Filed pursuant to Rule 424(b)(2)

Registration Statement No. 333-206782

Prospectus Supplement

(To prospectus dated September 14, 2015)

ITUS CORPORATION

9,066,987 Subscription Rights to Purchase Shares of Common Stock and

Up to 3,703,703 Shares of Common Stock Issuable upon Exercise of Subscription Rights

We are distributing to the holders of our common stock and certain warrants (as described in more detail below), at no charge, non-transferrable subscription rights (each, a “Right”) to purchase our common stock (the “Rights Offering”). Each holder of our common stock at 5:00 p.m., Eastern time, on March 1, 2017 (the “Record Date”) will receive one Right to purchase one share of our common stock (subject to proration as described below) for each one share of common stock owned by such holder on the Record Date (the “Basic Subscription Privilege”). Each Right will be exercisable at a price per share (the “Subscription Price”) equal to the lesser of (i) $3.24 and (ii) a 15% discount to the volume weighted average price for our common stock for the five trading day period through and including Friday, March 24, 2017 (subject to extension as described below, the “Expiration Date”). Pursuant to the terms of this Rights Offering, the Rights may be exercised for a maximum of $12,000,000 of subscription proceeds (the “Maximum Offering Amount”). If the Rights Offering is not fully subscribed and you fully exercise your Basic Subscription Privilege, you may also exercise your Rights to purchase at the Subscription Price common stock that were not subscribed for by other Rights holders under the Rights Offering (the “Over-Subscription Privilege”). For a more detailed discussion, see “The Rights Offering.”

The Rights Offering commences on March 3, 2017 (the “Commencement Date”) and the Rights will expire if they are not exercised by 5:00 p.m., Eastern time, on Friday, March 24, 2017, unless the Rights Offering is extended. There is no minimum number of Rights that must be exercised in this Rights Offering, no minimum number that any Rights holder must exercise, and no minimum number of shares of common stock that we will issue at the closing of this Rights Offering. Once made, all exercises of Rights are irrevocable.We may extend the subscription period up to an additional 30 days, at our sole discretion.

We are conducting the rights offering to raise capital that we intend to use for general corporate purposes, including ongoing clinical work and working capital, and to repay the Redemption Debenture in the principal amount of $3,000,000. See “Use of Proceeds.”

Our common stock is listed on The NASDAQ Capital Market (“NASDAQ”) under the symbol “ITUS.” On March 1, 2017, the last reported sales price of our common stock on NASDAQ was $3.85 per share. As of March 1, 2017, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $40,553,000 based on 8,757,587 outstanding shares of common stock, of which approximately 7,580,000 shares are held by non-affiliates, and a per share price of $5.35, based upon the closing sale price of our common stock on January 6, 2017. As of the date hereof, we have not sold any of our securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12 calendar month period that ends on and includes the date hereof.

Our board of directors is making no recommendation regarding your exercise of the Rights. The Rights may not be sold, transferred or assigned and will not be listed for trading on NASDAQ or any other stock exchange or market. You are urged to obtain a current price quote for our common stock before exercising your Rights.

We have engaged Advisory Group Equity Services, Ltd. doing business as RHK Capital to act as the dealer-manager (the “Dealer-Manager”) for this Rights Offering.

Investing in our securities involves a high degree of risk. You should read this prospectus supplement and the information incorporated herein by reference carefully before you make your investment decision. See “Risk Factors” beginning on page S-21 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

| | | Per Share | | Total |

| Public offering price (1) | | $ | 3.24 | | $ | 12,000,000 |

| Dealer-Manager fees (2) | | $ | 0.19 | | $ | 720,000 |

| Proceeds, before expenses, to us (3) | | $ | 3.05 | | $ | 11,280,000 |

| (1) | | Assumes the Rights Offering is fully subscribed and that a 15% discount to the volume weighted average price for our common stock for the five trading day period through and including the Expiration Date is greater than $3.24. |

| (2) | | In connection with the Rights Offering, we have agreed to pay the Dealer-Manager a fee of 6.0% of the proceeds of the Rights Offering. See “Plan of Distribution.” |

| (3) | | We have also agreed to pay the Dealer-Manager a 1.8% non-accountable expense fee and an out-of-pocket accountable expense allowance of 0.2% of the proceeds of the Rights Offering. These expenses are not included in the table. For more information, see “Plan of Distribution.” |

You should carefully consider whether to exercise your Rights before Friday, March 24, 2017 (unless extended). You may not revoke or revise any exercises of Rights once made unless we terminate the Rights Offering.

If you have any questions or need further information about this Rights Offering, please contact MacKenzie Partners, Inc., the information agent for the Rights Offering, at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

Dealer-Manager

Doing business as RHK Capital

The date of this prospectus supplement is March 3, 2017

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus supplement or the accompanying prospectus.

This prospectus supplement and any later prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

You should assume that the information contained in this prospectus supplement and in any other prospectus supplement is accurate only as of their respective dates and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any other prospective supplement for any sale of securities.

Table of content

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this Rights Offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this Rights Offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. This prospectus supplement, the accompanying prospectus, any related free-writing prospectus and the documents incorporated into each by reference include important information about us, the securities being offered and other information you should know before investing in our securities.

You should rely only on this prospectus supplement, the accompanying prospectus, any related free-writing prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectuses we have prepared. Neither we nor the Dealer-Manager has authorized anyone to provide you with information that is in addition to, or different from, that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectuses we have prepared. If anyone provides you with different or inconsistent information, you should not rely on it. We are not offering to sell securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free-writing prospectus is accurate as of any date other than as of the date of this prospectus supplement, the accompanying prospectus or any related free-writing prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business, financial condition, liquidity, results of operations, and prospects may have changed since those dates.

Unless otherwise stated, all references to “us,” “our,” “ITUS,” “we,” the “Company” and similar designations refer to ITUS Corporation. Our logo, trademarks and service marks are the property of ITUS Corporation. Other trademarks or service marks appearing in this prospectus supplement are the property of their respective holders.

S-i

Table of content

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated by reference herein may contain forward looking statements that involve risks and uncertainties. All statements other than statements of historical fact contained in this prospectus supplement and the documents incorporated by reference herein, including statements regarding future events, our future financial performance, business strategy, and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus supplement and the documents incorporated by reference herein, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long term business operations, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed (i) in our Annual Report on Form 10-K for the fiscal year ended October 31, 2016, (ii) in this prospectus supplement and, in particular, the risks discussed below and under the heading “Risk Factors” and (iii) those discussed in other documents we file with the SEC. The following discussion should be read in conjunction with the consolidated financial statements for the fiscal years ended October 31, 2016 and 2015 and notes incorporated by reference herein. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus supplement. You are advised to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K filed with the SEC.

S-ii

Table of content

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere in this prospectus supplement. This summary does not contain all the information that you should consider before investing in our Company. You should carefully read the entire prospectus supplement, including all documents incorporated by reference herein. In particular, attention should be directed to our “Risk Factors,” “Information With Respect to the Company,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment decision.

Business Overview

ITUS Corporation, through its wholly owned subsidiary, Anixa Diagnostics Corporation, is using the power of the immune system to diagnose cancer. CchekÔ, our early cancer detection blood test, monitors subtle changes that occur in the immune system throughout early tumor formation and tumor growth. We hope that Cchek will one day become part of the standard blood work ordered for patients during routine doctor visits.

