(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ?

Check the appropriate box:

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Solicitation Material Pursuant to Rule 14a-11(c) or rule 14a-12 |

|

| ITUS Corporation |

|

|

| (Name of Registrant as Specified in its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| 1) | Title of each class of securities to which transaction applies: |

|

| 2) | Aggregate number of securities to which transaction applies: |

|

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

|

| 4) | Proposed maximum aggregate value of transaction: |

|

| 5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| (1) | Amount Previously Paid: |

|

| (2) | Form, Schedule or Registration Statement No.: |

|

| (3) | Filing Party: |

|

| (4) | Date Filed: |

ITUS CORPORATION

3150 Almaden Expressway, Suite 250

San Jose, CA 95118

February __, 2018

To the Stockholders of ITUS Corporation:

You are cordially invited to attend the Special Meeting of Stockholders (the “Meeting”) of ITUS Corporation (the “Company”) to be held at 10:00 a.m. on Thursday, March 29, 2018, at the Company’s corporate offices at 3150 Almaden Expressway, Suite 250, San Jose, California 95118, to consider and vote upon the following proposals:

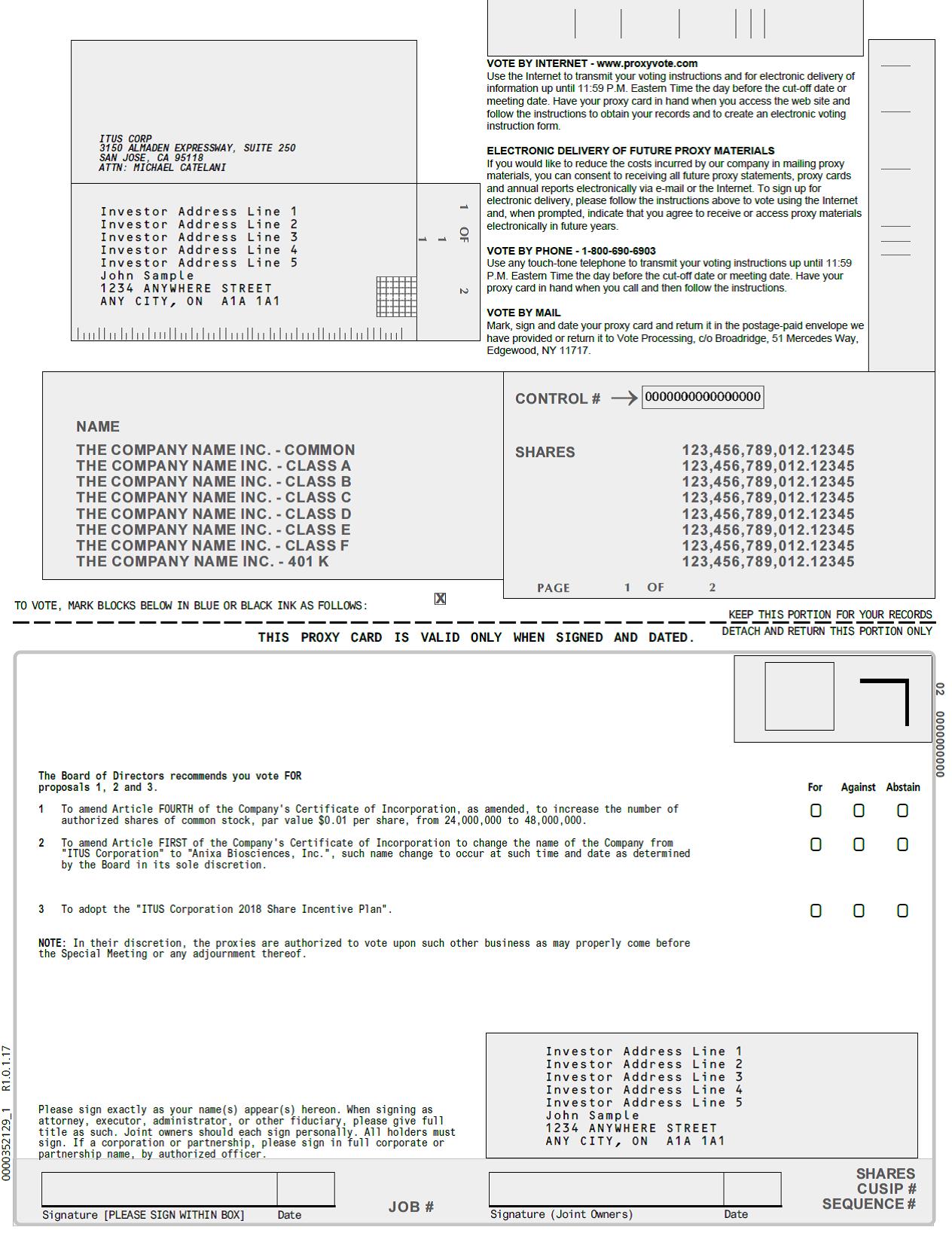

1. To consider and vote upon an amendment to Article FOURTH of the Company’s Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to increase the number of authorized shares of common stock, par value $0.01 per share (the “Common Stock”), from 24,000,000 to 48,000,000 (the “Amendment Proposal”);

2. To consider and vote upon an amendment to Article FIRST of the Certificate of Incorporation to change the name of the Company from “ITUS Corporation” to “Anixa Biosciences, Inc.,” such name change to occur at such time and date as determined by the Board of Directors (the “Board”) in its sole discretion (the “Name Change Proposal”);

3. To consider and vote upon the adoption of the “ITUS Corporation 2018 Share Incentive Plan” (the “Incentive Plan Proposal”); and

4. To transact such other business as may properly come before the Meeting or any adjournment thereof.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE AMENDMENT PROPOSAL, NAME CHANGE PROPOSAL AND INCENTIVE PLAN PROPOSAL.

The Board has fixed the close of business on February 1, 2018 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof. Accordingly, only stockholders of record at the close of business on the Record Date are entitled to notice of, and shall be entitled to vote at, the Meeting or any postponement or adjournment thereof.

Your vote is important. You are requested to carefully read the Proxy Statement and accompanying Notice of Special Meeting for a more complete statement of matters to be considered at the Meeting.

| Sincerely yours, |

|

|

| /s/ Dr. Amit Kumar |

| Dr. Amit Kumar |

| Chairman, President and Chief Executive Officer |

| ITUS Corporation |

2

IMPORTANT

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE READ THE PROXY STATEMENT AND PROMPTLY VOTE YOUR PROXY VIA THE INTERNET, BY TELEPHONE OR, IF YOU RECEIVED A PRINTED FORM OF PROXY IN THE MAIL, BY COMPLETING, DATING, SIGNING AND RETURNING THE ENCLOSED PROXY IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES AT THE MEETING.YOUR PROXY, GIVEN THROUGH THE RETURN OF THE PROXY CARD, MAY BE REVOKED PRIOR TO ITS EXERCISE BY FILING WITH OUR CORPORATE SECRETARY PRIOR TO THE MEETING A WRITTEN NOTICE OF REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE, OR BY ATTENDING THE MEETING AND VOTING IN PERSON.

THE PROXY STATEMENT, OUR FORM OF PROXY CARD AND OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED OCTOBER 31, 2017 ARE AVAILABLE ON THE INTERNET AT HTTP://IR.ITUSCORP.COM/ALL-SEC-FILINGS OR AT THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV.

3

ITUS CORPORATION

3150 Almaden Expressway, Suite 250

San Jose, CA 95118

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held on March 29, 2018

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of ITUS Corporation (the “Company”) for use at the Special Meeting of Stockholders of the Company and at all adjournments and postponements thereof (the “Meeting”). The Meeting will be held at 10:00 a.m. on Thursday, March 29, 2018, at the Company’s corporate offices at 3150 Almaden Expressway, Suite 250, San Jose, California 95118, for the following purposes:

1. To consider and vote upon an amendment to Article FOURTH of the Company’s Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to increase the number of authorized shares of common stock, par value $0.01 per share (the “Common Stock”), from 24,000,000 to 48,000,000 (the “Amendment Proposal”);

2. To consider and vote upon an amendment to Article FIRST of the Certificate of Incorporation to change the name of the Company from “ITUS Corporation” to “Anixa Biosciences, Inc.,” such name change to occur at such time and date as determined by the Board in its sole discretion (the “Name Change Proposal”);

3. To consider and vote upon the adoption of the “ITUS Corporation 2018 Share Incentive Plan” (the “Incentive Plan Proposal”); and

4. To transact such other business as may properly come before the Meeting or any adjournment thereof.

The Board unanimously recommends a vote “FOR” the approval of the Amendment Proposal, Name Change Proposal and Incentive Plan Proposal.

