder of record on the record date for such meeting, or a duly authorized proxy for such stockholder, which conforms to the requirements of Article I, Section 10 of our Amended and Restated By-laws and is delivered personally to, or mailed to and received by, the Secretary of the CopyTele at the address set forth in the preceding paragraph not less than 45 days prior to the first anniversary of the date of the notice accompanying this Proxy Statement; provided however, that such notice need not be given more than 75 days prior to the next annual meeting.

ANNUAL REPORT

A copy of our Annual Report, including financial statements for fiscal year 2005, accompanies this Proxy Statement.

By Order of the Board of Directors

ANNE ROTONDO

Secretary

Melville, New York

October 3, 2006

12

ANNUAL MEETING OF STOCKHOLDERS OF

COPYTELE, INC.

October 31, 2006

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

ê Please detach along perforated line and mail in the envelope provided. ê

n

| PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x

| ||||||||||||

| 1. Election of Directors: | NOMINEES | FOR | AGAINST | ABSTAIN | ||||||||

| ¨ FOR ALL NOMINEES

¨ WITHHOLD AUTHORITY FOR ALL NOMINEES

¨ FOR ALL EXCEPT (See instructions below) |

o Denis A. Krusos o Frank J. DiSanto o Henry P. Herms o George P. Larounis |

2. RATIFICATION OF THE SELECTION OF GRANT THORNTON LLP AS INDEPENDENT AUDITORS OF COPYTELE FOR THE FISCAL YEAR ENDING OCTOBER 31, 2006. |

¨ | ¨ | ¨ | |||||||

|

3. IN THEIR DISCRETION, THE PROXIES ARE AUTHORIZED TO VOTE UP ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT(S) OR POSTPONEMENT(S) THEREOF.

Receipt is acknowledged of Notice of Annual Meeting, Proxy Statement and Annual Report for the fiscal year ended October 31, 2005. | ||||||||||||

| INSTRUCTION: Towithhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here:

|

||||||||||||

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method.

|

¨ |

|||||||||||

| Signature of Stockholder | Date: | Signature of Stockholder | Date: |

| n |

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |

n |

Annual Meeting of Stockholders

October 31, 2006 - 10:30 A.M.

To be held at:

FOX HOLLOW

7725 Jericho Turnpike

Woodbury, New York

(516) 921-1415

Long Island Expressway to Exit 44 North (which is Rt. 135 North) to Exit 14 East (which is Woodbury 25 East)

Northern State Parkway to Exit 36B North (which is Rt. 135 North) to Exit 14 East (which is Woodbury 25 East)

Belt Parkway to Southern State Parkway to Exit 28A North (which is Rt. 135 North) to Exit 14 East (which is Woodbury 25 East)

At Exit 14 East, make right turn onto Jericho Turnpike (25 East). Fox Hollow is on left after first traffic light.

THIS PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

COPYTELE, INC.

Annual Meeting of Stockholders – October 31, 2006

THE UNDERSIGNED stockholder of CopyTele, Inc., hereby appoints DENIS A. KRUSOS and FRANK J. DiSANTO, or either of them, with full power of substitution, as the proxy or proxies of the undersigned at the Annual Meeting of Stockholders of CopyTele to be held at the Fox Hollow, Woodbury, New York, on October 31, 2006, at 10:30 a.m., and any adjournment(s) or postponement(s) thereof, and to vote thereat all shares of Common Stock of CopyTele which the undersigned would be entitled to vote if personally present in accordance with the instructions on the reverse side of this Proxy.

The shares represented by this Proxy will be voted as specified on the reverse side hereof, but if no specification is made, the proxies intend to vote FOR the election of all nominees as directors, FOR the ratification of the selection of auditors and, in the discretion of such proxies, for or against such other matters as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

(Continued and to be signed on the reverse side)