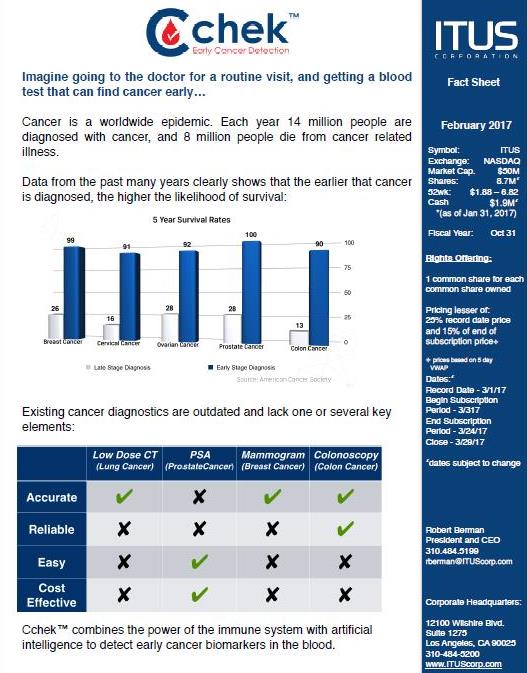

Cancer survival data from the past 50 years indicates that the earlier cancer is diagnosed, the higher the likelihood of survival. For many cancers, such as breast cancer and prostate cancer, early diagnoses (e.g., at stage 1 or stage 2) often result in cancer survival rates of between 90% and 100%, while later diagnoses (e.g., at stage 3 or stage 4) often result in survival rates of less than 30%. While much of the focus and research dollars have been spent trying to cure advanced cancers, the cancer survival data indicates that technologies which can find cancer early have the potential to have an enormous impact on increasing cancer survival rates and reducing cancer mortalities. For those cancers for which we currently have cancer detection technologies, we believe existing diagnostics are outdated, yielding results that are often inaccurate and unreliable for the doctor and invasive and expensive for the patient. For many other cancers, there are no effective means of early cancer detection.

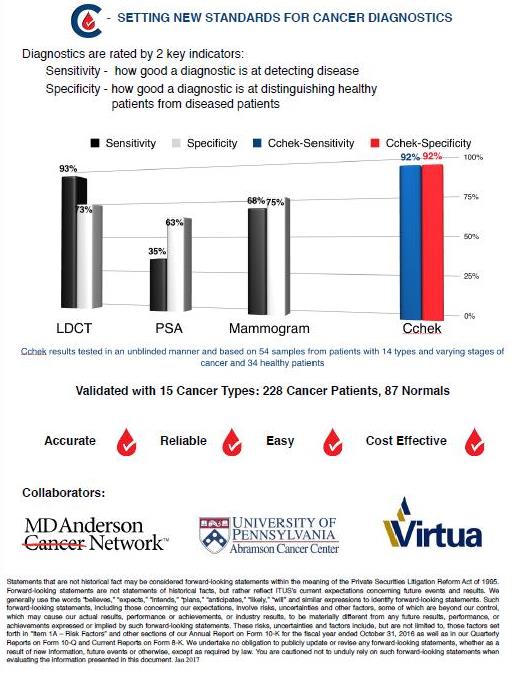

Although early in its development, the efficacy of Cchek has already been demonstrated with 15 cancer types, including lung cancer, breast cancer, colon cancer, prostate cancer, pancreatic cancer, ovarian cancer, liver cancer, thyroid cancer and seven other cancers. When tested using blood samples from biopsy verified cancer patients and blood samples from healthy patients, Cchek has demonstrated a high degree of accuracy in detecting early and late stage cancers, and a high degree of reliability in distinguishing the blood of cancer patients from healthy patients. While many of the newest immunotherapy drugs are attempting to modify or enhance the power of the immune system to treat advanced cancers, we are relying on certain types of immune cells to diagnose cancer. Through the use of proprietary methodologies and protocols for identifying and monitoring these cells, including the use of artificial intelligence to interpret results, we believe that it will be possible to diagnose the presence of many types of cancer early with a relatively simple, inexpensive blood test.

Over the next nine to 12 months, we intend to undertake several important steps that are necessary to continue the development of Cchek and prepare the technology for the regulatory approval process. We plan to accumulate and process a greater number of cancer blood samples and normal blood samples, to be tested under consistent conditions and with the same protocols. We also intend to test benign conditions to determine whether we can successfully distinguish benign conditions from cancer. We expect to continue the development of our neural network and our use of artificial intelligence to determine whether it is capable of distinguishing one type of cancer from another. Finally, we aim to standardize our processes and procedures for Cchek and test and simulate a variety of varying conditions that may occur with the widespread distribution of a diagnostic test to determine the effects that such conditions may have on test results following commercialization.

Company History

We were incorporated in November 1982 under the laws of the State of Delaware. From inception through October 2012, our primary operations involved the development of patented technologies in the areas of thin-film displays and encryption. Beginning in October 2012, under the leadership of a new management team, we recapitalized our company, unencumbered our assets, changed our corporate name and trading symbol, relocated our headquarters and modernized our computer systems. In July 2015, our shares of common stock began trading on NASDAQ.

S-1

Table of content

In June 2015, we announced the formation of a new subsidiary, Anixa Diagnostics Corporation (“Anixa”) to develop a platform for non-invasive blood tests for the early detection of cancer. That platform is called Cchek™. In July 2015, we announced a collaborative research agreement with The Wistar Institute (“Wistar”), the nation’s first independent biomedical research institute and a National Cancer Institute designated cancer research center, for the purpose of validating our cancer detection methodologies and establishing protocols for identifying certain biomarkers in the blood which we identified and which are known to be associated with malignancies. In August 2016, we announced the renewal and expansion of our relationship with Wistar.

Company Operations

In October 2015, we and Wistar announced favorable results from initial testing of a small group of breast cancer patients and healthy controls. One hundred percent of the blood samples tested from patients with varying stages of breast cancer showed the presence of the biomarkers we identified, and none of the healthy patient blood samples contained the biomarkers. Breast cancer is the second most common cancer in the United States and throughout the world.

In April 2016, we announced that we had demonstrated the efficacy of our Cchek early cancer detection platform with lung cancer. Lung cancer is the leading cause of death among cancers in the United States and throughout the world, accounting for approximately 27% of all cancer related deaths in the United States and 19% worldwide. In September 2016, we announced that we had demonstrated the efficacy of our Cchek early cancer detection platform with colon cancer. Colon cancer is the third most common cancer in men and the second most common cancer in women worldwide, with approximately 1.4 million new cases diagnosed each year, and approximately 700,000 deaths. At the end of September 2016 through the end of October 2016, we made similar announcements with respect to the efficacy of our Cchek early cancer detection platform for melanoma, ovarian cancer, liver cancer, thyroid cancer and pancreatic cancer. In November 2016, we announced that we had demonstrated the efficacy of our Cchek early cancer detection platform with six additional cancer types including appendiceal cancer (cancer of the appendix), uterine cancer, osteosarcoma (cancer of the bone), leiomyosarcoma (cancer of the soft tissue), liposarcoma (cancer of the connective tissue), and vulvar cancer (cancer of the vulva). In January 2017, we announced that we had demonstrated the efficacy of our Cchek early cancer detection platform with prostate cancer, bringing the number of cancer types for which the efficacy of Cchek has been validated to 15 through that date.

