UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

CopyTele, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

| (1) | Title of each class of securities to which transaction applies: |

|

| (2) | Aggregate number of securities to which transaction applies: |

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| (4) | Proposed maximum aggregate value of transaction: |

|

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

| (1) | Amount Previously Paid: |

|

| (2) | Form, Schedule or Registration Statement No.: |

|

| (3) | Filing Party: |

|

| (4) | Date Filed: |

COPYTELE, INC.

________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 11, 2013

________________________________

TO THE STOCKHOLDERS OF COPYTELE, INC.

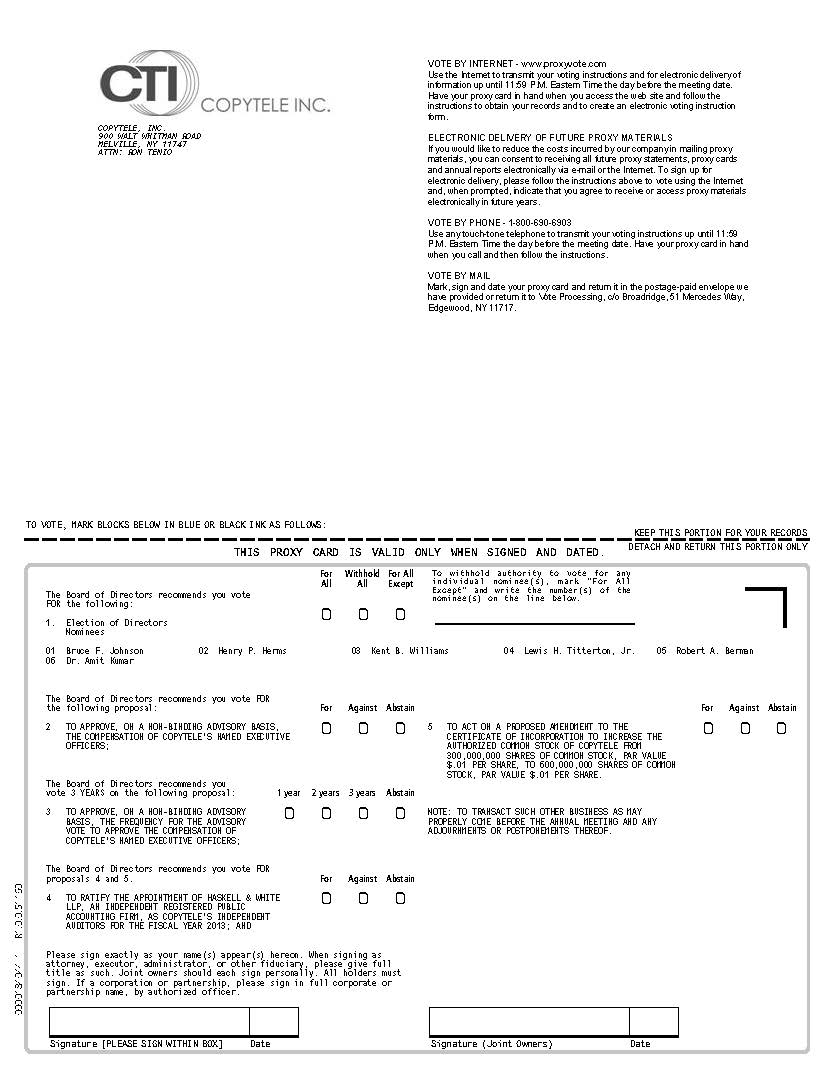

You are cordially invited to attend the Annual Meeting of Stockholders of CopyTele, Inc., a Delaware corporation, to be held at the Fox Hollow, Woodbury, New York, on Friday, October 11, 2013, at 10:30 a.m., local time, for the following purposes:

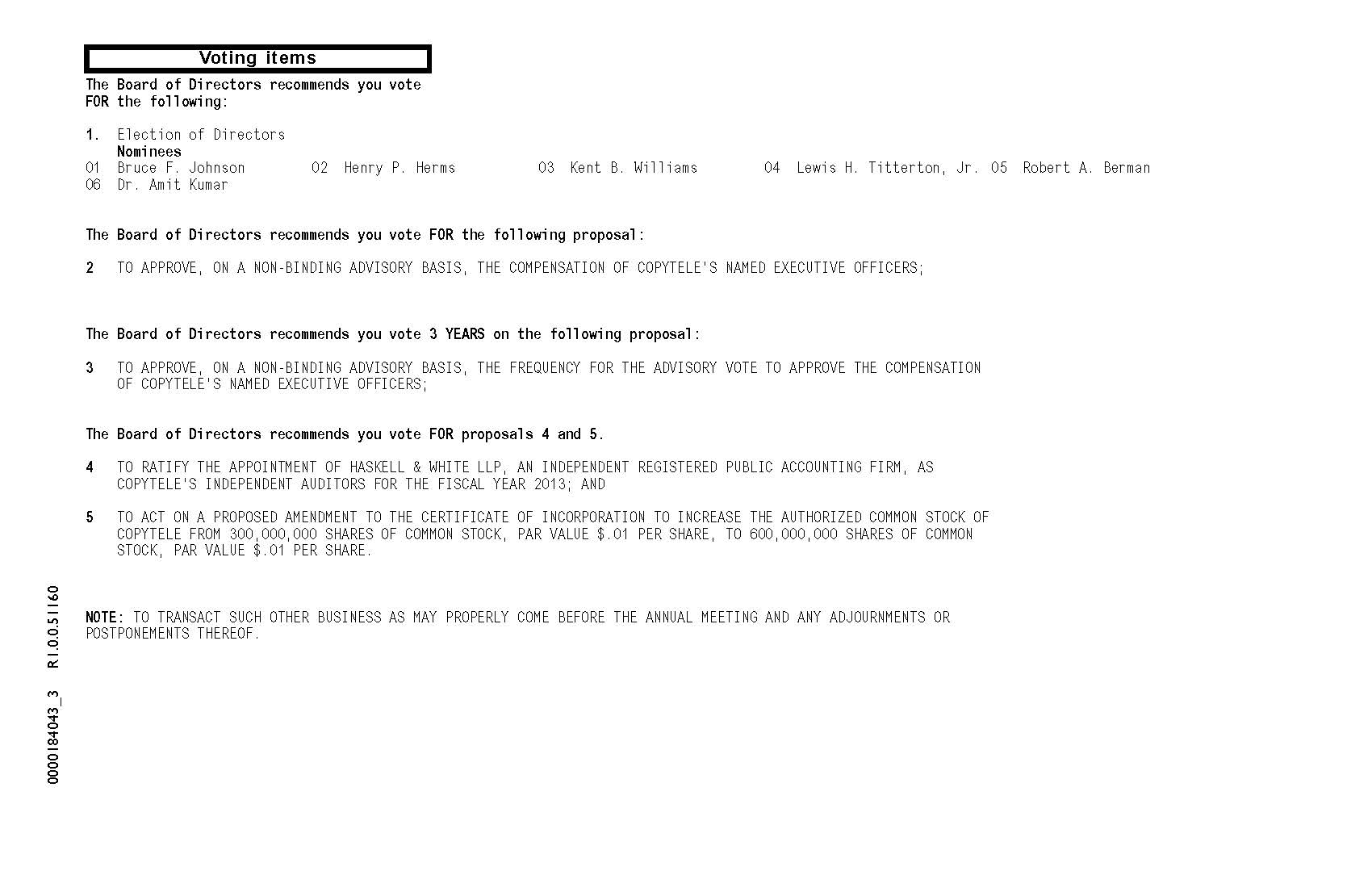

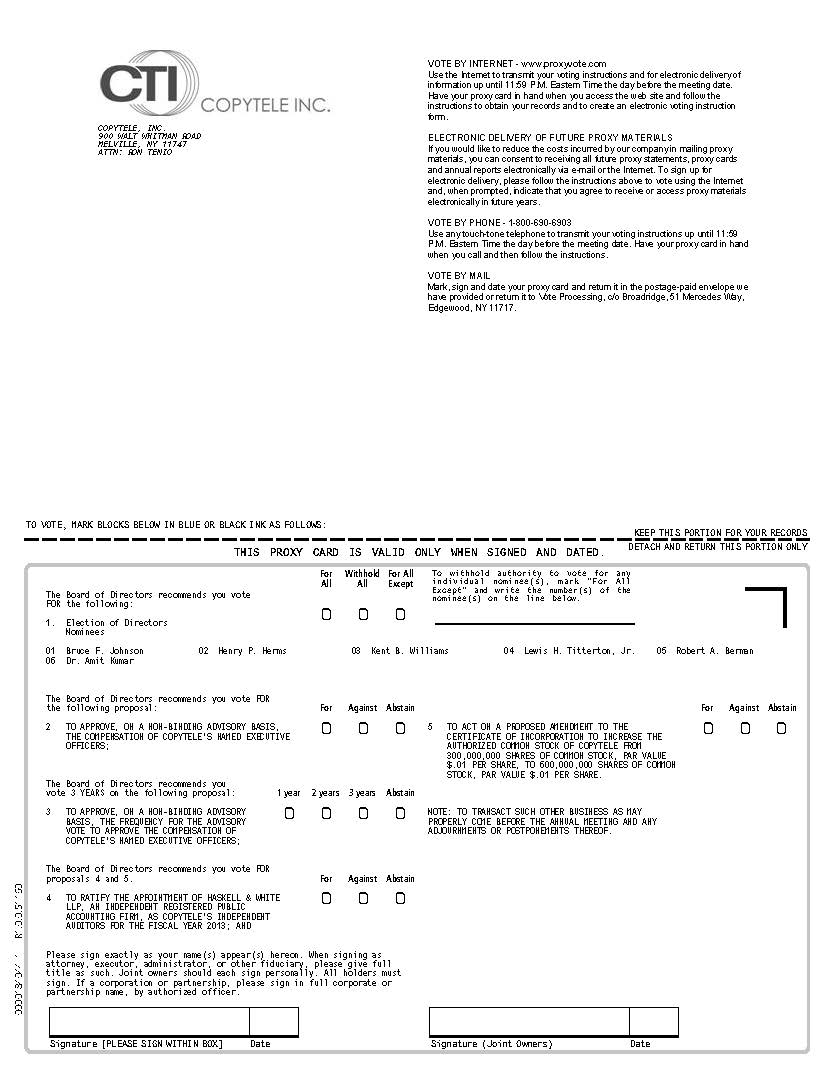

1. To elect six directors nominated by the Board of Directors to serve until the next Annual Meeting of Stockholders;

2. To approve, on a non-binding advisory basis, the compensation of CopyTele’s named executive officers;

3. To approve, on a non-binding advisory basis, the frequency for the advisory vote to approve the compensation of CopyTele’s named executive officers;

4. To ratify the appointment of Haskell & White LLP, an independent registered public accounting firm, as CopyTele’s independent auditors for fiscal year 2013;

5. To act on a proposed amendment to the Certificate of Incorporation to increase the authorized Common Stock of CopyTele from 300,000,000 shares of Common Stock, par value $.01 per share, to 600,000,000 shares of Common Stock, par value $.01 per share; and

6. To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors of CopyTele has fixed the close of business on August 16, 2013, as the record date for the Annual Meeting. This means that only holders of record of Common Stock at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting or at any adjournment or postponement of the Annual Meeting.

Whether or not you expect to attend the Annual Meeting, please read the proxy statement and promptly vote your proxy through the internet, by telephone or, if you received a printed form of proxy in the mail, by completing, dating, signing and returning the enclosed proxy so that your shares may be represented at the Annual Meeting. If you attend the Annual Meeting, you may vote in person even if you have previously returned your proxy.

By Order of the Board of Directors

Ron Tenio

Secretary

Melville, New York

August 27, 2013

COPYTELE, INC.

900 Walt Whitman Road

Melville, NY 11747

__________________

PROXY STATEMENT

__________________

ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 11, 2013

__________________

The Board of Directors of CopyTele, Inc. (“CopyTele”, “we”, “us” or the “Company”) is furnishing you this Proxy Statement to solicit proxies on its behalf to be voted at our Annual Meeting of Stockholders to be held on Friday, October 11, 2013, at 10:30 a.m., local time, and at any adjournments or postponements thereof. On or about August 27, 2013, we mailed to our stockholders of record as of the close of business on August 16, 2013 a notice containing instructions on how to access our proxy materials over the internet and vote. On or about August 27, 2013, we also began mailing printed copies of the Proxy Statement and the accompanying form of proxy to stockholders who had previously requested paper copies of our proxy materials.

VOTING

General

The Board of Directors has fixed the close of business on August 16, 2013 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. Each stockholder will be entitled to one vote for each share of common stock, par value $0.01 per share (the “Common Stock”) held on all matters to come before the Annual Meeting and may vote in person or by proxy authorized in writing. As of August 16, 2013, there were 206,376,189 shares of Common Stock issued and outstanding.

At the Annual Meeting, stockholders will be asked to consider and vote upon:

· Item 1 - the election of six directors nominated by the Board of Directors to serve until the next Annual Meeting of Stockholders;

· Item 2- the approval, on a non-binding advisory basis, the compensation of CopyTele’s named executive officers (the “Say on Pay Proposal”);

· Item 3- the approval, on a non-binding advisory basis, the frequency for the advisory vote to approve the compensation of CopyTele’s named executive officers (the “Say on Pay Frequency Proposal”);

· Item 4 - the ratification of the appointment of Haskell & White LLP, an independent registered public accounting firm, as our independent auditors for fiscal year 2013; and

· Item 5 - the approval of a proposed amendment to the Company’s Certificate of Incorporation to increase the authorized Common Stock of the Company from 300,000,000 to 600,000,000 shares of Common Stock (the “Increase in Authorized Common Stock Proposal”).

Stockholders may also consider and act upon such other matters as may properly come before the Annual Meeting or any adjournment or adjournments thereof.

1

Quorum and Required Votes

To carry on the business of the Annual Meeting, we must have a quorum. This means that at least a majority of the outstanding shares of Common Stock eligible to vote must be present at the Annual Meeting, either by proxy or in person. Shares of Common Stock represented by a properly signed and returned proxy are considered present at the Annual Meeting for purposes of determining a quorum. Abstentions and broker non-votes are counted as present at the Annual Meeting for determining whether we have a quorum. A broker non-vote occurs when a broker returns a proxy but does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner. With respect to broker non-votes, the shares will not be considered entitled to vote at the Annual Meeting on non-routine matters, such as the election of directors, the Say on Pay Proposal and the Say on Pay Frequency Proposal, which means your broker may not vote your shares on Items 1, 2 or 3 if you have not given your broker specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker so that your vote can be counted.

Election of directors will be determined by a plurality vote of the combined voting power of all shares of Common Stock present in person or by proxy and voting at the Annual Meeting. Accordingly, votes “withheld” from director-nominee(s), abstentions and broker non-votes will not count against the election of such nominee(s).

Approval, on a non-binding advisory basis, of the Say on Pay Proposal will be determined by the vote of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting and voting on such matter. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting and they will have the same effect as a vote against the matters. With respect to broker non-votes, the shares will not be considered entitled to vote at the Annual Meeting for such matter and they are not counted in the vote.

With respect to the Say on Pay Frequency Proposal, the frequency of every year, every two years and every three years, if any, that receives the affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote at the Annual Meeting will be the frequency for the advisory vote on compensation of CopyTele’s named executive officers that has been recommended by our stockholders. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting and they will have the same effect as a vote against any frequency. With respect to broker non-votes, the shares will not be considered entitled to vote at the Annual Meeting for such matter and they are not counted in the vote.

Approval of the proposal to ratify the appointment of Haskell & White LLP as our independent auditors for fiscal year 2013 or any other matter that may come before the Annual Meeting, will be determined by the vote of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting and voting on such matters. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting and they will have the same effect as votes against the matter.

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote on such matter at the Annual Meeting is required for approval of the Increase in Authorized Common Stock Proposal. With respect to an abstention, the shares will be considered present and entitled to vote at the Annual Meeting and they will have the same effect as a vote against the matter.

2

Voting and Revocation of Proxies

Your vote is important. We encourage you to promptly vote your proxy through the internet, by telephone or, if you received a printed form of proxy in the mail, by completing, dating, signing and returning the form of proxy in the enclosed envelope. The way you vote now does not limit your right to change your vote at the Annual Meeting if you attend in person.

Common Stock represented by properly executed proxies received by us and not revoked will be voted at the Annual Meeting in accordance with the instructions contained therein. If instructions are not given, executed proxies will be voted FOR the election of each nominee for election as named herein, FOR Items 2, 4 and 5 and for “3 years” in Item 3. The Board of Directors has not received timely notice (and does not know) of any matters that are to be brought before the Annual Meeting other than as set forth in the Notice of Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named in the proxy or their substitutes will vote in accordance with their best judgment on such matters.

Any proxy signed and returned by a stockholder may be revoked at any time before it is voted by filing with the Secretary of CopyTele written notice of such revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. You may also change your proxy before it is voted at the meeting by granting a subsequent proxy through the internet or by telephone. Attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy.