Stockholders of record of our common stock at the close of business on February 1, 2018 (the “Record Date”) will be entitled to notice of, and are cordially invited to, attend this Meeting and to attend any adjournment or postponement thereof. However, to assure your representation at the Meeting, please vote your proxy via the internet, by telephone, or, if you received a printed form of proxy in the mail, by completing, dating, signing and returning the enclosed proxy. Even if you have previously submitted your proxy, you may choose to vote in person at the Meeting. Whether or not you expect to attend the Meeting, please read the Proxy Statement and then promptly vote your proxy in order to ensure your representation at the Meeting.

You may cast your vote by visiting http://www.proxyvote.com. You may also have access to the materials for the Meeting by visiting the website: http://www.ituscorp.com/.

Each share of common stock entitles the holder thereof to one vote. A complete list of stockholders of record entitled to vote at this Meeting will be available for ten days before this Meeting at the principal executive office of the Company for inspection by stockholders during ordinary business hours for any purpose germane to this Meeting.

You are urged to review carefully the information contained in the enclosed proxy statement prior to deciding how to vote your shares.

This notice and the attached proxy statement are first being disseminated to stockholders on or about February ___, 2018.

| BY ORDER OF THE BOARD OF DIRECTORS, |

|

|

| /s/ Michael J. Catelani |

| Michael J. Catelani |

| Secretary |

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS SUBMITTED AT THE MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Meeting to be Held on March 29, 2018: This Proxy Statement is available at: http://www.ituscorp.com/ .

4

TABLE OF CONTENTS

|

| Page |

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS | 6 |

| THE SPECIAL MEETING | 10 |

| PROPOSAL 1 – AMENDMENT PROPOSAL | 13 |

| PROPOSAL 2 – NAME CHANGE PROPOSAL | 15 |

| PROPOSAL 3 – INCENTIVE PLAN PROPOSAL | 16 |

| OTHER INFORMATION | 19 |

| ANNEX A - CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION OF ITUS CORPORATION | 25 |

| ANNEX B - CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION OF ITUS CORPORATION | 26 |

| ANNEX C - ITUS CORPORATION 2018 SHARE INCENTIVE PLAN | 27 |

5

PROXY STATEMENT

ITUS CORPORATION

SPECIAL MEETING OF STOCKHOLDERS

to be held at 10:00 a.m. on Thursday, March 29, 2018

at 3150 Almaden Expressway, Suite 250, San Jose, California 95118

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving this Proxy Statement?

The Company has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the Company’s solicitation of proxies for use at the Special Meeting of Stockholders of the Company (the “Meeting”) to be held at 10:00 a.m. on Thursday, March 29, 2018, at the Company’s corporate offices at 3150 Almaden Expressway, Suite 250, San Jose, California 95118, and at any postponement(s) or adjournment(s) thereof. These materials were first sent or given to stockholders on or about February ___, 2018. This proxy statement gives you information on these proposals so that you can make an informed decision.

In this proxy statement, we refer to ITUS Corporation as the “Company”, “we”, “us” or “our” or similar terminology.

What is included in these materials?

These materials include this Proxy Statement for the Meeting. If you requested printed versions of these materials by mail, these materials also include the proxy card or voting instruction form for the Meeting.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), the Company has elected to provide access to its proxy materials via the Internet instead of mailing printed copies. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Internet Availability Notice”) to the Company’s stockholders. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, instructions on how to access the proxy materials over the Internet or to request a printed copy may be found with the Internet Availability Notice. All stockholders will have the ability to access the proxy materials on the website referred to in the Internet Availability Notice or request to receive a printed set of the proxy materials. Stockholders may request to receive proxy materials in printed form by telephone, mail, by logging on to http://www.proxyvote.com or electronically by email on an ongoing basis. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our stockholder meetings.

How can I get electronic access to the proxy materials?

The Internet Availability Notice will provide you with instructions regarding how to:

· View the Company’s proxy materials for the Meeting on the Internet; and

· Instruct the Company to send future proxy materials to you electronically by email.

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s stockholder meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials. Your election to receive proxy materials by email will remain in effect until you terminate it.

Who can vote at the Meeting?

Stockholders who owned shares of our common stock, par value $0.01 per share (“Common Stock”), on February 1, 2018 (the “Record Date”) may attend and vote at the Meeting. There were ______ shares of Common Stock outstanding on the Record Date. All shares of Common Stock have one vote per share and vote together as a single class. Information about the stockholdings of our directors and executive officers is contained in the section of this Proxy Statement entitled “Beneficial Ownership of Principal Stockholders, Officers and Directors” on page 20 of this Proxy Statement.

What is the proxy card?

The proxy card enables you to appoint Dr. Amit Kumar, our Chairman, President and Chief Executive Officer, and Michael Catelani, our Chief Operating Officer and Chief Financial Officer, as your representatives at the Meeting. By completing and returning the proxy card or voting online as described herein, you are authorizing Dr. Kumar and Mr. Catelani to vote your shares at the Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Meeting. Even if you plan to attend the Meeting, we think that it is a good idea to complete and return your proxy card before the Meeting date just in case your plans change. If a proposal comes up for vote at the Meeting that is not on the proxy card, the proxies will vote your shares, under your proxy, according to their best judgment.

6

What am I voting on?

You are being asked to vote:

1. To approve an amendment to Article FOURTH of the Company’s Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to increase the number of authorized shares of Common Stock from 24,000,000 to 48,000,000 (the “Amendment Proposal”);

2. To approve an amendment to Article FIRST of the Certificate of Incorporation to change the name of the Company from “ITUS Corporation” to “Anixa Biosciences, Inc.,” such name change to occur at such time and date as determined by the Board of Directors (the “Board”) in its sole discretion (the “Name Change Proposal”);

3. To adopt the “ITUS Corporation 2018 Share Incentive Plan” (the “Incentive Plan Proposal”); and

4. To transact such other business as may properly come before the Meeting or any adjournment thereof.

How does the Board recommend that I vote?

Our Board unanimously recommends that the stockholders vote “FOR” the Amendment Proposal, Name Change Proposal and the Incentive Plan Proposal.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If, on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are a “stockholder of record” who may vote at the Meeting, and we are sending these proxy materials directly to you. As the stockholder of record, you have the right to direct the voting of your shares as described below. Whether or not you plan to attend the Meeting, please complete, date and sign the enclosed proxy card to ensure that your vote is counted.

Beneficial Owner

If, on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered the beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered the stockholder of record for purposes of voting at the Meeting. As the beneficial owner, you have the right to direct your broker on how to vote your shares and to attend the Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank or other nominee holder. If you do not make this request, you can still vote by using the voting instruction card enclosed with this proxy statement; however, you will not be able to vote in person at the Meeting.

If I am a stockholder of record of the Company’s Common Stock, how do I vote?

There are four ways to vote:

1. Via the Internet. You may vote by proxy via the Internet by following the instructions provided with the Internet Availability Notice.

2. Via telephone. Using a touch-tone telephone, you may transmit your voting instructions to the number provided in the Internet Availability Notice.

3. In person. If you are a stockholder of record, you may vote in person at the Meeting. The Company will give you a ballot when you arrive.

4. By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided.

7

If I am a beneficial owner of shares held in street name, how do I vote?

There are four ways to vote:

1. Via the Internet. You may vote by proxy via the Internet by following the instructions provided by your brokerage firm, bank, broker-dealer or other similar organization that holds your shares.

