Exhibit 4.14

408.708.9808

NASDAQ: ITUS

[Grant Date]

[Employee]

c/o ITUS Corporation

3150 Almaden Expressway, Suite 250

San Jose, CA 95118

RE: Grant of Stock Option to Employee

Dear [Employee]:

On January 25, 2018, the Board of Directors of ITUS Corporation (the "Company") adopted the ITUS Corporation 2018 Share Incentive Plan (as the same was approved by the stockholders of the Company on March 29, 2018) (as may be amended from time to time pursuant to the terms thereof, the "Plan"). The Plan provides for the grant of certain rights, options and other awards to officers, employees and non-employee directors of the Company and consultants of the Company and its subsidiaries. A copy of the Plan is annexed hereto and shall be deemed a part hereof as if fully set forth herein. Unless the context otherwise requires, all terms defined in the Plan shall have the same meaning when used herein.

1. The Company hereby grants to you, as a matter of separate inducement and not in lieu of any salary or other compensation for your services, the right and option to purchase, in accordance with the terms and conditions set forth in the Plan, but subject to the limitations set forth herein and in the Plan, the number of shares of Common Stock of the Company listed below (the “Option Shares”), at the exercise price per share listed below, such option price being, in the judgment of the Committee, not less than one hundred percent (100%) of the fair market value of such share at the date hereof (the “Option”).

Type of Grant: ______ Incentive Stock Option

______ Non-Qualified Stock Option

Date of Grant:

Commencement Date for Vesting:

Total Number of Shares Granted:

Exercise Price per Share:

1

The Option will be designated as either an Incentive Stock Option (“ISO”) or a Non-Qualified Stock Option (“NSO”).

If designated in this letter as an ISO, this Option is intended to qualify as an ISO under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”). However, if this Option is intended to be an Incentive Stock Option, to the extent that it exceeds the $100,000 rule of Code Section 422(d) it will be treated as an NSO. Further, if for any reason this Option (or portion thereof) will not qualify as an ISO, then, to the extent of such non-qualification, such Option (or portion thereof) shall be regarded as a NSO granted under the Plan. In no event will the Company, the Board of Directors, the Committee or any of their respective employees or directors have any liability to you (or any other person) due to the failure of the Option to qualify for any reason as an ISO. If designated in this letter as an ISO, this Option shall be subject to all of the terms and conditions for incentive stock options set forth in the Code and the Plan, including, without limitation, Section 6 of the Plan.

You may exercise this Option (i), in cash (ii) by the delivery of shares of Common Stock then owned by you in an amount equal to the exercise price per share, (iii) by delivery to the Company of (x) irrevocable instructions to deliver directly to a broker the stock certificates representing the Option Shares for which this Option is being exercised, and (y) irrevocable instructions to such broker to sell such Option Shares for which the Option is being exercised, and promptly deliver to the Company the portion of the proceeds equal to the exercise price per share and any amount necessary to satisfy the Company’s obligation for withholding taxes, or any combination thereof. For purposes of making payment in shares of Common Stock, such shares shall be valued at their Fair Market Value on the date of exercise of the Option and shall have been held by you for at least six months.

IF THE BOX INDICATING “YES” BELOW IS CHECKED, THIS OPTION MAY ALSO BE EXERCISED VIA THE FOLLOWING CASHLESS EXERCISE PROVISIONS:

[ ] YES [ ] NO

If the box “YES” above is checked, you may also elect to exercise this Option, or a portion hereof, and to pay for the Option Shares by way of a cashless exercise in which event the Company shall issue to you the number of incremental Option Shares to which you are entitled upon exercise of the Option computed according to the following equation:

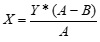

; where

2

X = the number of Option Shares to be issued to you.

Y = the Option Shares purchasable under this Option or, if only a portion of this Option is being exercised, the portion of the Option Shares being exercised.

A = the Fair Market Value (as defined in the Plan) of one share of Common Stock on the exercise date.

B = the Exercise Price.

Notwithstanding the foregoing, it is specifically understood by you that no warranty is made to you with respect to the value of such shares.

2. Subject to the provisions and limitations hereof, the Option shall vest and may be exercised by you as follows:

(a) First Installment: ____ Option Shares vesting on the [date hereof] [first anniversary of the date of grant];

(b) Second Installment if any: ____ Option Shares vesting on the [second] anniversary of the Date of Grant; [and]

(c) Third Installment if any: ____ Option Shares vesting on the [third] anniversary of the Date of Grant.

3. In no event shall you exercise the Option for a fraction of a share or for less than one hundred (100) shares (unless the number purchased is the total balance for which the Option is then exercisable).

4. The unexercised portion of the Option granted herein will automatically and without notice terminate and become null and void upon the expiration of [ten] ([10]) years from the date of the grant of the Option. In the event your service as an employee of the Company is terminated prior to the expiration of ten (10) years from the date hereof, the Option shall, to the extent not theretofore exercised, terminate and become null and void, except to the extent described below. None of the events described below shall extend the period of exercisability of the Option beyond ten (10) years from the date hereof:

(a) if you die, and at a time when you were entitled to exercise the Option as herein provided, the Option shall, to the extent not theretofore exercised, remain exercisable for one (1) year after your death, by your legatee, distributee, guardian or legal or personal representative; and

(b) if your employment is terminated by reason of your disability (as defined in the plan), voluntary retirement or dismissal by the Company other than for cause as defined in the Plan, and at a time when you were entitled to exercise the Option as herein provided, the Option shall, to the extent not theretofore exercised, remain exercisable for ninety (90) days after the date of such termination of employment; and

3

(c) if you die during the ninety (90) day period specified in clause (b) above and at a time when you were entitled to exercise the Option, your legal representative, or such person who acquired the Option by reason of your death may, not later than one (1) year from your date of death, exercise the Option, to the extent not theretofore exercised, in respect of any or all of such number of shares subject to the Option.