Proxy Solicitation

This proxy solicitation is being made on behalf of CopyTele by its Board of Directors. CopyTele will bear the costs of solicitations of proxies for the Annual Meeting. In addition to solicitation by mail, our directors, officers and regular employees may solicit proxies from stockholders by telephone, telegram, personal interview or otherwise. Such directors, officers and employees will not receive additional compensation, but may be reimbursed for out-of-pocket expenses in connection with such solicitation. We have requested brokers, nominees, fiduciaries and other custodians to forward soliciting material to the beneficial owners of Common Stock held of record by them, and such custodians will be reimbursed for their reasonable expenses.

PRINCIPAL HOLDERS OF COMMON STOCK

The following table sets forth certain information with respect to Common Stock beneficially owned as of August 22, 2013 by: (a) each person or entity who is known by our management to be the beneficial owner of more than 5% of our outstanding Common Stock; (b) each current director and executive officer of CopyTele (including those persons who have been nominated for election as directors by the Board of Directors) and (c) all directors and executive officers as a group:

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1)(2)(3)(4)(5)(7) | Percent of Class (6) |

| Mars Overseas Limited (8) | 20,000,000 | 9.69% |

| Lewis H. Titterton, Jr. 900 Walt Whitman Road Melville, NY 11747 | 10,577,359 | 5.11% |

| Robert A. Berman | 3,173,458 | 1.51% |

| Dr. Amit Kumar | 3,739,444 | 1.78% |

| Bruce F. Johnson | 7,646,196 | 3.68% |

| Kent B. Williams | 1,207,244 | * |

| Henry P. Herms | 1,365,583 | * |

| John A. Roop | 1,333,336 | * |

| All Directors and Executive Officers as a Group | 29,042,620 | 13.32% |

3

* Less than 1%.

(1) A beneficial owner of a security includes any person who directly or indirectly has or shares voting power and/or investment power with respect to such security or has the right to obtain such voting power and/or investment power within 60 days. Except as otherwise noted, each designated beneficial owner in this proxy statement has sole voting power and investment power with respect to the shares of Common Stock beneficially owned by such person.

(2) Includes 795,008 shares and 795,008 shares which Henry P. Herms and all directors and executive officers as a group, respectively, have the right to acquire within 60 days upon exercise of options granted pursuant to the 2003 Share Incentive Plan and/or the 2010 Share Incentive Plan.

(3) Includes 99,540 shares indirectly owned through the Vista Asset Management 401(k) plan, of which Kent Williams and his wife are the sole trustees, 47,700 shares owned by Mr. Williams’ wife and 215,460 shares indirectly owned by Mr. Williams’ wife through the Vista Asset Management 401(k) plan. Mr. Williams disclaims beneficial ownership of the shares owned by his wife.

(4) Includes 500,000 shares, 1,000,000 shares, 1,000,000 shares and 2,500,000 shares that Robert A. Berman, Dr. Amit Kumar, Bruce F. Johnson and all directors and executive officers as a group, respectively, have the right to acquire within 60 days upon conversion of debentures and exercise of warrants purchased by them in the private placement on January 25, 2013.

(5) Includes 783,334 shares, 2,666,672 shares, 733,334 shares, 1,333,326 shares, 2,666,672 shares, 150,000 shares and 8,333,348 shares which Lewis H. Titterton, Robert A. Berman, Kent B. Williams, John Roop, Dr. Amit Kumar, Bruce F. Johnson and all directors and executive officers as a group, respectively, have the right to acquire within 60 days pursuant to option agreements with the Company.

(6) Based on 206,376,189 shares of Common Stock outstanding as of August 22, 2013.

(7) The Company has relied solely on information provided in Amendment No. 1 to the Schedule 13G which Mars Overseas Limited filed with the Securities and Exchange Commission on May 17, 2010. As reported in the Schedule 13G/A, Mars Overseas is a joint venture controlled by six entities. The governing documents of Mars Overseas require majority voting of the six entities that are party to the joint venture with respect to the 20,000,000 CopyTele shares owned by Mars Overseas. Four of these six entities are controlled by members of the Dhoot family, which include Messrs. Venugopal N. Dhoot, Rajkumar N. Dhoot and Pradipkumar N. Dhoot. The remaining two entities are publicly traded corporations outside of the United States, of which the above-mentioned members of the Dhoot family hold a significant percentage, although less than 50% of such publicly traded companies. Messrs. Venugopal N. Dhoot, Rajkumar N. Dhoot and Pradipkumar N. Dhoot all disclaim beneficial ownership in the shares held by Mars Overseas except to the extent of their pecuniary interest, and disclaim membership as a group.

ELECTION OF DIRECTORS

(Item 1)

Our Board of Directors currently consists of six directors. Six directors are to be elected at the Annual Meeting by the holders of Common Stock, each to serve until the next Annual Meeting of Stockholders and until his successor shall be elected and shall qualify. Lewis H. Titterton, Jr., Robert A. Berman, Dr. Amit Kumar, Bruce F. Johnson, Kent B. Williams and Henry P. Herms are nominated for reelection to the Board (the “Director Nominees”). Each Director Nominee is presently a director of the Company. All of the Director Nominees are available for election as members of the Board of Directors. If for any reason a Director Nominee becomes unavailable for election, the proxies solicited by the Board of Directors will be voted for a substitute nominee selected by the Board of Directors.

The following table sets forth certain information with respect to all of our Director Nominees:

|

Name |

Age |

Position with the Company | Director and/or Executive Officer Since |

| Lewis H. Titterton Jr. | 69 | Chairman of the Board | 2010 |

| Robert A. Berman | 50 | Director, President and Chief Executive Officer | 2012 |

| Henry P. Herms | 68 | Director, Chief Financial Officer and Vice President - Finance | 2000 |

| Dr. Amit Kumar | 49 | Director, Strategic Advisor | 2012 |

| Bruce F. Johnson | 71 | Director | 2012 |

| Kent B. Williams | 63 | Director | 2012 |

5

The following sets forth the biographical background information for all of our Director Nominees:

Mr. Titterton has served as a director since August 16, 2010, the Chairman of the Board since July 20, 2012 and interim Chief Executive Officer from August 21, 2012 until September 19, 2012. Mr. Titterton is currently Chairman of the Board of NYMED, Inc., a diversified health services company. His background is in high technology with an emphasis on health care and he has been with NYMED, Inc. since 1989. Mr. Titterton founded MedE America, Inc. in 1986 and was Chief Executive Officer of Management and Planning Services, Inc. from 1978 to 1986. Mr. Titterton also served as one of our Directors from July 1999 to January 2003. He holds a M.B.A. from the State University of New York at Albany, and a B.A. degree from Cornell University.

Mr. Berman has served as our President and Chief Executive Officer since September 19, 2012 and was elected to our Board of Directors on November 30, 2012. Mr. Berman has experience in a broad variety of areas including finance, acquisitions, marketing, and the development, licensing, and monetization of intellectual property. He was recently the CEO of IP Dispute Resolution Corporation, a consulting company focused on patent monetization, from March 2007 to September 2012. Prior to IPDR, Mr. Berman was the Chief Operating Officer and General Counsel of Acacia Research Corporation from 2000 to March 2007. Mr. Berman holds a J.D. from the Northwestern University School of Law and a B.S. in Entrepreneurial Management from the Wharton School of the University of Pennsylvania.

Dr. Kumar has served on our Board of Directors since November 30, 2012 and has been a strategic advisor to the Company since September 19, 2012. Dr. Kumar has been CEO of Geo Fossil Fuels LLC, an energy company, since December 2010. From September 2001 to June 2010, Dr. Kumar was President and CEO of CombiMatrix Corporation, a Nasdaq listed biotechnology company and also served as director from September 2000 to June 2012. Dr. Kumar was Vice President of Life Sciences of Acacia Research Corp., a publicly traded patent monetization company, from July 2000 to August 2007 and also served as a director from January 2003 to August 2007. Dr. Kumar has served as Chairman of the Board of Directors of Ascent Solar Technologies, Inc., a publicly-held solar energy company, since June 2007, and as a director of Aeolus Pharmaceuticals, Inc. since June 2004. Dr. Kumar holds an A.B. in Chemistry from Occidental College and Ph.D. from Caltech.

Mr. Johnson has served on our Board of Directors since August 29, 2012. Mr. Johnson has been a commodity trader on the Chicago Mercantile Exchange for over 40 years. He has served as a member of the board of directors of CME Group Inc. since 1998. He had previously served as President, Director and part-owner of Packers Trading Company, a former futures commissions merchant/clearing firm at the CME from 1969 to 2003. He also serves on the board of directors of the Chicago Crime Commission. Mr. Johnson holds a B.S. in Marketing from Bradley University and a J.D. from John Marshall Law School.