2. Via telephone. Using a touch-tone telephone, you may transmit your voting instructions to the number provided in the Internet Availability Notice.

3. In person. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Meeting, you must obtain a legal proxy from the brokerage firm, bank, broker-dealer or other similar organization that holds your shares. Please contact that organization for instructions regarding obtaining a legal proxy.

4. By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the vote instruction form and sending it back in the envelope provided by your brokerage firm, bank, broker-dealer or other similar organization that holds your shares.

How do I request a paper copy of the proxy materials?

There are four ways to request a paper copy of proxy materials:

· By mail. You may obtain a paper copy of the proxy materials by sending a written notice to the Company at 3150 Almaden Expressway, Suite 250, San Jose, CA 95118, Attn: Michael Catelani, Secretary.

· By telephone. You may obtain a paper copy of the proxy materials by calling 1(800) 579-1639 or the Company at (408) 708-9808.

· Via the Internet. You may obtain a paper copy of the proxy materials by logging on to http://www.proxyvote.com.

· By Email. You may obtain a paper copy of the proxy materials by email at sendmaterial@proxyvote.com.

Please make your request for a paper copy as instructed above on or before March 15, 2018 to facilitate timely delivery.

What does it mean if I receive more than one proxy card?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards to ensure that all of your shares are voted.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Meeting. You may do this by:

· sending a written notice to Michael Catelani, our corporate Secretary, stating that you would like to revoke your proxy of a particular date;

· signing another proxy card with a later date and returning it before the polls close at the Meeting; or

· attending the Meeting and voting in person.

Please note, however, that if your shares are held of record by a brokerage firm, bank or other nominee, you must instruct your broker, bank or other nominee that you wish to change your vote by following the procedures on the voting form provided to you by the broker, bank or other nominee. If your shares are held in street name, and you wish to attend and vote at the Meeting, you must bring to the Meeting a legal proxy from the broker, bank or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

Will my shares be voted if I do not sign and return my proxy card?

If your shares are held in your name and you do not sign and return your proxy card, your shares will not be voted unless you vote in person at the Meeting. If you hold your shares in the name of a broker, bank or other nominee, your nominee may determine to vote your shares at its own discretion on certain routine matters, such as the Amendment Proposal and Name Change Proposal, absent instructions from you. However, due to voting rules that may prevent your bank or broker from voting your uninstructed shares on a discretionary basis in the Incentive Plan Proposal and other non-routine matters, it is important that you cast your vote.

8

How are votes counted?

You may vote “for,” “against” or “abstain” on each of the proposals being placed before our stockholders. Abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present at the Meeting.

Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. The Incentive Plan Proposal is “non-routine.” Thus, in tabulating the voting result for this proposal, shares that constitute broker non-votes are not considered votes cast on that proposal. The Amendment Proposal and Name Change Proposal are each a “routine” matter and therefore a broker may vote on those matters without instructions from the beneficial owner as long as instructions are not given.

How many votes are required to approve the Amendment Proposal?

How many votes are required to approve the Name Change Proposal?

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote on this matter at the Meeting is required for approval of the Name Change Proposal. With respect to an abstention, the shares will be considered present and entitled to vote at the Meeting and they will have the same effect as a vote against the matter.

How many votes are required to approve the Incentive Plan Proposal?

The affirmative vote of a majority of the votes cast at the Meeting by the holders of Common Stock entitled to vote is required to approve the Incentive Plan Proposal. With respect to an abstention, the shares will be considered present and entitled to vote at the Meeting, but they will have no effect on the vote of the Incentive Plan Proposal.

What happens if I don’t indicate how to vote my proxy?

If you just sign your proxy card without providing further instructions, your shares will be counted as a “for” vote for each of the Amendment Proposal, Name Change Proposal and Incentive Plan Proposal.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.

Where do I find the voting results of the Meeting?

We will announce voting results at the Meeting and file a Current Report on Form 8-K announcing the voting results of the Meeting.

Who can help answer my questions?

You can contact our corporate Secretary, Michael Catelani, at (408) 708-9808 or by sending a letter to Mr. Catelani at the offices of the Company at 3150 Almaden Expressway, Suite 250, San Jose, CA 95118 with any questions about proposals described in this Proxy Statement or how to execute your vote.

9

General

This Proxy Statement is being furnished to you, as a stockholder of ITUS Corporation, as part of the solicitation of proxies by our Board for use at the Meeting to be held on March 29, 2018, and any adjournment or postponement thereof. This Proxy Statement is first being furnished to stockholders on or about February ___, 2018. This Proxy Statement provides you with information you need to know to be able to vote or instruct your proxy how to vote at the Meeting.

Date, Time, Place of Meeting

The Meeting will be held at 10:00 a.m. on Thursday, March 29, 2018, at the Company’s corporate offices at 3150 Almaden Expressway, Suite 250, San Jose, California 95118, or such other date, time and place to which the Meeting may be adjourned or postponed.

Purpose of the Meeting

At the Meeting, the Company will ask stockholders to consider and vote upon the following proposals:

1. To approve an amendment to Article FOURTH of the Company’s Certificate of Incorporation to increase the number of authorized shares of Common Stock from 24,000,000 to 48,000,000;

2. To approve an amendment to Article FIRST of the Certificate of Incorporation to change the name of the Company from “ITUS Corporation” to “Anixa Biosciences, Inc.,” such name change to occur at such time and date as determined by the Board in its sole discretion;

3. To adopt the “ITUS Corporation 2018 Share Incentive Plan”; and

4. To transact such other business as may properly come before the Meeting or any adjournment thereof.

Recommendations of the Board

After careful consideration, the Board has unanimously determined to recommend that stockholders vote “FOR” each of the Amendment Proposal, Name Change Proposal and Incentive Plan Proposal.

Record Date and Voting Power

Our Board fixed the close of business on February 1, 2018, as the record date for the determination of the outstanding shares of Common Stock entitled to notice of, and to vote on, the matters presented at this Meeting. As of the Record Date, there were ______ shares of Common Stock outstanding. Each share of Common Stock entitles the holder thereof to one vote. Accordingly, a total of ______ votes may be cast at this Meeting.

Quorum and Required Vote

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present at the meeting if a majority of the Common Stock outstanding and entitled to vote at the Meeting is represented in person or by proxy. Abstentions and broker non-votes will count as present for purposes of establishing a quorum.

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote on this matter at the Meeting is required for approval of the Amendment Proposal. With respect to an abstention, the shares will be considered present and entitled to vote at the Meeting and they will have the same effect as a vote against the matter.

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote on this matter at the Meeting is required for approval of the Name Change Proposal. With respect to an abstention, the shares will be considered present and entitled to vote at the Meeting and they will have the same effect as a vote against the matter.

The affirmative vote of a majority of the votes cast at the Meeting by the holders of Common Stock entitled to vote is required to approve the Incentive Plan Proposal. With respect to an abstention, the shares will be considered present and entitled to vote at the Meeting, but they will have no effect on the vote of the Incentive Plan Proposal.

10

Voting

There are four ways to vote:

1. Via the Internet. Use the Internet to vote by going to the Internet address listed on your proxy card or Internet Availability Notice; have your proxy card or Internet Availability Notice in hand as you will be prompted to enter your control number and to create and submit an electronic vote. If you vote in this manner, your “proxy,” whose name is listed on the proxy card and Internet Availability Notice, will vote your shares as you instruct on the proxy card. If you sign and return the proxy card or submit an electronic vote but do not give instructions on how to vote your shares, your shares will be voted as recommended by the Board. If you are not a record holder, you may vote by proxy via the Internet by following the instructions provided by your brokerage firm, bank, broker-dealer or other similar organization that holds your shares.

2. Via Telephone. Using a touch-tone telephone, you may transmit your voting instructions to the number provided in the Internet Availability Notice.

3. In person. If you are a stockholder of record, you may vote in person at the Meeting. The Company will give you a ballot when you arrive. If you are a beneficial owner of shares of Common Stock held in street name and you wish to vote in person at the Meeting, you must obtain a legal proxy from the brokerage firm, bank, broker-dealer or other similar organization that holds your shares. Please contact that organization for instructions regarding obtaining a legal proxy.