On December 7, 2016, MD Anderson Cancer Center enrolled to join our early cancer detection biomarker study. Patient blood samples produced by MD Anderson will assist us in achieving the critical mass necessary to begin discussions with regulators.

Our Cchek cancer detection platform measures a patient's immune response to a malignancy by detecting the presence, absence and quantity of certain immune cells that exist in and around a tumor and that enter the blood stream. These types of cells and the tumor microenvironment have been the focus of recent groundbreaking published and reported research in immune-oncology, enabling the development of novel immunotherapies used for treating certain cancer types. Instead of seeking to alter or boost the body’s immune system and its ability to destroy cancer cells, as is the case with immunotherapy drugs, we have developed proprietary techniques and protocols for measuring the subtle immunological changes that occur in the blood stream during tumor development. Specifically, we seek to identify a subset of myeloid cells that we believe are diagnostic. These cells, often referred to as Myeloid Derived Suppressor Cells (MDSCs), are identified by specific surface proteins enabling characterization. We generally refer to MDSCs and other cells of the immune system that we believe can be diagnostic in nature as biomarkers. Through our proprietary protocols, we have had early success and have demonstrated accuracy in detecting these biomarkers in the peripheral blood of biopsy verified cancer patients, and in distinguishing the blood of healthy patients from the blood of cancer patients. Our goal is to establish Cchek as a non-invasive, inexpensive, cancer diagnostic blood test that can reduce or eliminate the need for traditionally expensive, invasive, painful and often inaccurate cancer diagnostic procedures which are currently in use.

S-2

Table of content

In each instance where we have demonstrated the efficacy of our cancer detection platform, fresh (utilized within 48 hours) blood samples from biopsy verified cancer patients have been tested at Wistar using a variety of experimental methodologies and protocols. Such unblinded, non-uniform testing is common during the initial development stage of new technologies and diagnostic tests. Blood samples from patients with differing severities of cancers (with some cancers such as breast cancer stage 0 to stage 4) have been tested, including samples from both pre-treatment and post-treatment patients. In addition, Wistar has also tested blood from healthy donors. A critical aspect of any cancer diagnostic is the ability to accurately distinguish patients with cancer from healthy patients. Based upon our early results, our scientists are working with Wistar to finalize protocols and methodologies for identifying and classifying the immunologic biomarkers that are the foundation for our Cchek early cancer detection platform. Although our scientists, working in collaboration with Wistar, will continue to improve our processes and methodologies to achieve maximum performance, we expect our testing to become more uniform over time and to eventually test patient samples in a double-blinded manner. While studies comparing biopsy verified cancer patients have been compared to healthy donors, we have not yet evaluated benign conditions such as non-malignant neoplasias, systemic inflammatory conditions, infections and other potential conditions that impact or may impact the immune system. Such testing will be necessary for regulatory approval.

Based upon and following the results of a more extensive clinical study, we intend to determine what further studies are necessary and whether and when to begin the process of seeking regulatory approval for a cancer screening test or confirmatory diagnostic test based upon our Cchek technology. One manner of seeking regulatory approval is to have a lab certified to run our cancer tests pursuant to the Clinical Laboratory Improvement Act of 1967 and the Clinical Laboratory Improvement Amendments of 1988 (together, “CLIA”). Among other requirements, CLIA requires clinical laboratories that perform diagnostic testing to be certified by the state in which the lab is located, as well as the Center for Medicare and Medicaid Services. If we seek regulatory approval pursuant to CLIA, only those laboratories that are certified under CLIA to run our diagnostic test would be able to process test samples. CLIA certification may or may not require additional studies. We may seek to establish our own CLIA certified laboratory to run the diagnostic tests, or we may potentially contract with an existing CLIA certified lab, and seek to have that laboratory certified to run our diagnostic test.

Another manner of obtaining regulatory approval would be to seek to have Cchek approved by the Food and Drug Administration (“FDA”), pursuant to what are commonly referred to as either the 510(K) process or the Premarket Application (“PMA”) process. The appropriate pathway for FDA approval would depend upon a variety of factors including the intended use of the test and the risks associated with such use. FDA approval can take several years and would entail additional clinical studies.

Our decision as to whether and when to seek CLIA certification or FDA approval of a diagnostic test or tests utilizing our Cchek technology will be dependent on a variety of factors including the results from more extensive clinical studies, the capital requirements of each approval process, the landscape for competitive diagnostic testing and the time and resources required by each approval process. It is possible that we may seek to have one or more diagnostic tests approved via CLIA certification, and other diagnostic test or tests approved by the FDA, or that we may seek simultaneous FDA approval and CLIA certification of a particular diagnostic test or tests.

During the balance of 2017, we expect Cchek to be the primary focus of our company. As part of our legacy operations, we remain engaged in limited patent licensing activities in the area of encrypted audio/video conference calling. We do not expect these activities to be a significant part of our ongoing operations.

Over the past several fiscal quarters, our revenue has been derived from technology licensing and the sale of patented technologies, including in connection with the settlement of litigation. In addition to our Anixa subsidiary, we may make investments in and form new companies to develop additional emerging technologies.

Recent Developments

In November 2013, we entered into a Patent Acquisition Agreement with Meetrix Communications, Inc. (“Meetrix”). Pursuant to the terms of the Patent Acquisition Agreement, which was entered into in connection with our former business operations involving the development of patented technologies in the area of thin-film displays and encryption, we purchased from Meetrix its right, title and interest in four U.S. patents (Meetrix maintained a limited license to continue to use the patents). In consideration for our purchase of the patents, we issued to Meetrix 40,000 shares of common stock (the “Meetrix Shares”), granted Meetrix a continuing royalty in the net proceeds earned by us relating to the patents (the “Meetrix Royalty”) and agreed to pay to Meetrix, no later than the fourth anniversary of the effective date of the Patent Acquisition Agreement, $5,000,000 (less the value of the Meetrix Shares and any Meetrix Royalty payments) (the “Meetrix Obligation”). Pursuant to the terms of the Patent Acquisition Agreement, we could elect to pay the Meetrix Obligation using stock of our company, with a value given to the stock equal to 90% of the weighted average closing prices for the 30 day period prior to such election. In December 2016, we provided notice to Meetrix of our intention to issue shares of common stock to satisfy the Meetrix Obligation, which as of the date of such notice was $4,775,934, at a price of $5.04 per share. On January 27, 2017, we filed a registration statement on Form S-1 to register the issuance of 947,606 shares of common stock to Meetrix to satisfy the Meetrix Obligations. Since the shares issuable to Meetrix as a result of the Meetrix Obligation have not been issued, Meetrix will not receive any Rights relating to those shares.

S-3

Table of content

Corporate Information

Our principal executive offices are located at 12100 Wilshire Boulevard, Suite 1275, Los Angeles, California 90025, our telephone number is (310) 484-5200, and our Internet website address is http://www.ITUScorp.com. The information on our website is not a part of, or incorporated in, this prospectus supplement or the accompanying prospectus.