Mr. Williams has served on our Board of Directors since August 21, 2012. He has the managing member of Vista Asset Management LLC, an investment advisory firm, since 2002. He has more than 40 years’ experience in the capital markets, including positions with U.S. Trust, Wood Island Associates and Merrill Lynch. In 2011, he also founded VIA Motors, a clean tech, plug-in electric vehicle company. He is a member of the CFA Institute and the CFA Society of San Francisco and received his M.B.A. from St. Mary’s College of California and a B.A. from the University of California at Berkeley.

Mr. Herms has served as our Chief Financial Officer and Vice President – Finance since November 2000 and as one of our Directors since August 2001. Mr. Herms was also our Chief Financial Officer from 1982 to 1987. He is also a former audit manager and CPA with the firm of Arthur Andersen LLP. He holds a B.B.A. degree from Adelphi University.

We believe that our board of directors represents a desirable mix of backgrounds, skills, and experiences. Below are some of the specific experiences, qualifications, attributes or skills in addition to the biographical information provided above that led to the conclusion that each person should serve as one of our directors in light of our business and structure:

6

Mr. Titterton has been involved with our Company as a director or investor for over nineteen years. Mr. Titterton also has substantial experience with advising on the strategic development of technology companies and over forty years of experience in various aspects of the technology industry.

Mr. Berman has experience in development, licensing, and monetization of intellectual property as well as a broad variety of other areas including finance, acquisitions, and marketing, and has served as an officer of another publicly traded patent monetization company.

Mr. Herms has served as our Chief Financial Officer and Vice President - Finance since 2000 and as our Chief Financial Officer from 1982 to 1987, and has a deep understanding of the financial aspects of our business. He also has substantial experience as a public accountant, which is important to the Board’s ability to review our consolidated financial statements, assess potential financings and strategies and otherwise supervise and evaluate our business decisions.

Dr. Kumar has experience in development, licensing, and monetization of intellectual property as well as a broad variety of other areas including finance, acquisitions, R&D, and marketing, and has served as a director and officer of another publicly traded patent monetization company.

Mr. Johnson has been involved with the Company as an investor for over 9 years and has over 30 years’ experience in the capital markets as a result of his investment background.

Mr. Williams has been involved with the Company as an investor for over 12 years and has over 40 years’ experience in the capital markets.

Except for Dr. Kumar and Mr. Johnson, none of our current directors or executive officers have served as a director of another public company within the past five years.

To the best of the Company’s knowledge, there are no arrangements or understandings between any director, Director Nominee or executive officer and any other person pursuant to which any person was selected as a director, Director Nominee or executive officer. There are no family relationships between any of the Company’s directors, Director Nominees or executive officers. To the Company’s knowledge there have been no material legal proceedings as described in Item 401(f) of Regulation S-K during the last ten years that are material to an evaluation of the ability or integrity of any of the Company’s directors, Director Nominees or executive officers.

The Board of Directors recommends a vote FOR each Director Nominee to serve on the Board of Directors. Proxies received by the Board of Directors will be so voted unless stockholders specify in their proxy a contrary choice.

Board of Directors and Corporate Governance

General

Our Board of Directors oversees the activities of our management in the handling of the business and affairs of our Company. As part of the Board’s oversight responsibility, it monitors developments in the area of corporate governance, including new Securities and Exchange Commission (the “SEC”) requirements, and periodically reviews and amends, as appropriate, our governance policies and procedures.

7

While we are not subject to the listing requirements of any national securities exchange or inter-dealer quotation system which require that our Board be comprised of a majority of “independent” directors, Messrs. Johnson and Williams meet the definition of “independent” as promulgated by the rules and regulations of the Nasdaq Stock Market. Mr. Titterton also meets the general Nasdaq definition of “independent” would not be independent under the Nasdaq’s audit committee independence rules due to his service as our interim Chief Executive Officer and his participation in the preparation of the Company’s financial statements for the quarter ended July 31, 2012. Our directors, Robert A. Berman, Amit Kumar and Henry Herms, are employees of, or consultants to, the Company and as such do not qualify an “independent” directors under the rules adopted by Nasdaq and other stock exchanges.

Except for the period between August 21, 2012 and November 29, 2012, we have not had, and do not currently have, a separately-designated standing audit, nominating or compensation committee because we believed that, given the size of our Company, separate committees were unnecessary.

On August 21, 2012, the Board of Directors established the Executive Committee, initially comprised of Lewis H. Titterton, Jr., Henry P. Herms and George P. Larounis, a former director of CopyTele. From August 21, 2012 through November 29, 2012, the Executive Committee assumed the functions of our Audit Committee, Compensation Committee and Stock Option Committee, as well as the authority to determine executive and director compensation at the Company. Three meetings of the Executive Committee were held during fiscal year 2012. On November 30, 2012, the Executive Committee was dissolved and the Board assumed the functions of our Audit Committee, Compensation Committee and Stock Option Committee. The Executive Committee did not have a committee charter.

The functions of the Audit Committee assumed by the entire Board of Directors include fulfilling its responsibility to oversee management’s conduct of our financial reporting process, including the selection of our independent auditors and the review of the financial reports and other financial information provided by us to any governmental or regulatory body, the public or other users thereof, our systems of internal accounting and financial controls, and the annual independent audit of our financial statements. Our Board of Directors has not made a determination as to whether or not Dr. Kumar or Messrs. Johnson, Titterton or Williams, the non-management directors, meet the definition of “audit committee financial expert.” The SEC’s rules do not require us to have an audit committee financial expert, and our Board of Directors has determined that it possesses sufficient financial expertise to effectively discharge its obligations.

The Board of Directors has full authority for determination of executive and director compensation. The Board of Directors’ processes and procedures for the consideration and determination of executive and director compensation for fiscal year 2012 are described under the heading “Compensation Discussion and Analysis.”

The members of the Stock Option Committee (until its functions were assumed by Executive Committee) were Denis A. Krusos, George Larounis and Henry P. Herms during fiscal year 2012. Twenty-one meetings of the Stock Option Committee were held during fiscal year 2012. The functions of the Stock Option Committee assumed by the Board of Directors include administration of the 2003 Plan and the 2010 Plan.

Board Leadership Structure and Role in Risk Oversight

Denis A. Krusos served as our Chairman until July 20, 2012, and Chief Executive Officer until August 21, 2012, while Lewis H. Titterton served as a non-employee director. On August 21, 2012, Mr. Krusos’s employment was terminated. Mr. Titterton was appointed as Chairman of the Board on July 20, 2012 and interim Chief Executive Officer on August 21, 2012 and he served in that capacity until our new Chief Executive Officer was appointed on September 19, 2012. Given the recent changes in the composition of the Board of Directors, we now believe that it is in the best interest of Company to separate the roles of the chief executive officer and chairman of the board and we expect to maintain those separate roles now that a new Chief Executive Officer has been appointed. As interim Chief Executive Officer from August 21, 2012 to September 19, 2012, Mr. Titterton was responsible for the day-to-day operations of the Company and was thus in a position to evaluate the most critical business issues for consideration by the Board of Directors.

8

Our Board of Directors consists of six directors. The Board of Directors has not appointed a lead independent director. Due to the size of the Board, the independent directors are able to closely monitor the activities of our Company. In addition, the independent directors are able to meet independently with the Company’s independent registered public accounting firm without management to discuss the Company’s financial statements and related audits. Therefore, the Board of Directors has determined that a lead independent director is not necessary at this time. To the extent the composition of the Board changes and/or grows in the future, the Board of Directors may reevaluate the need for a lead independent director.

Management is responsible for the day-to-day management of risks the Company faces, while the Board of Directors as a whole has ultimate responsibility for the Company’s oversight of risk management. Our Board of Directors takes an enterprise-wide approach to risk oversight, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk oversight is not only understanding the risks a Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. As a critical part of this risk management oversight role, our Board of Directors encourages full and open communication between management and the Board of Directors. Our Board of Directors regularly reviews material strategic, operational, financial, compensation and compliance risks with management. In addition our management team regularly reports to the full Board of Directors regarding their areas of responsibility and a component of these reports is risk within the area of responsibility and the steps management has taken to monitor and control such exposures. Additional review or reporting on risk is conducted as needed or as requested by our Board of Directors.

Attendance

Eleven meetings, exclusive of action by unanimous written consent, of the Board of Directors were held during fiscal year 2012. During such year, each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors and committees on which he served while a member thereof. All members of our Board of Directors who then were serving as directors, except George P. Larounis, a former director of CopyTele, attended our 2012 annual meeting of stockholders. We encourage our directors to attend the annual meeting of stockholders.