4. By mail. You may vote by mail. If you request printed copies of the proxy materials by mail and are a record holder, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided. If you request printed copies of the proxy materials by mail and are a beneficial holder you may vote by proxy by filling out the vote instruction form and sending it back in the envelope provided by your brokerage firm, bank, broker-dealer or other similar organization that holds your shares.

While we know of no other matters to be acted upon at this Meeting, it is possible that other matters may be presented at the Meeting. If that happens and you have signed and not revoked a proxy card, your proxy will vote on such other matters in accordance with his best judgment.

A special note for those who plan to attend the Meeting and vote in person: if your shares are held in the name of a broker, bank or other nominee, you must bring a statement from your brokerage account or a letter from the person or entity in whose name the shares are registered indicating that you are the beneficial owner of those shares as of the record date. In addition, you will not be able to vote at the Meeting unless you obtain a legal proxy from the record holder of your shares.

Expenses

The expense of preparing, printing and mailing this Proxy Statement, exhibits and the proxies solicited hereby will be borne by the Company. In addition to the use of the mails, proxies may be solicited by officers, directors and regular employees of the Company, without additional remuneration, by personal interviews, telephone, email or facsimile transmission. The Company will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of Common Stock held of record and will provide reimbursements for the cost of forwarding the material in accordance with customary charges.

Revocability of Proxies

Proxies given by stockholders of record for use at the Meeting may be revoked at any time prior to the exercise of the powers conferred. In addition to revocation in any other manner permitted by law, stockholders of record giving a proxy may revoke the proxy by an instrument in writing, executed by the stockholder or his attorney authorized in writing or, if the stockholder is a corporation, under its corporate seal, by an officer or attorney thereof duly authorized, and deposited either at the corporate headquarters of the Company at any time up to and including the last business day preceding the day of the Meeting, or any adjournments thereof, at which the proxy is to be used, or with the chairman of such Meeting on the day of the Meeting or adjournments thereof, and upon either of such deposits the proxy is revoked.

No Right of Appraisal

None of Delaware law, our Certificate of Incorporation or our Bylaws, as amended, provides for appraisal or other similar rights for dissenting stockholders in connection with any of the proposals to be voted upon at this Meeting. Accordingly, our stockholders will have no right to dissent and obtain payment for their shares.

Who Can Answer Your Questions About Voting Your Shares

You can contact our corporate Secretary, Michael Catelani, at (408) 708-9808 or by sending a letter to Mr. Catelani at offices of the Company at 3150 Almaden Expressway, Suite 250, San Jose, CA 95118 with any questions about proposals described in this Proxy Statement or how to execute your vote.

Principal Offices

The principal executive offices of the Company are located at 3150 Almaden Expressway, Suite 250, San Jose, CA 95118. The Company’s telephone number at such address is (408) 708-9808.

11

ALL PROXIES RECEIVED WILL BE VOTED IN ACCORDANCE WITH THE CHOICES SPECIFIED ON SUCH PROXIES. PROXIES WILL BE VOTED IN FAVOR OF A PROPOSAL IF NO CONTRARY SPECIFICATION IS MADE. ALL VALID PROXIES OBTAINED WILL BE VOTED AT THE DISCRETION OF THE PERSONS NAMED IN THE PROXY WITH RESPECT TO ANY OTHER BUSINESS THAT MAY COME BEFORE THE MEETING. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE AMENDMENT PROPOSAL, NAME CHANGE PROPOSAL AND INCENTIVE PLAN PROPOSAL.

12

PROPOSAL 1

AMENDMENT PROPOSAL

Description of Proposal

On January 25, 2018, the Board acted by written consent to unanimously approve an amendment to the Certificate of Incorporation, subject to stockholder approval, to increase the number of shares of Common Stock authorized by 24,000,000 from 24,000,000 to 48,000,000. The Board directed the Amendment Proposal to be submitted to a vote of the Company’s stockholders at the Meeting.

The Company’s Certificate of Incorporation currently authorizes the issuance of up to 24,000,000 shares of Common Stock and 20,000 shares of preferred stock. The Amendment Proposal will not increase or otherwise affect the Company’s authorized preferred stock.

On the Record Date, the Company had an aggregate __________ shares of Common Stock issued and outstanding and no shares of preferred stock issued or outstanding. Also on the Record Date, the Company had _________ shares reserved for issuance upon exercise of outstanding options under the Company’s 2010 Share Incentive Plan, _________ shares reserved for issuance upon exercise of outstanding options under the Company’s 2003 Share Incentive Plan, ________ shares reserved for issuance upon exercise of outstanding options not granted under such plans and ________ shares reserved for issuance upon exercise of outstanding warrants.

Reasons for the Amendment Proposal

The Board believes it is in the best interest of the Company to increase the number of authorized shares of Common Stock in order to give the Company greater flexibility in considering and planning for future potential business needs.

The additional shares of Common Stock will be available for issuance by the Board for various corporate purposes, including but not limited to raising capital, providing equity incentives to employees, officers or directors, effecting stock dividends, establishing strategic relationships with other companies and expanding our business through the acquisition of other businesses or products. If the amendment is approved, the additional authorized shares would be available for issuance at the discretion of the Board and without further stockholder approval, except as may be required by law or the rules of the Company’s then-current listing market or exchange.

The additional shares of Common Stock to be authorized by adoption of the Amendment Proposal would have rights identical to the currently issued and outstanding shares of Common Stock of the Company. Adoption of the Amendment Proposal would not affect the rights of existing holders of Common Stock and would not have any immediate dilutive effect on the proportionate voting power or other rights of existing stockholders. Like existing holders, holders of shares of Common Stock issued following adoption of the proposed amendment would not be entitled to pre-emptive rights with respect to any future issuances of Common Stock or preferred stock. Any issuance of shares other than in connection with a stock split or combination would reduce the proportionate ownership interest in the Company that each holder had immediately prior to the issuance and, depending on the price at which such shares are issued, could have a negative effect on the market price of the Common Stock.

Anti-Takeover Considerations

The Company has not proposed the increase in the number of authorized shares of Common Stock with the intention of using the additional authorized shares for anti-takeover purposes, but the Company would be able to use the additional shares to oppose a hostile takeover attempt or delay or prevent changes in control or management of the Company. For example, without further stockholder approval, the Board could sell shares of Common Stock in a private transaction to purchasers who would oppose a takeover and/or favor the current Board. In addition, the Certificate of Incorporation authorizes the issuance of “blank check” preferred stock with the designations, rights and preferences as may be determined from time to time by the Board. Accordingly, the Board is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of our Common Stock. The issuance of preferred stock could discourage, delay or prevent a change in control of the Company and also may have the effect of discouraging a third party from making a tender offer or otherwise attempting to obtain control of the Company even though the transaction might be economically beneficial to the Company and its stockholders. Although this proposal to increase the authorized number of shares of Common Stock has been prompted by business and financial considerations and not by the threat of any known or threatened hostile takeover attempt, stockholders should be aware that approval of this proposal could facilitate future efforts by the Company to oppose changes in control of the Company and perpetuate the Company’s management, including transactions in which the stockholders might otherwise receive a premium for their shares over then-current market prices.

Effecting the Amendment Proposal

If the Amendment Proposal is approved by the stockholders, shortly after the Meeting we will file an amendment to the Certificate of Incorporation with the Secretary of State of Delaware, such amendment to become effective upon filing. The amendment proposed by the Company to Article FOURTH of the Certificate of Incorporation is attached to this Proxy Statement as Annex A. Neither Delaware law, nor the Certificate of Incorporation, nor the Company’s Bylaws, as amended, provides for appraisal or other similar rights for dissenting stockholders in connection with this proposal. Accordingly, the Company’s stockholders will have no right to dissent and obtain payment for their shares.

13

Required Vote

Approval of the Amendment Proposal requires the affirmative vote of a majority of the issued and outstanding shares of Common Stock voting as one class. Abstentions are considered present for purposes of establishing a quorum but will count as a vote against the Amendment Proposal.