S-4

Table of content

S-6

Table of content

The Offering

The following summary contains basic information about the offering and is not intended to be complete. It does not contain all the information that may be important to you. For a more complete understanding of the securities we are offering, you should read the section entitled “The Rights Offering.”

| Securities to be Offered | We are distributing to you, at no charge, non-transferable Rights to purchase one share of common stock (subject to proration) for every one share of our common stock that you own on the Record Date, either as a holder of record or, in the case of shares held of record by brokers, banks or other nominees on your behalf, as a beneficial owner of such shares. |

| | |

| Size of the Offering | 9,066,987 Rights, representing one Right for each share of our common stock currently outstanding and one Right for each share of common stock underlying certain of our outstanding warrants (see “Participation of Certain Warrant Holders” below). |

| | |

| Subscription Price | The Subscription Price will be the lesser of (i) $3.24 (the “Initial Price”) and (ii) a fifteen percent (15%) discount to the volume weighted average price for our common stock for the five (5) trading day period through and including the Expiration Date (the “Alternate Price”). Subscribers must fund their subscriptions pursuant to both the Basic Subscription Privilege and Over-Subscription Privilege at the Initial Price. If, on the Expiration Date, the Alternate Price is lower than the Initial Price, any excess subscription amounts paid by a subscriber (the “Excess Subscription Amount”) will be put towards the purchase of additional shares in the Rights Offering unless a subscriber makes an election in the Rights Certificate to have the Excess Subscription Amount returned in cash. If a subscriber elects to receive his or her Excess Subscription Amount in cash rather than have such Excess Subscription Amount used to purchase shares in the Rights Offering, the Subscription Agent will refund the difference to such subscriber promptly after the closing of the Rights Offering with no interest or penalty. |

| | |

| Basic Subscription Privilege | Subject to proration if more than the Maximum Offering Amount is subscribed for, each Right will entitle its holder to subscribe for one share of common stock at the Subscription Price. At the end of the subscription period, unexercised Rights will expire and have no value. |

S-7

Table of content

| Over-Subscription Privilege | If, and only if, you fully exercise your Basic Subscription Privilege, you will also have an Over-Subscription Privilege which allows you to subscribe for additional shares that were not exercised by other stockholders. You must state your intention to exercise your Over-Subscription Privilege at the time that you exercise your Rights. The additional shares will be sold at the same Subscription Price per share and are also subject to proration. For more information, see “Questions and Answers Relating to the Rights Offering” below. |

| | |

| Proration | Both the Basic Subscription Privilege and Over-Subscription Privilege will be subject to proration to ensure that the aggregate proceeds raised in the Rights Offering does not exceed the Maximum Offering Amount. The Maximum Offering Amount equals the total amount that the Company may raise in an equity offering pursuant to General Instruction I.B.6 of Form S-3. If any proration is necessary, subscriptions for shares will be prorated. For more information regarding proration, including the precise formula for how your Rights will be prorated, see “Questions and Answers Relating to the Rights Offering – What is proration?” below. |

| | |

| Excess Subscription Amount | If, on the Expiration Date, the Alternate Price is lower than the Initial Price, any Excess Subscription Amounts paid by a subscriber will be put towards the purchase of additional shares in the Rights Offering unless a subscriber makes an election in the Rights Certificate to have the Excess Subscription Amount returned in cash. For more information, see “Questions and Answers Relating to the Rights Offering” below. |

| | |

| Record Date | Wednesday, March 1, 2017. |

| | |

| Commencement Date | The subscription period for the Rights Offering begins on Friday, March 3, 2017. |

| | |

| Expiration Date | 5:00 p.m., Eastern time, Friday, March 24, 2017. The Expiration Date is subject to extension of up to 30 days at the sole discretion of the Company. The Company is not required to give notice of such extension. |

| | |

| Subscription Period | The Rights Offering will take place beginning on the Commencement Date and will end on Friday, March 24, 2017, unless extended. Our board of directors may for any reason terminate the Rights Offering at any time before the completion of the Rights Offering. |

S-8

Table of content

| Subscription Procedure | If you are a record holder of our common stock, you must deliver a properly completed Rights Certificate (sent to you with this prospectus supplement) to the Subscription Agent together with payment in cleared or good funds to be received before Friday, March 24, 2017 (unless extended). You may deliver the documents and payments by first class mail or overnight courier service. If you use first class mail for this purpose, we recommend using registered mail, properly insured, with return receipt requested. |

| If you are a beneficial owner of shares that are registered in the name of a broker, dealer, custodian bank or other nominee, you should instruct your broker, dealer, custodian bank or other nominee to exercise your Rights on your behalf. Please follow the instructions of your broker or your nominee, who may require that you meet a deadline earlier than the Expiration Date. |

| |

| | |

| Delivery of Shares | As soon as practicable after the expiration of the Rights Offering, the Subscription Agent will arrange for the issuance of the shares of common stock purchased pursuant to the Rights Offering. If you hold your shares in the name of a custodian bank, broker, dealer or other nominee, the Depository Trust Company (the “DTC”) will credit your account with your nominee with the securities you purchased in the Rights Offering. If you are a holder of record of shares, all shares of common stock that are purchased by you in the Rights Offering will be issued in book-entry, or uncertificated, form meaning that you will receive a direct registration (DRS) account statement from our transfer agent reflecting ownership of these securities. |

| | |

| Non-Transferability of Rights | The Rights may not be sold, transferred, assigned or given away to anyone. The Rights will not be listed for trading on any stock exchange or market. |

| | |

| Participation of Certain

Warrant Holders | Certain holders of our warrants to purchase common stock have the contractual right to participate in this Rights Offering. Each such warrant holder will receive one Right for each share of common stock that such warrant holder’s warrant is exercisable for. A total of 309,400 Rights will be issued to these warrant holders. |

S-9

Table of content

| No Recommendation | None of the board of directors of our company, the Information Agent or the Dealer-Manager is making a recommendation regarding your exercise of the Rights. You are urged to make your decision to invest based on your own assessment of our business and the terms of the Rights Offering. Please see “Risk Factors” for a discussion of some of the risks involved in investing in our securities. |

| | |

| No Revocation | All exercises of Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your Rights. However, if we make a material change to the terms of the Rights Offering set forth in this prospectus supplement, for example, extending the Rights Offering beyond the Expiration Date as permitted in this prospectus supplement or materially increasing or decreasing the Subscription Price (a “Material Change”), you may cancel your subscription and receive a refund of any money you have advanced. |

| | |

| No Minimum Requirements | There is no minimum subscription requirement for closing this Rights Offering, and no minimum subscription requirement for any subscription rights holder. |

| | |

| Other Subscription Limitations | In the event that the exercise by a stockholder of the Rights could, as determined by us in our sole discretion, potentially result in a limitation on our ability to use net operating losses, tax credits and other tax attributes (the “Tax Attributes”) under the Internal Revenue Code of 1986, as amended (the “Code”), and rules promulgated by the Internal Revenue Service, we may, but we are under no obligation to, reduce the number of shares of common stock to be acquired by such stockholder to such number of shares of our common stock as we, in our sole discretion, shall determine to be advisable in order to preserve our ability to use the Tax Attributes. |