Nominations of Directors

We have not designated a nominating committee or other committee performing a similar function, due to the size of our Company and Board. Such matters are discussed by our Board of Directors as a whole. In selecting directors, the Board will consider candidates that possess qualifications and expertise that will enhance the composition of the Board, including the considerations set forth below. The considerations set forth below are not meant as minimum qualifications, but rather as guidelines in weighing all of a candidate’s qualifications and expertise.

· Candidates should be individuals of personal integrity and ethical character.

· Candidates should have background, achievements, and experience that will enhance our Board. This may come from experience in areas important to our business, substantial accomplishments or prior or current associations with institutions noted for their excellence. Candidates should have demonstrated leadership ability, the intelligence and ability to make independent analytical inquiries and the ability to exercise sound business judgment.

· Candidates should be free from conflicts that would impair their ability to discharge the fiduciary duties owed as a director to CopyTele and its stockholders, and we will consider directors’ independence from our management and stockholders.

· Candidates should have, and be prepared to devote, adequate time and energy to the Board and its committees to ensure the diligent performance of their duties, including by attending meetings of the Board and its committees.

· Due consideration will be given to the Board’s overall balance of diversity of perspectives, backgrounds and experiences, as well as age, gender and ethnicity.

· Consideration will also be given to relevant legal and regulatory requirements.

9

We are of the view that the continuing service of qualified incumbents promotes stability and continuity in the board room, contributing to the Board’s ability to work as a collective body, while giving us the benefit of the familiarity and insight into our affairs that our directors accumulate during their tenure. Accordingly, the process of the Board for identifying nominees for directors will reflect our practice of generally re-nominating incumbent directors who continue to satisfy the Board’s criteria for membership on the Board, whom the Board believes continue to make important contributions and who consent to continue their service on the Board. If the Board determines that an incumbent director consenting to re-nomination continues to be qualified and has satisfactorily performed his or her duties as director during the preceding term, and that there exist no reasons, including considerations relating to the composition and functional needs of the Board as a whole, why in the Board’s view the incumbent should not be re-nominated, the Board will, absent special circumstances, generally propose the incumbent director for re-election. Although we do not have a formal policy regarding the consideration of diversity in identifying and evaluating potential director candidates, the Board does take into account the personal characteristics (gender, ethnicity and age), skills and experience, qualifications and background of current and prospective directors’ diversity as one factor in identifying and evaluating potential director candidates, so that the Board, as a whole, will possess what the Board believes are appropriate skills, talent, expertise and backgrounds necessary to oversee our Company’s business.

If the incumbent directors are not nominated for re-election or if there is otherwise a vacancy on the Board, the Board may solicit recommendations for nominees from persons that the Board believes are likely to be familiar with qualified candidates, including from members of the Board and management. Since our 2012 annual meeting, we have elected two new board members, Mr. Berman and Dr. Kumar, effective November 30, 2012. Mr. Titterton, our Chairman of the Board, and Kent B. Williams, a non-employee director of CopyTele, recommended Mr. Berman and Dr. Kumar for election to the Board. While the Board of Directors may also engage a professional search firm to assist in identifying qualified candidates, the Board of Directors did not engage any third party to identify or evaluate or assist in identifying or evaluating the Director Nominees. We do not have a policy with regard to the consideration of director candidates recommended by stockholders. Due to the size of our Company and Board, the Board does not believe that such a policy is necessary.

Depending on its level of familiarity with the candidates, the Board may choose to interview certain candidates that it believes may possess qualifications and expertise required for membership on the Board. It may also gather such other information it deems appropriate to develop a well-rounded view of the candidate. Based on reports from those interviews or from Board members with personal knowledge and experience with a candidate, and on all other available information and relevant considerations, the Board will select and nominate candidates who, in its view, are most suited for membership on the Board.

Communications with Directors

Stockholders may send written communications to the Board by mailing those communications to CopyTele, Inc., 900 Walt Whitman Road, Melville, NY 11747, Attn.: Secretary, who will forward such communications to the relevant addressee. We will generally not forward to the directors stockholder communications that merely request general information about us.

10

Code of Ethics

We have adopted a formal code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. We will provide a copy of our code of ethics to any person without charge, upon request. For a copy of our code of ethics write to Secretary, CopyTele, Inc., 900 Walt Whitman Road, Melville, NY 11747.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and ten percent stockholders to file initial reports of ownership and reports of changes in ownership of our Common Stock with the SEC. Directors, executive officers and ten percent stockholders are also required to furnish us with copies of all Section 16(a) forms that they file. Based upon a review of these filings, we believe that all required Section 16(a) fillings were made on a timely basis during fiscal year 2012, except that Mr. Berman filed his initial Form 3 one day late due to a delay in obtaining the necessary electronic filing codes from the SEC.

Transactions with Related Persons

On February 8, 2011, we sold 7,000,000 unregistered shares of our common stock in a private placement to 10 accredited investors, including Denis A. Krusos, the Company’s former Chairman and Chief Executive Officer, Peri D. Krusos (Mr. Denis Krusos' adult daughter), Henry P. Herms, the Company’s Chief Financial Officer and a director, and Lewis H. Titterton, a director and now the current Chairman, and George P. Larounis, former director of the Company, at a price of $0.1786 per share, for proceeds of $1,250,000. In conjunction with the sale of the common stock, we issued the investors warrants to purchase 7,000,000 unregistered shares of our common stock. Each warrant grants the holder the right to purchase one share of our common stock (or 7,000,000 shares of common stock in the aggregate) at the purchase price of $0.1786 per share on or before February 8, 2016. Certain of the investors are officers and/or directors of the Company and the warrants issued to such persons included a “cashless exercise” provision. Mr. Denis Krusos, Ms. Krusos. Mr. Herms, Mr. Titterton and Mr. Larounis purchased $250,000, $100,000, $50,000, $250,000 and $50,000, respectively, of securities in this offering. In June 2013, Mr. Krusos exercised his warrants on a “cashless” basis and received 547,493 shares of common stock. On May 29, 2013, the Company offered the holders of the warrants the opportunity to exercise the warrants at a reduced exercise price of $0.16 per share (payable in cash) during the period ended July 15, 2013. In connection therewith, Mr. Titterton, Mr. Johnson (who had participated in the offering prior to becoming a director) and Mr. Herms exercised warrants to purchase 1,400,000, 700,000 and 280,000 shares of our common stock.

As more fully disclosed under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Prior Agreements” in the Company’s Registration Statement on Form S-1, Registration No. 333-188096, filed with the SEC on April 24, 2013, we are parties to a Technology License Agreement with Volga-Svet Ltd., a Russian corporation (“Volga”), to produce and market our thin, flat, low voltage phosphor, Nano Displays in Russia. Volga is considered a related party under item 404 of Regulation S-K due to our 19.9% ownership interest in Volga. We have been working with Volga for the past fourteen years to assist us with our low voltage phosphor displays. During fiscal year 2012 we discontinued utilizing Volga for contract research and development work. In evaluating our investment in Volga at October 31, 2012, we determined that the discontinuation of funding by CopyTele and the lack of available financial information from Volga has impaired the value of our investment in Volga and accordingly, a write-off of our investment of approximately $128,000 was recorded as of October 31, 2012.

11

On September 12, 2012, we completed a private placement with 5 accredited investors, including Lewis H. Titterton, Jr., the Company’s Chairman and then Chief Executive Officer, and Bruce Johnson, a director of the Company, pursuant to which we sold $750,000 principal amount of 8% Convertible Debentures due 2016. These debentures mature on September 12, 2016, bear interest at the rate of 8% payable quarterly and are convertible into shares of Common Stock, and at a price per share of $0.092. The entire $750,000 principal amount of these debentures plus accrued interest were converted into 8,252,895 shares of common stock. The Company granted the holders customary piggy-back registration rights. Messrs. Titterton and Johnson each purchased $150,000 principal amount of the securities in this offering and subsequently each converted the debentures into 1,647,463 shares of common stock.