Recommendation of the Board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE Amendment PROPOSAL.

14

NAME CHANGE PROPOSAL

Introduction

On January 25, 2018, the Board acted by written consent to unanimously adopt the amendment to Article FIRST of our Certificate of Incorporation to change the Company’s name from “ITUS Corporation” to “Anixa Biosciences, Inc.,” such name change to occur at such time and date, if at all, as determined by the Board in its sole discretion. The Board is now asking you to approve this Name Change Amendment.

Effecting the Name Change Amendment requires that Article FIRST of our Certificate of Incorporation be amended. The amended text replacing the current Article FIRST is attached as Annex B to this Proxy Statement. If approved, the Name Change Amendment will be effective upon the filing of such amendment to the Certificate of Incorporation in the form attached as Annex B with the Secretary of State of Delaware with such filing to occur, if at all, at the sole discretion of the Board.

Stockholders will not be required to exchange outstanding stock certificates for new stock certificates if the Name Change Amendment is adopted and the Board, in its sole discretion, determines to effect the name change. When the Board effectuates the name change, the Company expects to change its trading symbol from “ITUS” to “ANIX,” it being understood that such symbol may not be available at the time of the name change and it further being understood that the Board, in its sole discretion, may choose a new symbol, whether or not “ANIX” is available, at the time of the name change.

Reason for the Name Change Proposal

Now that we have fully transitioned our business from the development, acquisition, licensing, and enforcement of patented technologies into a biotechnology company, our Board believes that the Company should better align its corporate name with our current business and mission. The Board believes that “Anixa Biosciences, Inc.” better reflects our current business and mission.

Text of Proposed Amendment; Effectiveness

The proposed Amendment will change Article FIRST of the Certificate of Incorporation to replace the current name of the Company, “ITUS Corporation,” with “Anixa Biosciences, Inc.” The Name Change Amendment will become effective upon its filing with the Secretary of State of Delaware.

Required Vote

Approval of the Name Change Proposal requires the affirmative vote of a majority of the issued and outstanding shares of Common Stock voting as one class. Abstentions are considered present for purposes of establishing a quorum but will count as a vote against the Name Change Proposal.

Recommendation of the Board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NAME CHANGE PROPOSAL.

15

PROPOSAL 3

INCENTIVE PLAN PROPOSAL

Introduction

We are asking our stockholders to approve the “ITUS Corporation 2018 Share Incentive Plan,” pursuant to which 5,000,000 shares of our Common Stock subject to replenishment will be reserved for issuance under the Plan in the form of (a) Stock Options, (b) Stock Appreciation Rights, (c) Stock Awards, (d) Performance Awards and (e) Stock Units (“Awards”). We will not grant or issue any Awards under the Plan unless at the time of such grant or issuance we have a sufficient number of authorized shares of Common Stock available to make such grant or issuance. On January 25, 2018, our Board adopted the Plan to attract and retain the best available personnel, to provide additional incentive to officers, employees, non-employee directors and consultants to the Company or any of its subsidiaries or affiliates and to promote the success of the Company’s business.

The following summary describes the material features of the Plan. The summary, however, does not purport to be a complete description of all the provisions of the Plan. Capitalized terms used but not defined in this proposal shall have the same meaning ascribed to them in the Plan, a copy of which is attached hereto as Annex C. The following description is qualified in its entirety by reference to the Plan.

Description of the Plan

Administration. The Plan will be initially administered by our compensation committee (the "Committee"). The Committee will have the authority to determine the terms and conditions of any agreements evidencing any Awards granted under the Plan and to adopt, alter and repeal rules, guidelines and practices relating to the Plan. Our Committee will have full discretion to administer and interpret the Plan and to adopt such rules, regulations and procedures as it deems necessary or advisable and to determine, among other things, the time or times at which the awards may be exercised and whether and under what circumstances an award may be exercised.

Eligibility. Officers, employees, non-employee directors and consultants to the Company or any of its subsidiaries or affiliates are eligible to participate in the Plan. As of the date of this proxy, the Company has two officers, one of which is also a director, four non-officer directors, six employees and five consultants. Our Committee has the sole and complete authority to determine who will be granted an award under the Plan.

A Number of Shares Authorized. The maximum aggregate number of shares of Common Stock that may be subject to Awards, including Stock Options, granted under the Plan is 5,000,000 shares, subject to certain adjustments. Additionally, commencing on the first business day in January 2019 and on the first business day of each calendar year thereafter while the Plan is in effect, the maximum aggregate number of shares of Common Stock available for issuance under this Plan will be increased such that, as of such first business day, the maximum aggregate number of shares of Common Stock available for issuance under the Plan will be no less than 2,000,000 shares. Any shares of Common Stock subject to a Stock Option or Stock Appreciation Right which for any reason is cancelled or terminated without having been exercised, any shares subject to Stock Awards, Performance Awards or Stock Units which are forfeited, any shares subject to Performance Awards settled in cash, any shares delivered to the Company as part or full payment for the exercise of a Stock Option or Stock Appreciation Right or any shares delivered to the Company in satisfaction of any tax withholding arising in connection with any Benefit consisting of shares of Common Stock, as the case may be, shall again be available for Awards under the Plan.

Duration. The Plan will have a term of ten years and no further awards may be granted under the Plan after that date.

Awards Available for Grant. Our Committee may grant awards of Non-Qualified Stock Options, Incentive (qualified) Stock Options, Stock Appreciation Rights, Stock Awards, Performance Awards and Stock Units or any combination of the foregoing.

Transferability. Each Award may be exercised during the participant’s lifetime only by the participant or, if permissible under applicable law, by the participant’s guardian or legal representative and may not be otherwise transferred or encumbered by a participant other than by will or by the laws of descent and distribution. Our Committee, however, may permit awards (other than incentive stock options) to be transferred to family members, a trust for the benefit of such family members, a partnership or limited liability company whose partners or stockholders are the participant and his or her family members or anyone else approved by it.

Amendment. Our Board may amend, suspend or terminate the Plan at any time; however, shareholder approval to amend the Plan may be necessary if the law or exchange that the company is then trading on so requires. No amendment, suspension or termination will impair the rights of any participant or recipient of any award without the consent of the participant or recipient.

Change in Control. Except to the extent otherwise provided in an Award agreement, in the event of a Change in Control as defined in the plan, all outstanding Stock Options and Stock Appreciation Rights issued under the Plan will become fully vested.

U.S. Federal Income Tax Consequences

The following is a general summary of the material U.S. federal income tax consequences of the grant and exercise and vesting of awards under the Plan and the disposition of shares acquired pursuant to the exercise of such awards and is intended to reflect the current provisions of the Code and the regulations thereunder. This summary is not intended to be a complete statement of applicable law, nor does it address foreign, state, local and payroll tax considerations. Moreover, the U.S. federal income tax consequences to any particular participant may differ from those described herein by reason of, among other things, the particular circumstances of such participant.

16

Options. There are a number of requirements that must be met for a particular option to be treated as a qualified option. One such requirement is that shares of common stock acquired through the exercise of a qualified option cannot be disposed of before the later of (i) two years from the date of grant of the option, or (ii) one year from the date of exercise. Holders of qualified options will generally incur no federal income tax liability at the time of grant or upon exercise of those options. However, the spread at exercise will be an “item of tax preference,” which may give rise to “alternative minimum tax” liability for the taxable year in which the exercise occurs. If the holder does not dispose of the shares before the later of two years following the date of grant and one year following the date of exercise, the difference between the exercise price and the amount realized upon disposition of the shares will constitute long-term capital gain or loss, as the case may be. Assuming both holding periods are satisfied, no deduction will be allowed to the company for federal income tax purposes in connection with the grant or exercise of the qualified option. If, within two years following the date of grant or within one year following the date of exercise, the holder of shares acquired through the exercise of a qualified option disposes of those shares, the participant will generally realize taxable compensation at the time of such disposition equal to the difference between the exercise price and the lesser of the fair market value of the share on the date of exercise or the amount realized on the subsequent disposition of the shares, and that amount will generally be deductible by the company for federal income tax purposes, subject to the possible limitations on deductibility under Sections 280G and 162(m) of the Code for compensation paid to executives designated in those Sections. Finally, if an otherwise qualified option becomes first exercisable in any one year for shares having an aggregate value in excess of $100,000 (based on the grant date value), the portion of the qualified option in respect of those excess shares will be treated as a non-qualified stock option for federal income tax purposes.