| | |

| Use of Proceeds | We intend to use the net proceeds of this offering for general corporate purposes, including ongoing clinical work and working capital, and to repay certain outstanding indebtedness. See “Use of Proceeds.” |

| | |

| Subscription Agent | Continental Stock Transfer & Trust Company. |

S-10

Table of content

| Information Agent | MacKenzie Partners, Inc. |

| | |

| Dealer-Manager | Advisory Group Equity Services, Ltd. doing business as RHK Capital. |

| | |

| U.S. Federal Income

Tax Considerations | For U.S. federal income tax purposes, you generally should not recognize income or loss in connection with the receipt or exercise of the Rights. You are urged, however, to consult your own tax advisor as to your particular tax consequences resulting from the receipt and exercise of the Rights. See “Material U.S. Federal Income Tax Considerations.” |

| | |

| Risk Factors | Your investment in our securities involves substantial risks. You should consider the “Risk Factors” and the “Note Regarding Forward-Looking Statements” included and incorporated by reference in this prospectus supplement and the accompanying prospectus, including the risk factors incorporated by reference from our filings with the SEC. |

| | |

| | |

| NASDAQ ticker symbol | Our common stock is listed on The NASDAQ Capital Market under the symbol “ITUS.” |

| | |

| Fees and Expenses | We will pay all fees and expenses charged by the Subscription Agent, the Information Agent and the Dealer-Manager in connection with the Rights Offering. You are responsible for paying any other commissions, fees, taxes or other expenses that may be incurred in connection with the exercise of the Rights. |

| | |

| Distribution Arrangements | The Dealer- Manager will provide marketing assistance and advice to our company in connection with the Rights Offering. Under the terms and subject to the conditions contained in the dealer-manager agreement, we have agreed to pay the Dealer-Manager a cash fee of 6% of the gross proceeds of the Rights Offering and a 1.8% non-accountable expense fee, as well as an out-of-pocket accountable expense allowance of 0.2% of the proceeds of the Right Offering. We have also agreed to indemnify the Dealer-Manager and its affiliates against certain liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”). The Dealer-Manager’s participation in this Rights Offering is subject to customary conditions contained in the dealer-manager agreement. The Dealer-Manager and its affiliates may provide to us from time to time in the future in the ordinary course of its business certain financial advisory, investment banking and other services for which it will be entitled to receive customary fees. The Dealer-Manager does not make any recommendation with respect to whether you should exercise the Basic Subscription Privilege or Over-Subscription Privilege, or to otherwise invest in our company. |

| | |

| Questions | If you have any questions about the Rights Offering, including questions about subscription procedures and requests for additional copies of this prospectus supplement and the accompanying prospectus or other documents, please contact our Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com. |

S-11

Table of content

The following are examples of what we anticipate will be common questions about the Rights Offering. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the Rights Offering. This prospectus supplement and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus contain more detailed descriptions of the terms and conditions of the Rights Offering and provide additional information about us and our business, including potential risks related to the Rights Offering and our business. We urge you to read this entire prospectus supplement and the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

Why are we conducting the Rights Offering?

We are conducting the Rights Offering to raise additional capital for general corporate purposes, including ongoing clinical work and working capital, and to repay certain outstanding indebtedness. Rather than seeking financing from new investors, our board of directors has chosen to give you the opportunity to purchase additional shares to maintain your current percentage ownership in our company and provide us with additional capital at these price levels. We cannot assure you that we will not need to seek additional financing in the future.

What is the Rights Offering?

We are distributing to the holders of our common stock, at no charge, non-transferrable subscription rights to purchase our common stock. Each holder of our common stock at 5:00 p.m., Eastern time, on March 1, 2017 will receive one (1) Right to purchase one (1) share of our common stock (subject to proration as described below) for each one (1) share of common stock owned by such holder on the Record Date. Each Right will be exercisable at a price per share equal to the lesser of (i) $3.24 and (ii) a fifteen percent (15%) discount to the volume weighted average price for our common stock for the five (5) trading day period through and including Friday, March 24, 2017 (subject to extension). Pursuant to the terms of this Rights Offering, the Rights may be exercised for a Maximum Offering Amount of $12,000,000. The Rights will be evidenced by a Rights Certificate that has been sent to you along with this prospectus supplement. Each Right will entitle the holder to a Basic Subscription Privilege and an Over-Subscription Privilege. The Over-Subscription Privilege will include Basic Subscription Privileges that remain unsubscribed at the Expiration Date. You will only be permitted to exercise your Over-Subscription Privilege, if any, if you fully exercise your Basic Subscription Privilege.

In addition to the foregoing, certain holders of our warrants to purchase common stock have the contractual right to participate in this Rights Offering. Each such warrant holder will receive one Right for each share of common stock that such warrant holder’s warrant is exercisable for. A total of 309,400 Rights will be issued to these warrant holders.

If I want to subscribe for the shares, how do I get started?

To subscribe for the common stock, you must follow the process described in the Rights Certificate sent to you. The Rights Certificate is also available from the Information Agent. For assistance or copies of the documents you may contact the Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

Where can I find the number of Rights I hold?

The number of Rights you hold will be shown on the Rights Certificate. The number shown is the total number of your Rights. You may exercise any or all of them for shares of common stock, but for purposes of the Basic Subscription Right, the number you exercise cannot exceed the number shown. That said, if you elect to exercise your Basic Subscription Right in full, you may also elect to exercise your Over-Subscription Privilege.

S-12

Table of content

What if I believe that the number of Rights indicated on my Rights Certificate is not correct?

Each share of common stock that you hold on the Record Date will entitle you to one Right. Depending on how you hold your shares (in certificated or book-entry form as a holder of record or through one or more brokerage accounts in “street name”), you may receive one or more Rights Certificates. If, after a review of all of your Rights Certificates, you do not believe that the number of Rights included on your Rights Certificate(s) is correct, please contact our Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

What is the Basic Subscription Privilege?

The Basic Subscription Privilege of each Right gives our stockholders of record as of March 1, 2017 the opportunity to purchase one share of common stock at the Subscription Price (subject to proration). We have granted to you, as a stockholder of record as of 5:00 p.m., Eastern time, on the Record Date, one Right for every share of our common stock you owned at that time. For example, if you owned 1,000 shares of our common stock as of 5:00 p.m., Eastern time, on the Record Date, you would receive 1,000 Rights and would have the right, subject to proration, to purchase up to 1,000 additional shares of common stock at the Subscription Price with your Basic Subscription Privilege. If you fully exercise your Basic Subscription Privilege, you would also be entitled to an Over-Subscription Privilege, in each case subject to proration as described herein. You may exercise the Basic Subscription Privilege of any number of your Rights, or you may choose not to exercise any Rights. If you exercise your Basic Subscription Privilege, you may elect to purchase shares of common stock up to the number of Rights you hold. However, all subscriptions, including those pursuant to the Basic Subscription Privilege, are subject to proration.

There is no minimum number of shares of common stock that you must purchase, but you may not purchase fractional shares. You may exercise all or a portion of your Basic Subscription Privilege, or you may choose not to exercise any Rights at all. However, if you exercise less than your full Basic Subscription Privilege, you will not be entitled to purchase shares under your Over-Subscription Privilege.