As more fully disclosed under the heading “Selling Stockholders” in the Company’s Registration Statement on Form S-1, Registration No. 333-188096, filed with the SEC on April 24, 2013, on January 25, 2013, we completed a private placement of $1,765,000 principal amount of 8% Convertible Debentures due 2015 and warrants to purchase 5,882,745 shares of common stock. We have the option to pay any interest on the debentures in common stock based on the average of the closing prices of our common stock for the 10 trading days immediately preceding the interest payment date. During June and July 2013, $325,000 principal amount of these debentures were converted into 2,166,775 shares of common stock. If all remaining interest through the maturity of the debentures that are currently outstanding were paid in common stock, we would issue an additional 800,354 shares (based on the average closing prices of our common stock for the 10 trading days ending August 22, 2013). We also have the option to pay any interest on the debentures with additional debentures. If all remaining interest through the maturity date of the debentures that are currently outstanding were paid in the form of debentures, we would issue $180,800 principal of additional 8% convertible debentures. Robert A. Berman, the Company’s President, Chief Executive Officer and a director, Dr. Amit Kumar, a consultant and director of the Company, and Bruce Johnson, a director of the Company, purchased $50,000, $100,000, and $100,000, respectively, of securities in this offering. Mr. Berman, Dr. Kumar and Mr. Johnson received 6,786 shares, 13,572 shares and 13,572 shares, respectively, in payment of interest on the debentures. Jeffery Titterton and Christopher Titterton, the adult sons of Lewis H. Titterton, Jr. our Chairman of the Board, purchased $25,000 and $25,000, respectively, of securities in this offering. Jeffery Titterton and Christopher Titterton have received 3,393 shares and 3,393 shares, respectively, in payment of interest on the debentures.

As more fully described in “Executive Compensation - Employment and Consulting Agreements,” on September 19, 2012, we entered into employment or consulting agreements with each of Robert A. Berman, the Company’s President, Chief Executive Officer and a director, Dr. Amit Kumar, a consultant and director of the Company, and John Roop, the Company’s Senior Vice President of Engineering and concurrently issued to them options to purchase 16,000,000, 16,000,000 and 8,000,000 shares of the Company’s common stock, respectively.

Related Person Transaction Approval Policy

While we have no written policy regarding approval of transactions between us and a related person, our Board of Directors, as matter of appropriate corporate governance, we review and approve all such transactions, to the extent required by applicable rules and regulations. Generally, management would present to the Board of Directors for approval at the next regularly scheduled Board meeting any related person transactions proposed to be entered into by us. The Board may approve the transaction if it is deemed to be in the best interests of our stockholders and the Company.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

The following discusses our executive compensation philosophy, decisions and practices for fiscal year 2012. As a small company with only 7 employees and a small management team, we have implemented a simple and modest compensation structure based on our overall goal to ensure that the total compensation paid to our executives is fair, reasonable and competitive. Our Board of Directors deems such a simple, less formula-based compensation structure advisable and consistent with the Company’s overall compensation objectives and philosophies. Accordingly, the method of compensation decision-making actually employed by the Company does not lend itself to extensive analytical and quantitative analysis, but rather is based on the business judgment of the Company’s Chief Executive Officer and our Board of Directors as described in more detail below.

12

Philosophy and Objectives

Our philosophy towards executive compensation is to create both short-term and long-term incentives based on the following principles:

· Total compensation opportunities should be competitive. We believe that our overall compensation program should be competitive so that we can attract, motivate and retain highly qualified executives.

· Total compensation should be related to our performance. We believe that our executives’ total compensation should be linked to achieving specified financial objectives which we believe will create stockholder value.

· Total compensation should be related to executive’s performance. We believe that our executives’ total compensation should reward individual performance achievements and encourage individual contributions to achieve better performance.

· Equity awards help executives think like stockholders. We believe that our executives’ total compensation should have an equity component because stock based equity awards help reinforce the executives’ long-term interest in our overall performance and thereby align the interests of the executive with the interests of our stockholders.

Role of our Board of Directors

Our Board of Directors is primarily responsible for determining executive compensation and employee benefit plans for fiscal year 2012. Our Board of Directors evaluates the performance of our Chief Executive Officer directly. The Chief Executive Officer is not present during the Board of Directors deliberations as to his compensation.

With respect to senior management other than the Chief Executive Officer, Mr. Berman, our current Chief Executive Officer, participates in the decision-making by making recommendations to the Board of Directors. After informal discussion regarding such recommendations, the Board of Directors vote on any recommended compensation changes. Our Board of Directors do not utilize any particular formula in determining any compensation changes but instead exercises its business judgment in view of our overall compensation philosophy and objectives.

Elements of Executive Compensation

Our executive compensation consists primarily of two elements: (1) base salary and (2) stock options under our stock equity incentive plans and, when appropriate, (3) performance based bonus. Our Board of Directors does not follow a specific set of guidelines or formulas in determining the amount and mix of compensation elements. We seek to reward shorter-term performance through base salary and, when appropriate, performance based bonus and longer-term performance through stock options granted under our stock equity incentive plans.

13

Base Salary

In setting salaries for fiscal year 2012, the Board of Directors considered several factors to help evaluate the reasonableness and competitiveness of the Company’s base salaries. The Board of Directors initially determines base salary for each executive based on the executive’s salary for the prior fiscal year. In light of our transition to a company whose primary business is Patent Monetization and Patent Assertion, in considering the base salary for our new management team, we considered (a) the executive’s role in such transition, (b) his level of job responsibilities, (c) the executive’s experience and tenure with other companies in that business, (d) the executive’s performance in helping in the (x) monetization and assertion of the Company’s existing patent portfolios, and (y) acquisition of patents and patent enforcement rights from third parties. The Board of Directors give no specific weight to any of the above factors so it is not possible to provide a complete qualitative and quantitative discussion linking the Company’s compensation objectives and policies with the actual salaries paid to our executives.

Because the market for talented executives is extremely competitive, the Board of Directors also considers, from time to time, the form and amount of compensation paid to executives of other companies, compiled from publicly available information. While the Company takes into account competitive market data, it does not target a specific benchmark for compensation from the other companies whose compensation it reviews. To maintain flexibility, the Company also does not target base salary at any particular percent of total compensation. While the Board of Directors can engage compensation consultants to assist with this task, the Board of Directors did not retain any third party consultants or engaged in any formal comparison of compensation of the Company to compensation at other companies during fiscal year 2012. Individual base salaries are reviewed annually.

Equity Based Incentives

Our use of equity compensation is driven by our goal of aligning the long-term interests of our executives with our overall performance and the interests of our stockholders. The Board of Directors believes it is important to provide our senior management with stock-based incentive compensation that increases in value in direct correlation with improvement in the performance of our common stock. The fundamental philosophy is to link the amount of compensation for an executive to his or her contribution to the Company’s success in achieving financial and other objectives. Equity incentives are not set at any particular percentage of total compensation.

In general, we grant stock options under stock equity incentive plans to directors, officers, and other employees upon commencement of their employment with us and periodically thereafter. We generally grant stock options at regularly scheduled Board meetings. The option awards are granted at an exercise price equal to the closing price of common stock on the grant date (the date the grant is approved.) Options for directors and officers generally vest on the date of grant or after a period ranging from 6 months to 3 years following the grant date, provided the directors or officers remain employed on the vesting date, so that such compensation is at risk of forfeiture based on the directors or officers’ continued service with us.

As with other elements of executive compensation, the determination of stock options granted were not based on complex or extensive quantitative or qualitative factors that lend themselves to substantive disclosure. Instead, the awards granted in fiscal year 2012 were based primarily on the business judgment of the Board of Directors.

The stock equity incentive plans also provide for the award of restricted stock, although such awards have not been used in any material respect. No restricted stock was awarded during fiscal year 2012. However, the Company may issue restricted stock in the future.

14

As a smaller reporting company, the Company has not previously sought a shareholder advisory vote on executive compensation and, therefore our Board of Directors has not considered the results of such vote in determining executive compensation policies and decisions.

Other Benefits

We provide our executives with customary, broad-based benefits that are provided to all employees, including medical insurance, life, and disability insurance. We also provide our executives with certain perquisites which are not a significant element of executive compensation.

Policy on Ownership of Stock and Options

We do not have any policy regarding levels of equity ownership (stock or options) by our executive officers or directors.

Policy on Deductibility of Compensation

Section 162(m) of the Internal Revenue Code limits the deductibility of compensation in excess of $1 million paid to certain executive officers named in the proxy statement, unless certain requirements are met. To maintain flexibility in compensating executive officers in a manner designed to aid in retention and promote varying corporate performance objectives, the Board of Directors has not adopted a policy of meeting the Section 162(m) requirements.

Compensation Committee Interlocks and Insider Participation

The Board of Directors is primarily responsible for overseeing our compensation and employee benefit plans and practices. We do not have a compensation committee or other Board committee that performs equivalent functions. During the last fiscal year, no officer or employee of the Company (other than officers who are also directors of the Company), nor any former officer of the Company, participated in deliberations of the Company’s Board of Directors concerning executive compensation.