No income will be realized by a participant upon grant of a non-qualified stock option. Upon the exercise of a non-qualified stock option, the participant will recognize ordinary compensation income in an amount equal to the excess, if any, of the fair market value of the underlying exercised shares over the option exercise price paid at the time of exercise. The company will be able to deduct this same amount for U.S. federal income tax purposes, but such deduction may be limited under Sections 280G and 162(m) of the Code for compensation paid to certain executives designated in those Sections.

Restricted Stock. A participant will not be subject to tax upon the grant of an award of restricted stock unless the participant otherwise elects to be taxed at the time of grant pursuant to Section 83(b) of the Code. On the date an award of restricted stock becomes transferable or is no longer subject to a substantial risk of forfeiture, the participant will recognize taxable compensation equal to the difference between the fair market value of the shares on that date over the amount the participant paid for such shares, if any, unless the participant made an election under Section 83(b) of the Code to be taxed at the time of grant. If the participant made an election under Section 83(b), the participant will recognize taxable compensation at the time of grant equal to the difference between the fair market value of the shares on the date of grant over the amount the participant paid for such shares, if any. (Special rules apply to the receipt and disposition of restricted shares received by officers and directors who are subject to Section 16(b) of the Securities Exchange Act of 1934 (the “Exchange Act”)). The company will be able to deduct, at the same time as it is recognized by the participant, the amount of taxable compensation to the participant for U.S. federal income tax purposes, but such deduction may be limited under Sections 280G and 162(m) of the Code for compensation paid to certain executives designated in those Sections.

Restricted Stock Units. A participant will not be subject to tax upon the grant of a restricted stock unit award. Rather, upon the delivery of shares or cash pursuant to a restricted stock unit award, the participant will have taxable compensation equal to the fair market value of the number of shares (or the amount of cash) the participant actually receives with respect to the award. The company will be able to deduct the amount of taxable compensation to the participant for U.S. federal income tax purposes, but the deduction may be limited under Sections 280G and 162(m) of the Code for compensation paid to certain executives designated in those Sections.

SARs. No income will be realized by a participant upon grant of an SAR. Upon the exercise of an SAR, the participant will recognize ordinary compensation income in an amount equal to the fair market value of the payment received in respect of the SAR. The company will be able to deduct this same amount for U.S. federal income tax purposes, but such deduction may be limited under Sections 280G and 162(m) of the Code for compensation paid to certain executives designated in those Sections.

Stock Bonus Awards. A participant will have taxable compensation equal to the difference between the fair market value of the shares on the date the shares of common stock subject to the award are transferred to the participant over the amount the participant paid for such shares, if any. The company will be able to deduct, at the same time as it is recognized by the participant, the amount of taxable compensation to the participant for U.S. federal income tax purposes, but such deduction may be limited under Sections 280G and 162(m) of the Code for compensation paid to certain executives designated in those Sections.

Section 162(m). In general, Section 162(m) of the Code denies a publicly held corporation a deduction for U.S. federal income tax purposes for compensation in excess of $1,000,000 per year per person to its principal executive officer, principal financial officer and the three other officers (other than the principal executive officer and principal financial officer) whose compensation is disclosed in its proxy statement as a result of their total compensation, subject to certain exceptions.

17

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF U.S. FEDERAL INCOME TAXATION INTENDED FOR THE INFORMATION OF THE COMPANY'S STOCKHOLDERS AND NOT AS TAX GUIDANCE TO RECIPIENTS OF AWARDS. THE FOREGOING DOES NOT PURPORT TO BE A COMPLETE STATEMENT OF THE LAW IN THIS AREA. DIFFERENT TAX RULES MAY APPLY TO SPECIFIC RECIPIENTS AND TRANSACTIONS UNDER THE PLAN AND UNDER THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH ANY ELIGIBLE INDIVIDUAL MAY RESIDE.

New Plan Benefits

Future grants under the Plan will be made at the discretion of the Committee and, accordingly, are not yet determinable. In addition, the value of the Awards granted under the Plan will depend on a number of factors, including the fair market value of our shares of common stock on future dates, the exercise decisions made by the participants and/or the extent to which any applicable performance goals necessary for vesting or payment are achieved. Consequently, it is not possible to determine the benefits that might be received by participants receiving discretionary grants under, or having their annual bonus paid pursuant to, the Plan.

Required Vote

Approval of the Plan will require the affirmative vote of the holders of a majority of the shares of the Company’s common stock represented in person or by proxy and entitled to vote at the Meeting. Assuming the presence of a quorum of more than 50% of the shares of our common stock, the failure to vote will have no effect on the outcome of the vote.

Interests of Directors or Officers

Our directors may grant awards under the Incentive Plan to themselves as well as our officers, in addition to granting awards to our other employees.

Recommendation of the Board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE INCENTIVE PLAN PROPOSAL.

18

Proxy Solicitation

All costs of solicitation of proxies will be borne by the Company. In addition to solicitation by mail, the Company’s officers and regular employees may solicit proxies personally or by telephone. The Company does not intend to utilize a paid solicitation agent.

Proxies

A stockholder may revoke his, her or its proxy at any time prior to its use by giving written notice to the Secretary of the Company, by executing a revised proxy at a later date or by attending the Meeting and voting in person. Proxies in the form enclosed, unless previously revoked, will be voted at the Meeting in accordance with the specifications made thereon or, in the absence of such specifications in accordance with the recommendations of the Board.

Securities Outstanding

As of the close of business on the Record Date there were ________ shares of Common Stock outstanding. Stockholders are entitled to one vote for each share of Common Stock owned.

Other Business

Our Board knows of no other matter to be presented at the Meeting. If any additional matter should properly come before the Meeting, it is the intention of the persons named in the enclosed proxy to vote such proxy in accordance with their judgment on any such matters.

Deadline for Submission of Stockholder Proposals for 2018 Annual Meeting of Stockholders

For any proposal to be considered for inclusion in our proxy statement and form of proxy for submission to the stockholders at our 2018 Annual Meeting of Stockholders, it must be submitted in writing and comply with the requirements of Rule 14a-8 of the Securities Exchange Act. Such proposals must be received by the Company at its offices at 3150 Almaden Expressway, Suite 250, San Jose, CA 95118 no later than April 10, 2018.

Stockholders may present proposals intended for inclusion in our proxy statement for our 2018 Annual Meeting of Stockholders provided that such proposals are received by the Secretary of the Company in accordance with the time schedules set forth in, and otherwise in compliance with, applicable SEC regulations, and the Company’s Bylaws, as amended, as applicable. Proposals submitted not in accordance with such regulations will be deemed untimely or otherwise deficient; however, the Company will have discretionary authority to include such proposals in the 2018 Proxy Statement.

Stockholder Communications

Stockholders wishing to communicate with the Board may direct such communications to the Board c/o the Company, Attn: Dr. Amit Kumar. Dr. Kumar will present a summary of all stockholder communications to the Board at subsequent Board meetings. The directors will have the opportunity to review the actual communications at their discretion.

Additional Information

We are subject to certain informational requirements of the Exchange Act and in accordance therewith file reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information are available on the SEC’s website at www.sec.gov. Stockholders who have questions in regard to any aspect of the matters discussed in this Proxy Statement should contact Michael Catelani, Secretary of the Company, at 3150 Almaden Expressway, Suite 250, San Jose, CA 95118.