Any excess subscription payments received by the Subscription Agent caused by proration will be promptly returned to the subscriber, without interest. Any Excess Subscription Amount resulting from the reduction of the Subscription Price from the Initial Price to the Alternate Price will be put towards the purchase of additional shares in the Rights Offering (either towards your Basic Subscription Privilege, if available, or towards the Over-Subscription Privilege if you have already exercised your Basic Subscription Privilege in full) unless a subscriber makes an election in the Rights Certificate to have the Excess Subscription Amount returned in cash without interest.

What is proration?

All subscriptions, including subscriptions pursuant to the Basic Subscription Privilege, will be subject to proration to ensure that the aggregate proceeds raised in the Rights Offering does not exceed the Maximum Offering Amount which is the total amount that the Company may raise in an equity offering pursuant to General Instruction I.B.6 of Form S-3. In the event that the number of subscriptions exceeds the Maximum Offering Amount, each subscriber will receive a pro rata portion of the shares issued pursuant to the Rights Offering. Each subscriber will receive a number of shares per Right equal to the product (disregarding fractions) obtained by multiplying the number of shares issuable by the Company to ensure that the Maximum Offering Amount is not exceeded based on the Subscription Price (the “Maximum Available New Stock”) by a fraction of which the numerator is the number of shares subscribed for by that subscriber under the Basic Subscription Right (or the Over-Subscription Privilege, as the case may be) and the denominator is the aggregate number of shares subscribed for by all of the subscribers pursuant to the Basic Subscription Right (or the Over-Subscription Privilege, as the case may be). Any fractional shares to which subscribers would otherwise be entitled pursuant to such allocation shall be rounded down to the nearest whole share.

S-13

Table of content

For example, assume that the Subscription Price is $5.00 per share and 8,000,000 Rights are exercised during the course of the Rights Offering. The gross proceeds to the Company, without proration, would equal $40,000,000 which is in excess of the Maximum Offering Amount. Accordingly, we would be required to prorate the subscriptions for each subscriber. If you exercised 100 Rights subscribing for 100 shares, your subscription would be prorated and you would receive only 30 shares of common stock (100 shares multiplied by the quotient of $12,000,000, or the Maximum Offering Amount, divided by $40,000,000) and would be refunded any additional money, without interest.

The Subscription Agent will notify rights holders of the number of shares allocated to each holder promptly after completion of the allocation process. Any excess subscription payments received by the Subscription Agent will be promptly returned, without interest.

What is the Over-Subscription Privilege?

The Over-Subscription Privilege provides stockholders that exercise all of their Basic Subscription Privileges the opportunity to purchase the shares of common stock that are not purchased by other stockholders in this Rights Offering (the “Remaining New Stock”) up to the Maximum Offering Amount. If you fully exercise your Basic Subscription Privilege, the Over-Subscription Privilege entitles you to subscribe for additional shares unclaimed by other holders of Rights in this Rights Offering at the same Subscription Price per share. If an insufficient number of shares is available to fully satisfy all Over-Subscription Privilege requests, we will allocate the available shares pro-rata among those stockholders exercising their Over-Subscription Privilege based on the number of available shares such that each subscriber would receive such number of shares equal to the product (disregarding fractions) obtained by multiplying the number of shares of Remaining New Stock by a fraction of which the numerator is the number of shares subscribed for by that participant under the Over-Subscription Privilege and the denominator is the aggregate number of shares of Remaining New Stock subscribed for by all participants under the Over-Subscription Privilege. Any fractional shares to which persons exercising their Over-Subscription Privilege would otherwise be entitled pursuant to such allocation shall be rounded down to the nearest whole share.

To properly exercise your Over-Subscription Privilege, you must deliver the subscription payment related to your Over-Subscription Privilege prior to the expiration of the Rights Offering or such earlier date as may be specified in the Rights Certificate you receive from the Subscription Agent. Because we will not know the total number of unsubscribed shares prior to the Expiration Date, you will need to deliver payment in an amount equal to the aggregate purchase price for the maximum number of shares that you desire to purchase.

Any excess subscription payments received by the Subscription Agent caused by proration will be promptly returned to the subscriber, without interest. Any Excess Subscription Amount resulting from the reduction of the Subscription Price from the Initial Price to the Alternate Price will be put towards the purchase of additional shares in the Rights Offering unless a subscriber makes an election in the Rights Certificate to have the Excess Subscription Amount returned in cash without interest.

How was the discount to market price determined by the Board for purposes of establishing the Subscription Price?

Our board of directors considered, among other things, the following factors in determining the discount to market price for purposes of establishing the Subscription Price:

· the current and historical trading prices of our common stock;

· the price at which stockholders might be willing to participate in the Rights Offering;

· our need for additional capital and liquidity;

· the cost of capital from other sources; and

· comparable precedent transactions, including the percentage of shares offered, the terms of the Rights being offered, the subscription price and the discount that the subscription price represented to the immediately prevailing closing prices for those offerings.

In conjunction with the review of these factors and following discussions with the Dealer-Manager, our board of directors also reviewed our history and prospects, including our past and present burn rate and cash requirements, our prospects for the future, the outlook for our industry and our current financial condition. Our board of directors believes that the discount to market price should be designed to provide an incentive to our current stockholders to participate in the Rights Offering and exercise their Rights.

S-14

Table of content

The Subscription Price does not necessarily bear any relationship to any established criteria for value, other than the current market price of our common stock on certain dates. You should not consider the Subscription Price as an indication of actual value of our company. We cannot assure you that the market price of our common stock will not decline during or after the Rights Offering. You should obtain a current price quote for our common stock before exercising your Rights and make your own assessment of our business and financial condition, our prospects for the future, and the terms of this Rights Offering. Once made, all exercises of Rights are irrevocable.

Why did the Board elect to price the Rights Offering at the lesser of the Initial Price and the Alternate Price?

The Board elected to price the Rights Offering at the lesser of the Initial Price and the Alternate Price to attempt to protect stockholders from any decline in the price of the Company’s common stock which may occur after the Commencement Date and prior to the Expiration Date. While there is no guarantee that this mechanism will sufficiently protect stockholders that exercise their Rights (see “Risk Factors” below), the Board and management wanted to increase the likelihood that the Subscription Price would be less than the current market price at the time the shares are delivered.

What is the role of the Dealer-Manager in this Rights Offering?

The Dealer-Manager, under the terms and subject to the conditions contained in the dealer-manager agreement, will contact stockholders of the Company regarding the exercise of their Rights and provide guidance to us on general market conditions and their impact on the Rights Offering. We have agreed to pay the Dealer-Manager certain fees for acting as the dealer-manager and to reimburse the Dealer-Manager for certain out-of-pocket expenses incurred in connection with the Rights Offering. See the section of this prospectus supplement titled “Plan of Distribution” for a more complete discussion of the compensation to be paid to the Dealer-Manager for its services as the dealer-manager. The Dealer-Manager is not underwriting or backstopping the Rights Offering and is not making any recommendation with respect to the Rights (including with respect to the exercise or expiration of such Rights) or shares of common stock.