Compensation Committee Report

The Board of Directors has reviewed and discussed the above “Compensation Discussion and Analysis” with management. Based upon this review and discussion, the Board recommended that the “Compensation Discussion and Analysis” be included in our Annual Report on Form 10-K for the year ended October 31, 2012.

| Lewis H. Titterton, Jr. | Bruce F. Johnson |

The following table sets forth certain information for fiscal year ended October 31, 2012, with respect to compensation awarded to, earned by or paid to our current Chief Executive Officer, our former interim Chief Executive Officer, our former Chief Executive Officer, our Chief Financial Officer and Senior Vice President of Engineering (the “Named Executive Officers”). No other executive officer received total compensation in excess of $100,000 during fiscal year 2012.

15

Employment and Consulting Agreements

Employment Agreement with Robert Berman

On September 19, 2012, the Company entered into an Employment Agreement with Mr. Berman (the “Berman Agreement”) to serve as President and Chief Executive Officer of the Company. Pursuant to the Berman Agreement, Mr. Berman will receive an annual base salary of $290,000, provided, however that payment of his salary is deferred until the Cash Milestone (as described below) has been achieved.

In addition to his base salary, Mr. Berman is entitled to a cash bonus of $50,000, if the Company generates aggregate cash payments in excess of a specified amount (the “Cash Milestone”) prior to September 19, 2013. Mr. Berman is also entitled to two additional cash bonuses of $50,000 if the average trading price of the Company’s common stock exceeds two separate price targets (the “Stock Price Targets”) prior to September 19, 2013.

The Company also granted Mr. Berman options to purchase 16,000,000 shares of the Company’s common stock, with an exercise price equal $0.2175 (the average of the high and the low sales price of the common stock on the trading day immediately preceding the approval of such options by the Board). Half of the options vest in 36 equal monthly installments commencing on October 31, 2012, provided that if the Berman Agreement is terminated or constructively terminated by the Company without cause (as defined below), an additional 12 months of vesting will be accelerated and such accelerated options will become immediately exercisable. The balance of the options will vest in three equal installments upon achievement of the Cash Milestone and the Stock Price Targets (without regard to the 12 month period). The options otherwise have the same terms and conditions as options granted under the Company’s 2010 Share Incentive Plan (as defined below).

If Mr. Berman’s employment is terminated by the Company or he terminates his employment for any reason or no reason, the Company shall be obligated to pay to Mr. Berman only any earned compensation and/or bonus due under the Berman Agreement, any unpaid reasonable and necessary expenses, and any accrued and unpaid benefits due to him in accordance with the terms and conditions of the Company’s benefit plans and policies including any accrued but unpaid vacation up to the cap of 20 days through the date of termination. All such payments shall be made in a lump sum immediately following termination as required by law.

“Cause” means (i) commission of or entrance of a plea of guilty or nolo contendere to a felony; (ii) conviction for engaging or having engaged in fraud, breach of fiduciary duty, a crime of moral turpitude, dishonesty, or other acts of willful misconduct or gross negligence in connection with the business affairs of the Company or its affiliates; (iii) a conviction for theft, embezzlement, or other intentional misappropriation of funds by employee from the Company or its affiliates; (iv) a conviction in connection with the willful engaging by employee in conduct which is demonstrably and materially injurious to the Company or its affiliates, monetarily or otherwise.

Employment Agreement with John Roop

On September 19, 2012, the Company entered into an Employment Agreement with John Roop (the “Roop Agreement”) to serve as Senior Vice President of Engineering of the Company. Pursuant to the Roop Agreement, Mr. Roop will receive an annual base salary of $225,000, provided, however that payment of his salary is deferred until the Cash Milestone (as described below) has been achieved.

In addition to his base salary, Mr. Roop is entitled to a cash bonus of $50,000, if the Company generates aggregate cash payments in excess of a specified amount (the “Cash Milestone”) prior to September 19, 2013. Mr. Roop is also entitled to two additional cash bonuses of $50,000 if the average trading price of the Company’s common stock exceeds two separate price targets (the “Stock Price Targets”) prior to September 19, 2013.

17

In addition to his base salary, Mr. Roop is entitled to receive the same cash bonuses granted to Mr. Berman and was granted options to purchase 8,000,000 shares of the Company’s common stock and upon the same terms as those granted to Mr. Berman.

If Mr. Roop’s employment is terminated by the Company or he terminates his employment for any reason or no reason, the Company shall be obligated to pay to Mr. Roop only any earned compensation and/or bonus due under the Roop Agreement, any unpaid reasonable and necessary expenses, and any accrued and unpaid benefits due to him in accordance with the terms and conditions of the Company’s benefit plans and policies including any accrued but unpaid vacation up to the cap of 20 days through the date of termination. All such payments shall be made in a lump sum immediately following termination as required by law.

Consulting Agreement with Amit Kumar

On September 19, 2012, Company entered into a consulting agreement with Dr. Kumar pursuant to which Dr. Kumar will provide business consulting services for an annual consulting fee of $120,000, provided, however that payment of the consulting fee is deferred until the Cash Milestone has been achieved.

In addition to his consulting fee, Dr. Kumar is entitled to receive the same cash bonuses granted to Mr. Berman and was granted options in the same amount and upon the same terms and those granted to Mr. Berman.

If Dr. Kumar’s consulting services are terminated by the Company or by Dr. Kumar for any reason or no reason, the Company shall be obligated to pay to Dr. Kumar only any consulting fees and/or bonus due under his consulting agreement and any unpaid reasonable and necessary expenses through the date of termination. All such payments shall be made in a lump sum immediately following termination.

The following table sets forth certain information with respect to unexercised stock options held by the Named Executive Officers outstanding on October 31, 2012:

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END TABLE | ||||

| Option Awards | ||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Un -Exercisable | Option Exercise Price ($) | Option Expiration Date |

| Robert A. Berman | 222,230 (1) ‑ | 7,777,770 8,000,000(2) | $0.2175 $0.2175 | 9/19/2022 9/19/2022 |

| Lewis H. Titterton Jr. | 250,000(3) | 500,000(3) | $0.2225 | 9/19/2022 |

| Denis A. Krusos | 500,000 250,000 1,000,000 1,500,000 1,000,000 1,000,000 700,000 1,000,000 1,000,000 600,000 |

| $0.430 $0.810 $1.040 $0.650 $0.520 $0.830 $0.700 $1.170 $0.920 $0.370 | 2/22/2014 5/10/2014 10/25/2014 2/17/2015 10/30/2015 5/31/2016 11/20/2016 8/21/2017 8/21/2017 8/21/2017 |

| Henry P. Herms | 5,000(5) 45,000 70,000(5) 100,000 100,000 50,000(5) 50,000 75,000(5) 100,000(5) 100,000 8,345(6) |

291,655(6) | $0.145 $0.810 $0.145 $0.650 $0.520 $0.145 $0.700 $0.145 $0.145 $0.370 $0.235 | 5/10/2014 5/10/2014 10/25/2014 2/17/2015 10/30/2015 5/31/2016 11/20/2016 11/11/2017 10/7/2019 6/01/2021 9/19/2022 |

| John Roop | 111,115(7) ‑ | 3,888,885 4,000,000(8) | $0.2175 $0.2175 | 9/19/2022 9/19/2022 |

18

(1) 222,230 options vested and became exercisable on October 31, 2012 and the remaining 7,777,770 shares shall vest and become exercisable in 35 consecutive monthly installments on the last day of each month, beginning November 30, 2012 and continuing through September 30, 2015.

(2) Options will vest in three equal installments upon achievement of the Cash Milestone and the Stock Price Targets.

(3) 250,000 options immediately vested on September 19, 2012, and the remaining 500,000 options shall vest and become exercisable in two consecutive annual installments of 250,000 options each beginning on September 19, 2013.

(4) Mr. Krusos’ employment was terminated effective August 21, 2012. The exercisability of Mr. Krusos’ options will be subject to the results of the Company’s ongoing review of the facts underlying his termination, which results shall be presented to the Board upon completion.

(5) Options were repriced on September 4, 2012. See “Options Repricing”, below.

(6) 8,345 options vested and became exercisable on October 31, 2012 and the remaining 291,655 shares shall vest and become exercisable in 35 consecutive monthly installments on the last day of each month, beginning November 30, 2012 and continuing through September 30, 2015.

(7) 111,115 options vested and became exercisable on October 31, 2012 and the remaining 3,888,885 shares shall vest and become exercisable in 35 consecutive monthly installments on the last day of each month, beginning November 30, 2012 and continuing through September 30, 2015.

(8) Options will vest in three equal installments upon achievement of the Cash Milestone and the Stock Price Targets.