19

BENEFICIAL OWNERSHIP OF PRINCIPAL STOCKHOLDERS, OFFICERS AND DIRECTORS

The following table sets forth certain information with respect to our common stock beneficially owned as of the Record Date by (a) each person who is known by our management to be the beneficial owner of more than 5% of our outstanding common stock, (b) each of our directors and executive officers, and (c) all directors and executive officers as a group:

| Amount and Nature of (1)(2)(3)(4) | Percent of Class (5) | |

| Directors and Officers of the Company | ||

| Dr. Amit Kumar | _______ | ___% |

| 3150 Almaden Expressway, Suite 250 |

|

|

| San Jose, CA 95118 |

|

|

| Bruce Johnson | _______ | ___% |

| 3150 Almaden Expressway, Suite 250 |

|

|

| San Jose, CA 95118 |

|

|

| Dr. John Monahan | _______ | ___% |

| 3150 Almaden Expressway, Suite 250 |

|

|

| San Jose, CA 95118 |

|

|

| Lewis H. Titterton | _______ | ___% |

| 3150 Almaden Expressway, Suite 250 |

|

|

| San Jose, CA 95118 |

|

|

| Richard H. Williams | _______ | ___% |

| 3150 Almaden Expressway, Suite 250 |

|

|

| San Jose, CA 95118 |

|

|

| Michael J. Catelani | _______ | ___% |

| 3150 Almaden Expressway, Suite 250 |

|

|

| San Jose, CA 95118 |

|

|

| All Directors and Executive Officers as a | _______ | ___% |

| 5% Stockholders of the Company | ||

| Bruce P. Eames | _______ | ___% |

| 3 Greenway Plaza, Ste. 200 |

|

|

| Houston, TX 77046 |

|

|

| * Less than 1%. |

|

|

(2) Includes _____ shares, _____ shares, _____ shares, _____ shares, _____ shares, _____ shares and _____ shares which Dr. Amit Kumar, Bruce Johnson, Dr. John Monahan, Lewis H. Titterton, Richard H. Williams, Michael J. Catelani and all directors and executive officers as a group, respectively, have the right to acquire within 60 days upon exercise of options granted pursuant to the 2010 Share Incentive Plan .

(3) Includes _____ shares, _____ shares and _____ shares that Dr. Amit Kumar, Lewis H. Titterton and all directors and executive officers as a group, respectively, have the right to acquire within 60 days upon exercise of warrants purchased by them in the private placement on July 15, 2014.

(4) Includes _____ shares, _____ shares, _____ shares and _____ shares which Dr. Amit Kumar, Bruce Johnson, Lewis H. Titterton and all directors and executive officers as a group, respectively, have the right to acquire within 60 days pursuant to option agreements with the Company.

(5) Based on _____ shares of common stock outstanding as of the Record Date.

20

EXECUTIVE COMPENSATION

| SUMMARY COMPENSATION TABLE | ||||||

|

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) | Option Awards ($) (2) | All Other Compensation ($) (3) | Total Compensation ($) |

| Dr. Amit Kumar (1) Chairman of the Board, President and Chief Executive Officer | 2017 2016

| $ 300,000 $ 300,000 | $ - $ 200,000 | $ 141,938 $ 566,896 | $ 12,000 $ 12,000 | $ 453,938 $ 1,078,896 |

| Robert A. Berman (4) Chief Executive Officer and Director | 2017 2016 | $ 228,077 $ 300,000 | $ - $ 200,000 | $ - $ 566,896 | $ 300,000 $ - | $ 528,077 $ 1,066,896 |

| Michael J. Catelani (5) Chief Operating Officer and Chief Financial Officer | 2017 | $ 174,561 | $ - | $ 385,859 | $ - | $ 560,420 |

(1) Dr. Kumar has served as the Company’s Executive Chairman of the Board since August 2016. On July 6, 2017 Dr. Kumar was appointed President and Chief Executive Officer of the Company.

(2) Amounts in the Option Awards column represent the aggregate grant date fair value of stock option awards made during the fiscal years ended October 31, 2017 and 2016 for each Named Executive Officer in accordance with Accounting Standards Codification (“ASC”) 718 and also reflects the repricing of outstanding options for Dr. Kumar and Mr. Catelani on September 6, 2017. For more information pertaining the valuation of option awards and the repricing of our options, please refer to our Annual Report on Form 10-K for the year ended October 31, 2017.

(3) Amounts in the All Other Compensation column reflect, for each Named Executive Officer, the sum of the incremental cost to us of all perquisites and personal benefits, which for Dr. Kumar consisted solely of compensation for use of a home office, and for Mr. Berman consisted solely of severance obligations related to his resignation on July 6, 2017.

(4) Mr. Berman resigned his position as Chief Executive Officer and director on July 6, 2017.

(5) Mr. Catelani has served as the Company’s Chief Financial Officer since November 1, 2016. On July 6, 2017, Mr. Catelani was appointed Chief Operating Officer of the Company.

Consulting Agreement with Dr. Amit Kumar

On September 19, 2012, the Company entered into a Consulting Agreement with Dr. Amit Kumar (the “Kumar Agreement”) pursuant to which Dr. Kumar agreed to provide business consulting services for an initial annual consulting fee of $120,000. On June 15, 2015, Dr. Kumar was appointed Vice Chairman of the Company and Executive Chairman of Anixa Diagnostics Corporation, a wholly-owned subsidiary of the Company. As a result of this appointment, Dr. Kumar’s cash compensation was increased to $300,000 by the Board. On August 23, 2016, Dr. Kumar was appointed Executive Chairman of the Company, and on July 6, 2017 Dr. Kumar was appointed President and Chief Executive Officer of the Company. The terms of the Kumar Agreement still remain in effect.

If Dr. Kumar’s services are terminated by the Company or he terminates his services for any reason or no reason, the Company shall be obligated to pay to Dr. Kumar only any earned compensation and/or bonus due under the Kumar Agreement and any unpaid reasonable and necessary expenses, due to him through the date of termination. All such payments shall be made in a lump sum immediately following termination.

Employment Agreement with Robert Berman

On September 19, 2012, the Company entered into an Employment Agreement with Mr. Berman (the “Berman Agreement”) to serve as President and Chief Executive Officer of the Company. Pursuant to the Berman Agreement, Mr. Berman initially received an annual base salary of $290,000, which was increased to $300,000 by the Board effective November 1, 2013.

21

On July 6, 2017, Mr. Berman resigned as President and Chief Executive Officer and as a director. Pursuant to the terms of a separation agreement entered into on August 16, 2017 between Mr. Berman and the Company, Mr. Berman is entitled to receive severance payments in an aggregate amount of $300,000 to be paid in four separate tranches with the final payment occurring on June 1, 2018.

Stock Options

The following table sets forth certain information with respect to unexercised stock options held by the Named Executive Officers outstanding on October 31, 2017:

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END TABLE | ||||

| Option Awards | ||||

| Name | Number of Securities Underlying Unexercised Options (#) | Number of Securities Underlying Unexercised Options (#) | Option Exercise Price | Option Expiration Date |

| Dr. Amit Kumar | 320,000 106,667 213,333 40,000(1) 111,111(2) |

88,889(2) | $0.67 $0.67 $0.67 $0.67 $0.67 | 9/19/2022 9/19/2022 9/19/2022 11/8/2023 2/18/2026 |

| Robert A. Berman | 320,000 106,667 213,333 40,000(1) 200,000(3) |

| $2.575 $2.575 $2.575 $2.575 $2.920 | 7/6/2022 7/6/2022 7/6/2022 7/6/2022 7/6/2022 |

| Michael J. Catelani |

| 50,000(4) 200,000(5)

| $0.67 $0.67 | 11/15/2026 7/6/2027 |

(1) Options vested and became exercisable in 36 consecutive monthly installments, beginning December 31, 2013 and continuing through November 30, 2016.

(2) Options vest and become exercisable in 36 consecutive monthly installments, beginning March 31, 2016 and continuing through February 28, 2019.

(3) Options were to vest and become exercisable in 36 consecutive monthly installments, beginning March 31, 2016 and continuing through February 28, 2019. However, pursuant to a separation agreement between the Company and Mr. Berman, the options vested and became exercisable upon Mr. Berman’s resignation on July 6, 2017.

(4) Options vest and become exercisable in one installment of 16,666 on November 1, 2017 and the remainder in eight consecutive quarterly installments, beginning January 31, 2018 and continuing through October 31, 2019.