The Dealer-Manager has informed us that it has entered into or intends to enter into selected dealer agreements with other broker-dealers pursuant to which (i) such other broker-dealers have agreed or will agree to use their commercially reasonable efforts to procure subscriptions for the shares of common stock, and (ii) the Dealer-Manager has agreed or will agree to reallocate a portion of its dealer-manager fee to each such broker-dealer whose clients exercise rights to purchase shares of common stock in this Rights Offering.

Any broker-dealer interested in participating as a selected dealer may contact the Dealer-Manager at itus@rhk.capital.

Am I required to exercise any or all of the Rights I receive in the Rights Offering?

No. You may exercise any number of your Rights, or you may choose not to exercise any Rights at all. Exercising or not exercising your Rights will not affect the number of shares of our common stock you own (or have the right to own upon exercise of other securities). However, if you choose not to exercise your Rights, your percentage ownership interest in the Company and your voting and other rights may be diluted by other stockholder purchases (to the extent we receive any subscriptions in this Rights Offering).

How soon must I act to exercise my Rights?

The Rights may be exercised at any time beginning on the Commencement Date which is Friday, March 3, 2017 and prior to the Expiration Date which is Friday, March 24, 2017, at 5:00 p.m., Eastern time, unless the subscription period is extended. If you elect to exercise any Rights, the Subscription Agent must actually receive all required documents and payments from you prior to March 24, 2017, at 5:00 p.m., Eastern time. Although we have the option of extending the subscription period for a period not to exceed 30 days, we do not intend to do so.

S-15

Table of content

How do I exercise my Rights?

If you are a shareholder of record (meaning you hold your shares of our common stock in your name and not through a broker, dealer, bank or other nominee) and you wish to participate in the Rights Offering, you must deliver a properly completed and signed Rights Certificate, together with payment of the Subscription Price for the Rights you elect to exercise (including any Over-Subscription Rights that you would like to exercise, if available), to the Subscription Agent before Friday, March 24, 2017 (unless extended). If you are exercising your Rights through your broker, dealer, bank or other nominee, you should promptly contact your broker, dealer, bank or other nominee and submit your subscription documents and payment for the shares subscribed for in accordance with the instructions and within the time period provided by your broker, dealer, bank or other nominee. For assistance you may contact the Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

What if my shares are held in “street name”?

If you hold your shares of our common stock in the name of a broker, dealer, bank or other nominee, then your broker, dealer, bank or other nominee is the record holder of the shares you own. The record holder must exercise the Rights on your behalf. Therefore, you will need to have your record holder act for you.

If you wish to participate in this Rights Offering and purchase shares, please promptly contact the record holder of your shares. We will ask the record holder of your shares, who may be your broker, dealer, bank or other nominee, to notify you of this Rights Offering and to send you all of the information and documentation necessary for you to participate in the Rights Offering. For assistance you may contact the Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

Because the final Subscription Price may not be determined until the Expiration Date, how much money should I send to the Subscription Agent if I want to exercise my Rights?

For purposes of initially exercising your Rights, you should assume that the Subscription Price will equal the Initial Price of $3.24 per share. Accordingly, for each Right that you would like to exercise, including any Rights that you would like the opportunity to exercise pursuant to the Over-Subscription Privilege, you should send $3.24 per share. For assistance you may contact the Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

What happens if the final Subscription Price is less than the Initial Price?

If, on the Expiration Date, the Alternate Price is lower than the Initial Price, any Excess Subscription Amounts paid by a subscriber will be put towards the purchase of additional shares in the Rights Offering unless a subscriber makes an election in the Rights Certificate to have the Excess Subscription Amount returned in cash. For example, assume that the initial Subscription Price is $5.00 per share. If you want to exercise your Rights to purchase 100 shares, you will promptly send payment to the Subscription Agent in the amount of $500. If the final Subscription Price decreases to $4.00 per share, you will receive 125 shares rather than 100 shares and no cash back. If you desire to only subscribe for a certain number of shares and you do not want any Excess Subscription Amounts to be applied to the purchase of additional shares in the Rights Offering, you will need to opt-out of this procedure by checking the appropriate box on the Rights Certificate. If you opt-out, the Subscription Agent will promptly refund to you any amounts overpaid for the Rights that you exercised, without interest or deduction. Detailed instructions to exercise your Rights, including regarding payment of the Subscription Price, are also included on your Rights Certificate.For assistance you may contact the Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

S-16

Table of content

How do I exercise my Rights?

If you wish to participate in the Rights Offering, you must take the following steps:

· deliver payment to the Subscription Agent using the methods outlined in this prospectus supplement before 5:00 p.m., Eastern time, on March 24, 2017; and

· deliver a properly completed Rights Certificate to the Subscription Agent using the methods outlined in this prospectus supplement before 5:00 p.m., Eastern time, on March 24, 2017.

What form of payment is required?

You must timely pay the full Subscription Price for the full number of shares you wish to acquire pursuant to the exercise of Rights by delivering to the Subscription Agent:

· a bank certified check;

· a personal check; or

· wire transfer.

If you send a payment that is insufficient to purchase the number of shares you requested, or if the number of shares you requested is not specified in the forms, the payment received will be applied to exercise your Rights to the fullest extent possible based on the amount of the payment received.

Bank certified checks and personal checks should be sent to Continental Stock Transfer & Trust Company, 17 Battery Place, New York, NY 10004, Attention: Corporate Actions Dept. If you are sending in a personal check, please be sure to mail the personal check for delivery on or prior to March 15, 2017 to ensure that your payment is processed prior to the Expiration Date.

If you are exercising your Rights pursuant to a wire transfer, please use the wire instructions below:

JP Morgan Chase

4 Metrotech Center

Brooklyn, NY 11245

ABA #: 021000021

Continental Stock Transfer & Trust as agent for ITUS Corporation Rights Offering

Acct #: 475-589386

To whom should I send my forms and payment?

If your shares are held in the name of a broker, dealer, bank or other nominee, then you should send your subscription documents and subscription payment to that broker, dealer, bank or other nominee. If you are the record holder, then you should send your Rights Certificate and payment of your Subscription Price to the Subscription Agent hand delivery, first class mail or overnight courier service to: Continental Stock Transfer & Trust Company, 17 Battery Place, New York, NY 10004, Attention: Corporate Actions Dept.

You or, if applicable, your nominee are solely responsible for completing delivery to the Subscription Agent of your subscription documents, Rights Certificate and payment. You should allow sufficient time for delivery of your subscription materials to the Subscription Agent and clearance of payment before the expiration of the Rights Offering.

When will I receive my new shares of common stock?

The Subscription Agent will arrange for the issuance of the common stock promptly after the expiration of the Rights Offering and all prorating calculations and reductions contemplated by the terms of the Rights Offering have been effected. If you hold your shares in the name of a broker, dealer, bank or other nominee, DTC will credit your account with your nominee with the securities you purchase in the Rights Offering. If you are a holder of record of shares, all shares that you purchase in the Rights Offering will be issued in book-entry, or uncertificated, form meaning that you will receive a direct registration (DRS) account statement from our transfer agent reflecting ownership of the common stock.

S-17

Table of content

If I exercise some or all of my Rights, may I cancel my exercise before the Rights Offering closes?