5. The Option is not transferable by you otherwise than by will or the laws of descent and distribution, and is exercisable, during your lifetime, only by you. The Option may not be pledged or hypothecated in any way (whether by operation of law or otherwise) and shall not be subject to execution, attachment or similar proceeding. Any attempted assignment, pledge, hypothecation or other disposition of the Option contrary to the provisions hereof, and the levy of any attachment or similar proceeding upon the Option, shall be null and void and without effect.

6. Any exercise of the Option shall be in writing addressed to the Corporate Secretary of the Company at the principal place of business of the Company, specifying the Option being exercised and the number of shares to be purchased. The purchase price for the shares being purchased shall be delivered to the Corporate Secretary within five days of the time such writing is so delivered.

7. If the Company, in its sole discretion, shall determine that it is necessary, to comply with applicable securities laws, the certificate or certificates representing the shares purchased pursuant to the exercise of the Option shall bear an appropriate legend in form and substance, as determined by the Company, giving notice of applicable restrictions on transfer under or in respect of such laws.

8. If the Option granted to you herein is an ISO, and if you sell or otherwise dispose of any of the Shares acquired pursuant to the ISO on or before the later of (i) the date two (2) years after the Date of Grant, or (ii) the date one (1) year after the date of exercise, you are required to immediately notify the Company in writing of such disposition. You hereby agree that you may be subject to income tax withholding by the Company on the compensation income recognized by you.

9. The Option granted hereunder is intended to be exempt from the definition of a “nonqualified deferred compensation plan” under Section 409A of Code and the Treasury regulations and other official guidance promulgated thereunder (“Section 409A”). In the event that the Board determines that the Option may be subject to Section 409A, the Board may adopt such amendments to the Plan and this letter or Option or adopt other policies and procedures (including amendments, policies and procedures with retroactive effect), or take any other actions, that the Board determines are necessary or appropriate to (a) exempt the Option from Section 409A and/or preserve the intended tax treatment of the benefits provided with respect to the Option, or (b) comply with the requirements of Section 409A and thereby avoid the application of penalty taxes under Section 409A

4

10. You hereby covenant and agree with the Company that if, at the time of exercise of the Option, there does not exist a Registration Statement on an appropriate form under the Securities Act of 1933, as amended (the "Act"), which Registration Statement shall have become effective and shall include a prospectus which is current with respect to the shares subject to the Option, you shall make the representations (i) that you are purchasing the shares for your own account and not with a view to the resale or distribution thereof, (ii) that any subsequent offer for sale or sale of any such shares shall be made either pursuant to (x) a Registration Statement on an appropriate form under the Act, which Registration Statement shall become effective and shall be current with respect to the shares being offered and sold, or (y) a specific exemption from the registration requirements of the Act, but in claiming such exemption, you shall, prior to any offer for sale or sale of such shares, obtain a favorable written opinion from counsel for or approved by the Company as to the applicability of such exemption and (iii) that you agree that the certificates evidencing such shares shall bear a legend to the effect of the foregoing.

By your acceptance hereof, you agree to reimburse the Company in cash at the time and as condition to the exercise of this Option for any taxes required by any government to be withheld or otherwise deducted and paid by the Company in respect of the issuance or disposition of the shares subject to the Option. In lieu thereof, the Company shall, in its discretion and at its election, have the right to withhold the amount of such taxes from any other sums due or to become due from the Company to you. The Company may, in its discretion, hold the stock certificate to which you are entitled upon the exercise of the Option as security for the payment of such withholding tax liability, until cash sufficient to pay that liability has been accumulated. In addition, at any time that the Company becomes subject to a withholding obligation under applicable law with respect to the exercise of an Option (the "Tax Date") you may elect to satisfy, in whole or in part, your related personal tax liabilities (an "Election") by (a) directing the Company to withhold from shares issuable in the related exercise either a specified number of shares or shares having a specified value (in each case not in excess of the related personal tax liabilities), (b) tendering shares previously issued pursuant to the exercise of the Option or other shares of the Company's common stock owned by you, or (c) combining any or all of the foregoing options in any fashion. An Election shall be irrevocable. Notwithstanding the foregoing, the Committee may disallow you from making the elections (a) through (c) above if the Company would be required to make and pay a cash withholding payment for tax liabilities. The withheld shares and other shares tendered in payment shall be valued at their fair market value on the Tax Date. The Committee may disapprove of any Election, suspend or terminate the right to make Elections, provide that the right to make Elections shall not apply to particular shares or exercises, or impose additional conditions or restrictions on the right to make an Election as it shall deem appropriate. In addition, you authorize the Company to effect any such withholding upon exercise of an Option by retention of shares issuable upon such exercise having a fair market value at the date of exercise which is equal to the amount to be withheld; provided, however, that the Company is not authorized to effect such withholding without your prior written consent if such withholding would subject you to liability under Section 16(b) of the Exchange Act.

5

This agreement is subject to all terms, conditions, limitations and restrictions contained in the Plan, which shall be controlling in the event of any conflicting or inconsistent provisions.

This agreement is not a contract of employment and the terms of your employment shall not be affected hereby or by any agreement referred to herein except to the extent specifically so provided herein or therein. Nothing herein shall be construed to impose any obligation on the Company to continue your employment, and it shall not impose any obligation on your part to remain in the employ of the Company thereof.

Please indicate your acceptance of all the terms and conditions of the Option and the Plan by signing and returning a copy of this letter.

Very truly yours,

ITUS Corporation

By: ___________________

ACCEPTED:

_________________________

[Employee]

6