(5) Options vest and become exercisable in one installment of 50,000 on July 6, 2018 and the remainder in twelve consecutive quarterly installments, beginning October 31, 2018 and continuing through July 31, 2021.

The following table summarizes stock option grants during fiscal year 2017.

| GRANTS OF PLAN BASED AWARDS TABLE | ||||

| Name | Grant Date | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise Price of Option Awards ($) | Grant Date Fair Value (1) ($) |

| Michael J. Catelani | 11/15/16 | 50,000 | $0.67 | $237,125 |

|

| 7/6/17 | 200,000 | $0.67 | $187,571 |

(1) Grant date fair value reflects the repricing of options on September 6, 2017

No stock options were exercised by Named Officers during fiscal 2017.

22

Option Re-Pricing

On September 6, 2017, the compensation committee of the Company re-priced certain issued and outstanding stock options to purchase in the aggregate 2,029,600 shares of Common Stock for all of the current officers, directors and employees of the Company (the “Re-Priced Options”) pursuant to the authority granted to the compensation committee by the Board. The new exercise price of the Re-Priced Options is $0.67, the closing sales price of the Company’s common stock on September 6, 2017.

All other terms of the previously granted Re-Priced Options remain the same, including without limitation, the number of shares underlying the options granted, the vesting periods of the options, and the expiration dates of the options.

The Company recorded additional stock-based compensation expense resulting from the incremental value of the fair value of the Re-Priced Options compared to the fair value of the original options immediately prior to the re-pricing of approximately $261,000 in fiscal year ended October 31, 2017.

The following stock option grants and related stock option agreements issued to the Company’s Named Executive Officers and directors were affected by the re-pricing:

|

Name |

# of Shares | Old Option | New Option Price | Expiration |

| Dr. Amit Kumar | 320,000 106,667 213,333 40,000 200,000 | $2.575 $2.575 $2.575 $2.575 $2.92 | $0.67 $0.67 $0.67 $0.67 $0.67 | 9/19/22 9/19/22 9/19/22 11/8/23 2/18/26 |

| Dr. John Monahan | 6,000 12,000 | $3.13 $5.30 | $0.67 $0.67 | 8/23/26 1/3/27 |

| Lewis H. Titterton, Jr. | 2,400 30,000 16,000 40,000 120,000 16,000 16,000 16,000 6,000 | $2.575 $2.575 $2.575 $2.575 $2.575 $2.575 $2.575 $2.92 $0.82 | $0.67 $0.67 $0.67 $0.67 $0.67 $0.67 $0.67 $0.67 $0.67 | 11/30/17 9/19/22 12/31/22 2/15/23 11/8/23 12/31/23 1/2/25 1/14/26 7/17/27 |

| Dr. Arnold Baskies | 6,000 12,000 | $3.13 $5.30 | $0.67 $0.67 | 8/23/26 1/3/27 |

| Dale Fox | 6,000 12,000 12,000 12,000 | $2.575 $2.575 $2.92 $5.30 | $0.67 $0.67 $0.67 $0.67 | 8/8/24 1/2/25 1/14/26 1/3/27 |

| Michael J. Catelani | 50,000 200,000 | $4.85 $0.96 | $0.67 $0.67 | 11/15/26 7/6/27 |

Potential Payments upon Termination or Change in Control

Dr. Amit Kumar

Options granted Dr. Kumar on February 18, 2016 provide for the vesting of the unvested portion of his options to be accelerated and such accelerated options to become immediately exercisable if Dr. Kumar is terminated without cause or upon a change in control as defined below. The intrinsic value of options granted on February 18, 2016 would be $122,667, which was calculated by multiplying (a) 88,889 options (being the number of options granted to him on February 18, 2016 that would be accelerated) by (b) an amount equal to the excess of (x) our closing share price on October 31, 2017 of $2.05 and (y) the options’ exercise price of $0.67 per share.

Michael J. Catelani

Options granted Mr. Catelani on July 6, 2017 provide for the vesting of the unvested portion of his options to be accelerated and such accelerated options to become immediately exercisable if Mr. Catelani is terminated without cause or upon a change in control as defined below. The intrinsic value of options granted on July 6, 2017 would be $276,000, which was calculated by multiplying (a) 200,000 options (being the number of options granted to him on July 6, 2017 that would be accelerated) by (b) an amount equal to the excess of (x) our closing share price on October 31, 2017 of $2.05 and (y) the options’ exercise price of $0.67 per share.

23

Under the 2010 Share Incentive Plan, “change in control” means:

· Change in Ownership: A change in ownership of the Company occurs on the date that any one person, or more than one person acting as a group, acquires ownership of stock of the Company that, together with stock held by such person or group, constitutes more than 50% of the total fair market value or total voting power of the stock of the Company, excluding the acquisition of additional stock by a person or more than one person acting as a group who is considered to own more than 50% of the total fair market value or total voting power of the stock of the Company.

· Change in Effective Control: A change in effective control of the Company occurs on the date that either: Any one person, or more than one person acting as a group, acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such person or persons) ownership of stock of the Company possessing 30% or more of the total voting power of the stock of the Company; or

· a majority of the members of the Board is replaced during any 12-month period by directors whose appointment or election is not endorsed by a majority of the members of the Board before the date of the appointment or election; provided, that this paragraph will apply only to the Company if no other corporation is a majority shareholder.

· Change in Ownership of Substantial Assets: A change in the ownership of a substantial portion of the Company’s assets occurs on the date that any one person, or more than one person acting as a group, acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such person or persons) assets from the Company that have a total gross fair market value equal to or more than 40% of the total gross fair market value of the assets of the Company immediately before such acquisition or acquisitions. For this purpose, “gross fair market value” means the value of the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets.

It is the intent that this definition be construed consistent with the definition of “Change of Control” as defined under Code Section 409A and the applicable treasury regulations, as amended from time to time.

There is no present arrangement for cash compensation of directors for services in that capacity. Consistent with the non-employee director compensation approved on March 28, 2013 for calendar year 2013, on November 8, 2013, the Board approved an amendment to the 2010 Share Incentive Plan to provide that on January 1st of each year commencing on January 1, 2014, each non-employee director (a “Director Participant”) of the Company at that time shall automatically be granted a 10 year nonqualified stock option to purchase 12,000 shares of common stock (or 16,000 in the case of the Chairman of the Board to the extent he qualifies as a Director Participant), with an exercise price equal to the closing price on the date of grant, that will vest in four equal quarterly installments in the year of grant. In addition, each person who is a Director Participant and joins the Board after January 1 of any year, shall be granted on the date such person joins the Board, a nonqualified stock option to purchase 12,000 shares of common stock (or 16,000 in the case of the Chairman of the Board) pro-rated based upon the number of calendar quarters remaining in the calendar year in which such person joins the Board (rounded up for partial quarters). In addition to the foregoing, Dr. Monahan and Mr. Titterton, and in lieu of the foregoing, Messrs. Johnson and Williams, were each granted a nonqualified stock option to purchase 50,000 shares of common stock on September 22, 2017. Further, on September 22, 2017, Mr. Williams was granted an additional nonqualified stock option to purchase 50,000 shares of common stock.

Our employee directors, Dr. Amit Kumar and Robert A. Berman, did not receive any additional compensation for services provided as a director during fiscal year 2017. The following table sets forth compensation of Bruce F. Johnson, Dr. John Monahan, Lewis H. Titterton, Jr., and Richard H. Williams, our non-employee directors, and Dr. Arnold Baskies and Dale Fox, our former non-employee directors, for fiscal year 2017:

| DIRECTORS’ COMPENSATION | |||

|

Name | Option Awards ($) (1) | All Other Compensation ($) (2) | Total Compensation ($) |

| Bruce F. Johnson (3) | $ 94,722 | $ 113,500 | $ 208,222 |

| Dr. John Monahan | $ 150,195 | $ 113,500 | $ 263,695 |

| Lewis H. Titterton, Jr. | $ 137,255 | $ 113,500 | $ 250,755 |

| Richard H. Williams (3) | $ 189,444 | $ 113,500 | $ 302,944 |