No. All exercises of Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your Rights and even if our board of directors extends the rights offering for a period of up to 30 days. However, if we amend the Rights Offering to allow for an extension of the subscription period of more than 30 days or make a Material Change to the terms of the Rights Offering set forth in this prospectus supplement, you may cancel your purchase and receive a refund of any money you have advanced. You should not exercise your Rights unless you are certain that you wish to purchase shares at the Subscription Price.

If I exercise some or all of my Rights and I determine that I would like to exercise more of my Rights or I would like to exercise or increase my Over-Subscription Privilege, may I do so and, if so, what steps do I need to take?

Yes. While you may not revoke any exercise of your Rights, if you desire to increase your subscription you may do so. Please contact the Information Agent MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.comto increase your subscription.

May I transfer my Rights?

No. You may not sell or transfer your Rights to anyone.

Are we requiring a minimum subscription to complete the Rights Offering?

No. We may complete the Rights Offering regardless of the number of Rights that may be exercised.

Are there any conditions to completing the Rights Offering?

No, but we have the right to cancel or modify the terms of the Rights Offering in our sole discretion.

Are there any other limitations on the exercise of the Rights aside from potential proration?

Yes. In the event that the exercise by a stockholder of the Rights could, as determined by us in our sole discretion, potentially result in a limitation on our ability to use the Tax Attributes under the Code and rules promulgated by the Internal Revenue Service, we may, but we are under no obligation to, reduce the number of shares of common stock to be acquired by such stockholder to such number of shares of our common stock as we, in our sole discretion, shall determine to be advisable in order to preserve our ability to use the Tax Attributes.

Can our board of directors extend, cancel or amend the Rights Offering?

Yes. We have the option to extend the Rights Offering and the period for exercising your Rights for a period not to exceed 30 days, at our sole discretion. We do not presently intend to extend the Rights Offering. If we elect to extend the Expiration Date to a date following Friday, March 24, 2017, we will issue a press release announcing such extension no later than 9:00 a.m., Eastern time, on the next business day after the most recently announced Expiration Date. We will extend the duration of the Rights Offering as required by applicable law or regulation and may choose to extend it if we decide to give stockholders more time to exercise their Rights in the Rights Offering.

Our board of directors may cancel the Rights Offering at any time in its sole discretion. If the Rights Offering is cancelled, we will issue a press release notifying stockholders of the cancellation and all subscription payments received by the Subscription Agent will be promptly returned, without interest or penalty.

S-18

Table of content

Our board of directors also has the right to amend or modify the terms of the Rights Offering in its sole discretion. If we make any Material Change to the terms of the Rights Offering set forth in this prospectus, we will offer persons who have exercised their Rights the opportunity to cancel their purchases and the Subscription Agent will refund the funds advanced by each such person and recirculate an updated prospectus supplement. In addition, upon such event, we may extend the Expiration Date to allow holders of Rights ample time to make new investment decisions and for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the Rights Offering and the new expiration date. The terms of the Rights Offering cannot be modified or amended after the Expiration Date. Although we do not presently intend to do so, we may choose to amend or modify the terms of the Rights Offering for any reason, including, without limitation, in order to increase participation in the Rights Offering. Such amendments or modifications may include a change in the Subscription Price, although we do not currently anticipate any such change.

Has our board of directors made any recommendation to our stockholders regarding the Rights Offering?

No. Neither our board of directors nor the Dealer-Manager is making any recommendation to stockholders regarding the exercise of Rights in the Rights Offering. You should make an independent investment decision about whether or not to exercise your Rights. Stockholders who exercise Rights risk the loss of the amount invested. Please see “Risk Factors” for a discussion of material risks involved in investing in our common stock.

Will our directors and executive officers participate in the Rights Offering?

To the extent they hold common stock as of the Record Date, our directors and executive officers will be entitled to participate in the Rights Offering on the same terms and conditions applicable to other Rights holders. While none of our directors or executive officers has entered into any binding commitment or agreement to exercise Rights received in the Rights Offering, our directors and executive officers have indicated that they intend on participating in the Rights Offering.

How many shares of the company’s common stock will be outstanding after the rights offering?

At the Record Date, 8,757,587 shares of our common stock were outstanding. The number of shares of common stock outstanding after the Rights Offering will depend on the final Subscription Price and the number of Rights that are exercised. If the Subscription Price does not decrease and if all of the Rights are exercised, there will be 12,461,290 shares of common stock outstanding after the Rights Offering.

How much proceeds will we receive from the Rights Offering?

Assuming the Rights Offering is subscribed in full, we will receive proceeds of approximately $11,040,000, net of expenses and fees incident to this Rights Offering estimated at approximately $960,000, including dealer-manager fees. However, until the subscription period ends, we will not know the total proceeds that we have received in the Rights Offering. For a description on how we plan to use the proceeds of the Rights Offering, please see “Use of Proceeds.”

Are there material risks in exercising my Rights?

Yes. The exercise of your Rights involves material risks. Among other things, you should carefully consider each of the risks described under the heading “Risk Factors” in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference.

If the Rights Offering is not completed, will my subscription payment be refunded to me?

Yes. The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. If the Rights Offering is not completed, all subscription payments received by the Subscription Agent will be promptly returned, without interest. If you own your common stock in a brokerage account, it may take longer for you to receive the return of your payment because the Subscription Agent will return your payment through the broker, dealer, bank or other nominee that is the record holder of your shares of common stock.

S-19

Table of content

Will the Rights be listed on a stock exchange or national market?

No. The Rights may not be sold, transferred or assigned and will not be listed for trading on any stock exchange or market.

Will the shares of common stock that I receive upon exercise of my Rights be freely-tradable?

Yes. The Rights Offering is being conducted pursuant to an effective registration statement. Accordingly, all shares issued upon exercise of the Rights will be free of any restrictive legend and will be freely-tradable on NASDAQ.

How do I exercise my Rights if I live outside the United States?

To exercise your Rights, you must follow the process described in the subscription documents sent to you and also available from the Information Agent. For assistance you may contact the Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

What fees or charges apply if I exercise my Rights?

We are not charging any fee or sales commission to issue Rights to you or to issue the shares to you if you exercise your Rights. If you hold your shares in “street name” and exercise your Rights through a broker, dealer, bank or other nominee that is the record holder of your shares, you are responsible for paying any fees your record holder may charge you.

What are the U.S. federal income tax consequences of exercising Rights?

For U.S. federal income tax purposes, you generally should not recognize income or loss in connection with the receipt or exercise of Rights unless the Rights Offering is treated as a distribution described in either Section 305(b) or 305(c) of the Code. We believe that the Rights Offering should not be treated as either such distribution, but certain aspects of that determination are unclear. Our position is not binding on the Internal Revenue Service or the courts, however. You are urged to consult your own tax advisor as to your particular tax consequences resulting from the receipt and exercise of Rights and the receipt, ownership and disposition of our shares. For further information, please see “Material U.S. Federal Income Tax Consequences.”

Who should I contact if I have other questions?

If you have other questions or need assistance, please contact the Information Agent, MacKenzie Partners, Inc., at (212) 929-5500 or (800) 322-2885 (toll free), or by email at ITUS@mackenziepartners.com.

S-20

Table of content

RISK FACTORS