19

The following table sets forth certain information with respect to grants of stock options to the Named Executive Officers during fiscal year 2012:

| GRANTS OF PLAN BASED AWARDS TABLE | ||||

| Name | Grant Date | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise Price of Option Awards ($/Sh) | Grant Date Fair Value ($)(1) |

| Robert A. Berman | 9/19/2012(2) | 16,000,000 | $0.2175(4) | $2,882,667 |

| Lewis H. Titterton Jr. | 9/19/2012 | 750,000 | $0.2225(5) |

|

| Denis A. Krusos | ‑ | ‑ | ‑ | ‑ |

| Henry P. Herms | 9/19/2012(3) 9/04/2012(7) | 300,000 300,000 | $0.235(6) $0.145 | $57,930 $11,289 |

| John Roop | 9/19/2012(8) | 8,000,000 | $0.2175(4) | $1,441,333 |

(1) In accordance with ASC 718, the aggregate grant date fair value of stock option awards for each Named Executive Officer reflects the repricing of certain options on September 5, 2012. See “Option Repricing,” below.

(2) Reflects options granted to Mr. Berman under the Berman Agreement.

(3) Reflects options granted to Mr. Herms under the 2010 Share Incentive Plan.

(4) The exercise price was determined by calculating the average of the high and the low sales price of the Common Stock on the trading day immediately preceding the approval of such options by the Board.

(5) The exercise price was based on the average of the high and the low sales price of the Common Stock on the second trading day immediately following the approval of such options by the Board.

(6) The exercise price was based on the closing trading price of the Common Stock on the second trading day immediately following the approval of such options by the Board.

(7) Options were repriced on September 4, 2012. See “Options Repricing”, below.

(8) Reflects options granted to Mr. Roop under the Roop Agreement.

There were no stock options exercised during fiscal year 2012 by Named Executive Officers.

Option Repricing

On September 4, 2012, the Board approved a re-pricing of options to purchase a total of 1,840,000 shares of the Company’s common stock granted under the Company’s 2003 Share Incentive Plan, which were granted from May 11, 2004 to October 8, 2009 with exercise prices ranging from $0.65 to $1.46 and are held by 11 persons, including Henry P. Herms and George Larounis. Pursuant to the re-pricing, the option agreements were unilaterally amended by the Board to reduce the exercise price of each option to $0.145, which was the closing sales price of the Company’s common stock on September 4, 2012. The number of shares, the vesting commencement date and the length of the vesting period, and expiration period for each of these options were not altered.

20

The following stock option grants and related stock option agreements issued to the Company’s Named Executive Officers and directors are affected by the re-pricing:

|

|

|

| Old Option Price | New Option Price |

|

|

|

| Grant Date | # of Shares | Exercise Date | Expiration Date | ||

|

| ||||||

| Henry P. Herms |

|

|

|

|

| |

|

| 5/11/04 | 5,000 | $0.81 | $0.145 | 9/4/12 | 5/10/14 |

|

| 10/26/04 | 70,000 | $1.04 | $0.145 | 9/4/12 | 10/25/14 |

|

| 6/1/06 | 50,000 | $0.83 | $0.145 | 9/4/12 | 5/31/16 |

|

| 11/12/07 | 75,000 | $1.17 | $0.145 | 9/4/12 | 11/11/17 |

|

| 10/8/09 | 100,000 | $0.92 | $0.145 | 9/4/12 | 10/7/19 |

|

|

| 300,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| George Larounis |

|

|

|

|

| |

|

| 10/26/04 | 60,000 | $1.04 | $0.145 | 9/4/12 | 10/25/14 |

|

| 6/1/06 | 120,000 | $0.83 | $0.145 | 9/4/12 | 5/31/16 |

|

| 11/13/07 | 60,000 | $1.21 | $0.145 | 9/4/12 | 11/12/17 |

|

| 10/8/09 | 60,000 | $0.92 | $0.145 | 9/4/12 | 11/30/17 |

|

|

| 300,000 |

|

|

|

|

Potential Payments upon Termination or Change in Control

Robert A. Berman

As more fully described in “Employment Agreement with Robert Berman,” if Mr. Berman is terminated without cause, an additional 12 months of vesting of his options will be accelerated and such accelerated options will become immediately exercisable. The value of such options would be $110,667, which was calculated by multiplying (a) 2,666,664 options (being the number of options granted to him on September 19, 2012 that would be accelerated) by (b) an amount equal to the excess of the (x) our closing share price on October 31, 2012 of $0.259 and (y) the options’ exercise price of $0.2175 per share.

In addition to the acceleration of the options upon termination of employment without cause, if Mr. Berman’s employment is terminated by the Company or he terminates his employment for any reason or no reason, the Company shall be obligated to pay to Mr. Berman only any earned compensation and/or bonus due under the Berman Agreement, any unpaid reasonable and necessary expenses, and any accrued and unpaid benefits due to him in accordance with the terms and conditions of the Company’s benefit plans and policies including any accrued but unpaid vacation up to the cap of 20 days through the date of termination (which accrued and unpaid benefits would have a maximum value of $22,308).

Mr. Berman’s outstanding unvested options would immediately vest and become exercisable upon a change in control as defined in the 2010 Share Incentive Plan. The value of Mr. Berman’s outstanding options would be $654,777, which was calculated by multiplying (a) 15,777,770 options (being the number of options granted to him on September 19, 2012 that were unvested and outstanding on October 31, 2012) by (b) an amount equal to the excess of the (x) our closing share price on October 31, 2012 of $0.259 and (y) the options’ exercise price of $0.2175 per share.

21

John Roop

As more fully described in “Employment Agreement with John Roop,” if Mr. Roop is terminated without cause, an additional 12 months of vesting of his options will be accelerated and such accelerated options will become immediately exercisable. The value of such options would be $55,333, which was calculated by multiplying (a) 1,333,332 options (being the number of options granted to him on September 19, 2012 that would be accelerated options by (b) an amount equal to the excess of the (x) our closing share price on October 31, 2012 of $0.259 and (y) the options’ exercise price of $0.2175 per share.

In addition to the acceleration of the options upon termination of employment without cause, if Mr. Roop’s employment is terminated by the Company or he terminates his employment for any reason or no reason, the Company shall be obligated to pay to Mr. Roop only any earned compensation and/or bonus due under the Roop Agreement, any unpaid reasonable and necessary expenses, and any accrued and unpaid benefits due to him in accordance with the terms and conditions of the Company’s benefit plans and policies including any accrued but unpaid vacation up to the cap of 20 days through the date of termination (which accrued and unpaid benefits would have a maximum value of $ 17,308).

Mr. Roop’s outstanding unvested options would immediately vest and become exercisable upon a change in control as defined in the 2010 Share Incentive Plan. The value of Mr. Roop’s outstanding options would be $327,389 which was calculated by multiplying (a) 7,888,885 options (being the number of options granted to him on September 19, 2012 that were unvested and outstanding on October 31, 2012) by (b) an amount equal to the excess of the (x) our closing share price on October 31, 2012 of $0.259 and (y) the options’ exercise price of $0.2175 per share.

Henry P. Herms

Mr. Herms’ outstanding unvested stock option awards granted under the 2010 Share Incentive Plan would immediately vest and become exercisable upon a change in control as defined below. The value of Mr. Herms’ outstanding options would be $7,000, which was calculated by multiplying (a) 291,655 options (being the unvested portion of options granted to him on September 19, 2012 that he held on October 31, 2012) by (b) an amount equal to the excess of the (x) our closing share price on October 31, 2012 of $0.259 and (y) the options’ exercise price of $0.235 per share.

Under the 2010 Share Incentive Plan, “change in control” means:

· Change in Ownership: A change in ownership of the Company occurs on the date that any one person, or more than one person acting as a group, acquires ownership of stock of the Company that, together with stock held by such person or group, constitutes more than 50% of the total fair market value or total voting power of the stock of the Company, excluding the acquisition of additional stock by a person or more than one person acting as a group who is considered to own more than 50% of the total fair market value or total voting power of the stock of the Company.

· Change in Effective Control: A change in effective control of the Company occurs on the date that either:

22

o Any one person, or more than one person acting as a group, acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such person or persons) ownership of stock of the Company possessing 30% or more of the total voting power of the stock of the Company; or

o A majority of the members of the Board of Directors of the Company is replaced during any 12-month period by directors whose appointment or election is not endorsed by a majority of the members of the board of directors before the date of the appointment or election; provided, that this paragraph will apply only to the Company if no other corporation is a majority shareholder.

· Change in Ownership of Substantial Assets: A change in the ownership of a substantial portion of the Company's assets occurs on the date that any one person, or more than one person acting as a group, acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such person or persons) assets from the Company that have a total gross fair market value equal to or more than 40% of the total gross fair market value of the assets of the Company immediately before such acquisition or acquisitions. For this purpose, “gross fair market value” means the value of the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets.

It is the intent that this definition be construed consistent with the definition of “Change of Control” as defined under Code Section 409A and the applicable treasury regulations, as amended from time to time.